Robert Kiyosaki has as soon as once more stolen the highlight together with his latest daring prediction that the Bitcoin worth will soar previous $1 million. Besides, the Rich Dad Poor Dad additionally stated that the Gold worth will hit $30K whereas the Silver worth will attain $3,000 per coin in the identical timeframe. Notably, this comes as he reiterates his prediction of a “GREATER DEPRESSION” for the US.

Robert Kiyosaki Predicts Bitcoin Price To $1M Amid Crash Woes

In a latest put up on X, the Rich Dad Poor Dad author painted a grim image of America’s monetary future. He warned that hovering bank card debt, climbing unemployment, and dwindling pensions sign the early phases of a devastating financial disaster. According to him, the “biggest stock market crash in history” is unfolding proper now.

However, amid this, he reiterated his earlier recommendation whereas saying that Bitcoin worth is poised to hit $1 million by 2035. Simultaneously, he additionally remained optimistic about treasured metals like gold and silver amid the macroeconomic woes.

Kiyosaki Urges Taking Action

Meanwhile, Kiyosaki emphasised he had lengthy warned about this crash in a number of books, together with Rich Dad’s Prophecy, Fake, and Who Stole My Pension. He stated those that listened to his recommendation at the moment are higher off. But, he worries for individuals who dismissed it.

“People who heeded my warnings are doing well today. I am concerned for those who did not.” Kiyosaki shared, urging people to nonetheless take motion. He believes that investing in gold, silver, or perhaps a portion of Bitcoin immediately might be life-changing.

He confused, “It’s not too late, if you take action.” According to Kiyosaki, hesitation and unfavorable self-talk are what hold folks poor. He identified that even small investments, like a couple of ounces of gold or half a Bitcoin, may assist people escape poverty after the financial storm passes.

Why Bitcoin Price May Hit $1M? Kiyosaki Reveals

Robert Kiyosaki’s perception that the Bitcoin worth will attain $1 million by 2035 isn’t only a wild guess. It’s primarily based on his deep distrust of government-backed currencies and the collapsing conventional monetary system. He defined that the US is drowning in debt and dropping financial energy. At the identical time, he sees decentralized property like BTC as the brand new retailer of worth.

Meanwhile, he added that the wealthy are already getting ready, whereas the center class and poor are left weak. “This coming Great Depression will cause millions to be poor and a few who take action, may enjoy great wealth and freedom,” he warned.

Notably, the Rich Dad Poor Dad creator has lengthy warned of a “financial disaster”, which he thinks might be as a result of authorities’s inefficiency. Also, Kiyosaki has been actively supporting Bitcoin, gold, and silver throughout the financial turmoil, deeming these as safer havens.

What’s Next For BTC?

BTC price today was up almost 1% and exchanged palms at $85,071 whereas its one-day quantity fell 38% to $13.07 billion. Notably, Bitcoin worth has hovered between $84K and $85K during the last 24 hours, accompanied by a hovering Futures Open Interest of over 5%.

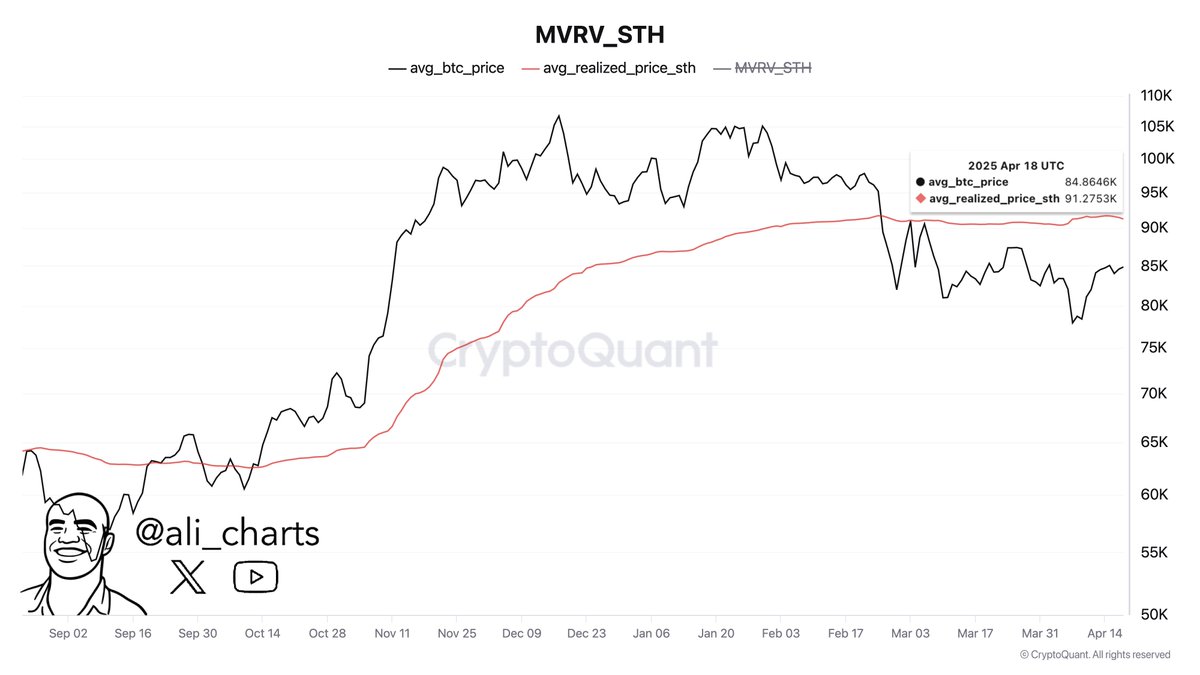

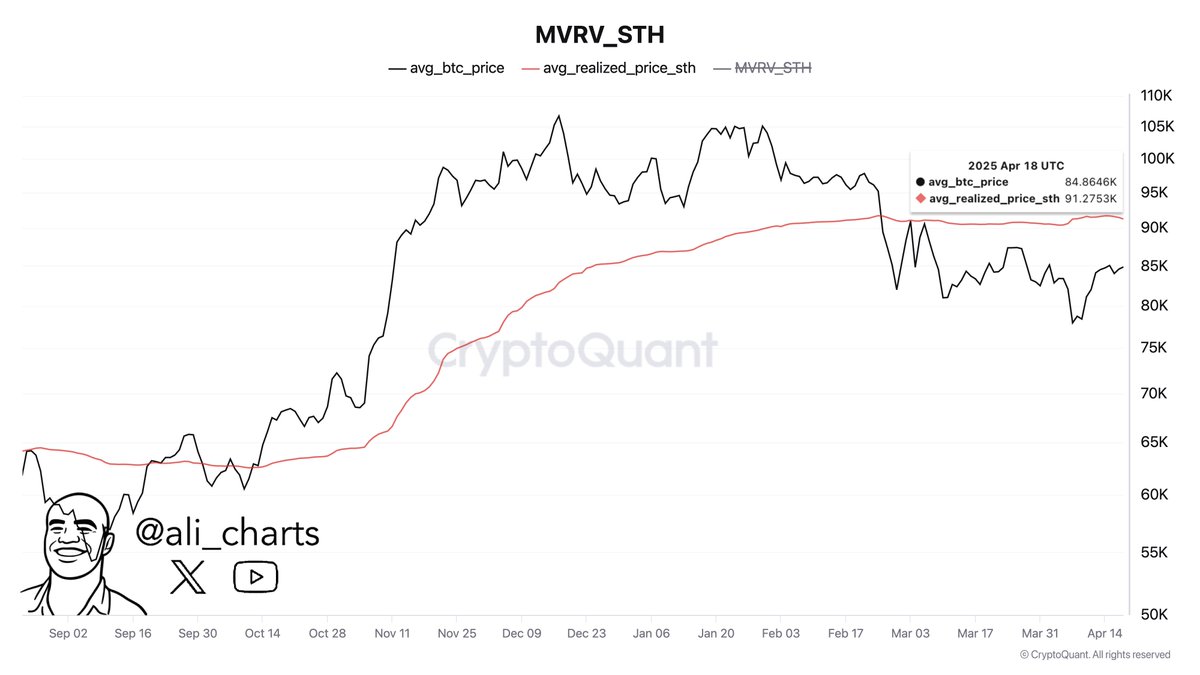

Notably, the market members are maintaining shut monitor as BTC continues to commerce inside a decent vary, sparking hypothesis about its subsequent main transfer. Amid this, analyst Ali Martinez has make clear the present state of the market, highlighting key worth ranges that would decide Bitcoin’s future trajectory.

According to Martinez, a breakout above $86,000 or a breakdown beneath $83,000 will probably outline the following vital worth shift. Looking additional forward, Martinez identifies $91,275 as an important resistance degree, aligning with the short-term holder realized worth.

A surge previous this level may sign a renewed bullish pattern, whereas failure to interrupt via could result in continued consolidation. Besides, a latest BTC price prediction additionally confirmed that the flagship crypto would possibly hover the $90K within the coming weeks.

Disclaimer: The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.