Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Bitcoin worth continues to face headwinds, as the most recent report on Digital Asset Fund Flows reveals a staggering $751 million in outflows from the digital asset. The sheer quantity of this withdrawal raises alarm bells about whether or not institutions may be cashing out from the flagship cryptocurrency.

Bitcoin Price Faces Pressure Amid Massive Outflows

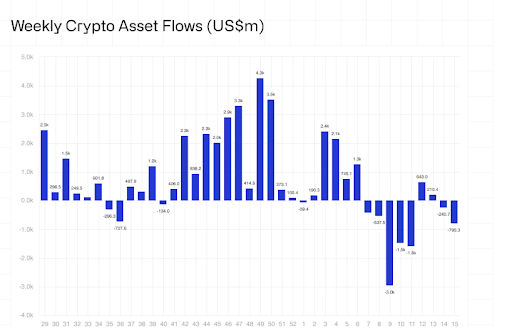

CoinShares’ weekly report on Digital Asset Fund Flows has disclosed an enormous $795 million in outflows from the crypto market—shockingly, $751 million of which got here from Bitcoin alone. This mass exodus marks one of many largest single-week outflows of the 12 months, and it comes at a time when the price of Bitcoin has hit a wall.

Related Reading

James Butterfill, the Head of Research at CoinShares, revealed that since early February 2025, digital asset funding merchandise have suffered cumulative outflows of roughly $7.2 billion, successfully erasing virtually all of the year-to-date inflows. Notably, this week marks the third consecutive week of declines, with Bitcoin leading the downturn and recording probably the most vital losses amongst main digital belongings.

As of this report, web flows for 2025 have dwindled to a modest $165 million, a pointy drop from a multi-billion greenback peak simply two months in the past. This steep decline underscores a cooling sentiment among institutional investors and highlights a rising sense of warning amid ongoing market volatility.

Currently, the Bitcoin price is struggling to regain previous all-time highs, with latest outflows serving as one of many many limitations hindering the cryptocurrency’s breakout potential. Until these outflows reverse and the market stabilizes, Bitcoin’s path to setting new all-time highs stays challenged.

Despite shedding $751 million in outflows, Bitcoin nonetheless maintains a reasonably optimistic place with $545 million in web year-to-date inflows. However, the sheer scale and pace of the most recent outflows increase concern. The undeniable fact that Bitcoin suffered such an enormous withdrawal indicators a possible shift in sentiment amongst establishments. Whether it’s on account of profit-taking or macroeconomic uncertainty, this transfer means that huge gamers are starting to tug out — no less than within the quick time period.

In addition to Bitcoin, Ethereum noticed $37 million in outflows, whereas Solana, Aave, and SUI additionally posted losses of $5.1 million, $0.78 million, and $0.58 million, respectively. Surprisingly, even quick Bitcoin merchandise, designed to profit from market downturns, weren’t spared, recording $4.6 million in outflows.

Tariffs And Political Volatility Drive Outflows

One of the important thing drivers behind the pullback throughout digital belongings is the rising financial uncertainty sparked by tariff insurance policies which have adversely influenced investor sentiment. The wave of negative sentiment started in February after United States (US) President Donald Trump introduced plans to impose tariffs on all imports coming into the nation from Canada, Mexico, and China.

Related Reading

However, a late-week rebound in crypto costs was seen after Trump’s temporary reversal of the controversial tariffs, offering a quick respite for the market. This coverage shift helped increase complete Asset Under Management (AUM) throughout digital belongings from a low of $120 billion on April 8 to $130 billion, marking an 8% restoration.

Featured picture from Adobe Stock, chart from Tradingview.com