Bitcoin costs gained by solely 0.95% up to now week amidst an intense market consolidation. The premier cryptocurrency is struggling to interrupt out of the $85,000-$86,000 value vary following a powerful value rally within the second week of April. However, in style crypto analyst Ali Martinez has recognized the most important value resistance for the present Bitcoin uptrend.

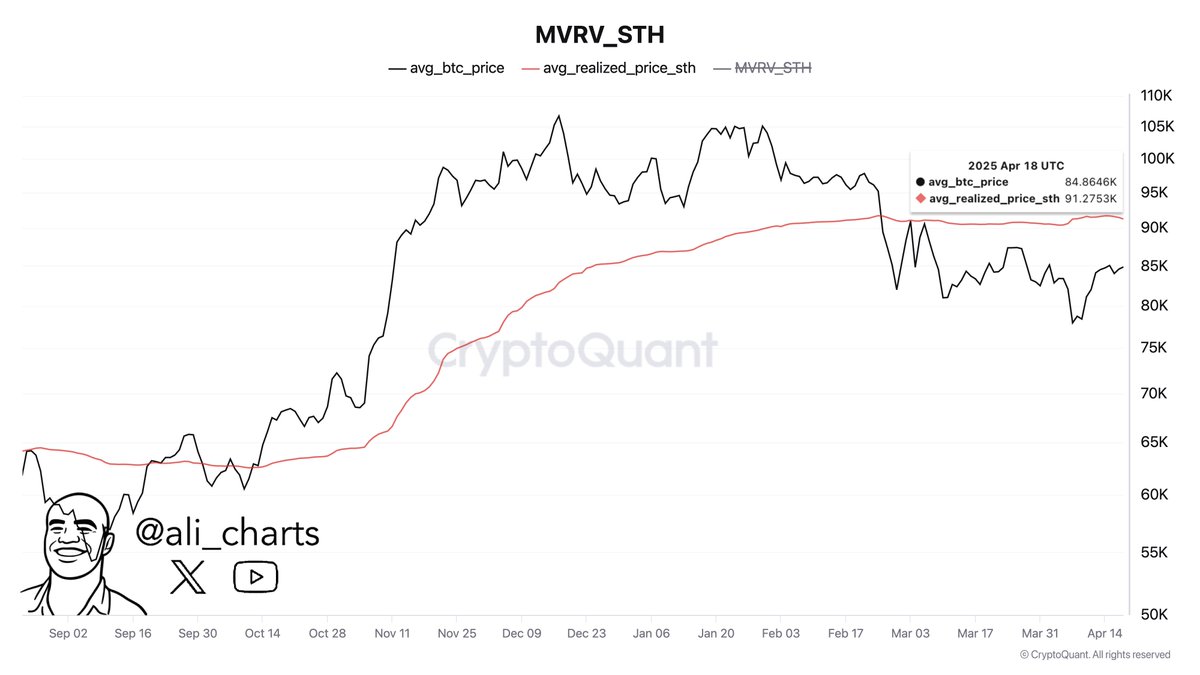

Bitcoin STH Realized Price At $91,000 Presents Major Make-Or-Break Moment

In a recent post on X, Martinez states that Bitcoin faces a key resistance degree on the $91,275 following a value rebound in early April. Notably, the asset surged by 17.33% after reaching a value low of $75,000 on April 9. However, BTC has since entered a consolidation following this feat, producing no important value motion in both course.

Over the previous week, the crypto market chief moved solely between $84,000 to $86,000, forming a good range-bound market. However, amidst these struggles, Martinez states that Bitcoin short-term holders realized the value lies at $91,275, indicating the pivotal resistance to the latest market resurgence lies forward.

For context, the short-term holders’ realized value is the typical value at which new consumers (i.e, new traders of Bitcoin over the previous 155 days) acquired their BTC. It is a vital technical indicator used to judge short-term market sentiment and habits.

When a market value is above the STH realized value, it signifies a bullish momentum as latest consumers are in revenue and are more likely to maintain. In this case, the STH realized value serves as a powerful help degree, with new market entrants usually defending their entry zone.

However, when Bitcoin’s value is beneath the STH realized value as presently seen out there, the realized value types a major psychological value resistance. This is as a result of many short-term holders could select to exit as soon as the market breaks even, rising the promoting strain round that zone.

Therefore, Bitcoin reclaiming $91,275 is crucial to validate a ample bullish potential to gasoline a whole value reversal.

Bitcoin Price Overview

At the time of writing, Bitcoin is buying and selling at $84,872, reflecting a value development of 0.14% within the final day. Meanwhile, the premier cryptocurrency is down by 1.34% on its month-to-month chart as bearish strain continues to wane.

While a significant market resistance lies at $91,000, Bitcoin faces an instantaneous opposition on the $86,000 value zone, breaking previous which may spur a pointy value rise to $91,000. However, a value fall beneath the help at $84,500 may end in an extra value slide to $84,000 with the potential to commerce as little as $83,300.