MicroStrategy has halted its Bitcoin purchases amid this current market crash, with the flagship crypto dropping beneath $80,000. The MSTR inventory can be in bear territory for the time being, due to the widespread market crash as a consequence of Donald Trump’s tariffs.

MicroStrategy Halts Bitcoin Purchase Amid Market Crash

MicroStrategy, now Strategy, has halted its Bitcoin buy, failing to amass any BTC between March 31 and April 6. This is important as the corporate has developed a knack for buying BTC each different week, due to its capital increase by inventory gross sales.

Last week, Coingape reported that Michael Saylor’s firm purchased 22,048 BTC for $1.92 billion the earlier week, one in all their largest purchases so far. Meanwhile, the corporate bought 6,911 BTC every week earlier for $584 million.

Meanwhile, it’s price mentioning that MicroStrategy purchased 80,715 BTC for $7.66 billion within the first quarter of this yr at a mean worth of $94,922. The firm at present holds 528,185 BTC, which it purchased for $35.63 billion, at a mean worth of $67,458 per Bitcoin.

Thanks to the current drop in the Bitcoin price, Strategy dangers watching its BTC funding return to its entry worth and even run right into a loss. The firm revealed in a submitting that its unrealized loss on digital property for the primary quarter was $5.91 billion.

The firm’s Bitcoin funding dropping into the crimson is important because it might drive them to dump some cash, which might negatively impression the market.

Although Saylor and his agency would perform this sale over-the-counter, information round it might dampen traders’ confidence and spark a bearish sentiment. For context, the software program firm at present holds over 2% of Bitcoin’s whole circulating provide.

MSTR Stock Slides Over 13%

Nasdaq information exhibits that MicroStrategy’s inventory is down over 13% and is at present buying and selling round $256. The drop within the MSTR stock price isn’t solely as a result of Bitcoin worth decline, though each property share a powerful optimistic correlation.

MSTR has primarily declined due to Donald Trump’s tariffs, which have put the US inventory market near bear market territory. According to a Bloomberg report, the S&P 500 misplaced 3.5% on the open and is now getting ready to getting into a bear market. The Nasdaq can be not far off.

As a consequence, MSTR has misplaced all its beneficial properties from earlier within the yr and at present boasts a year-to-date (YTD) lack of 8%. The inventory continues to be vulnerable to struggling extra declines as Trump’s commerce conflict heightens.

BTC Whales Still Accumulating

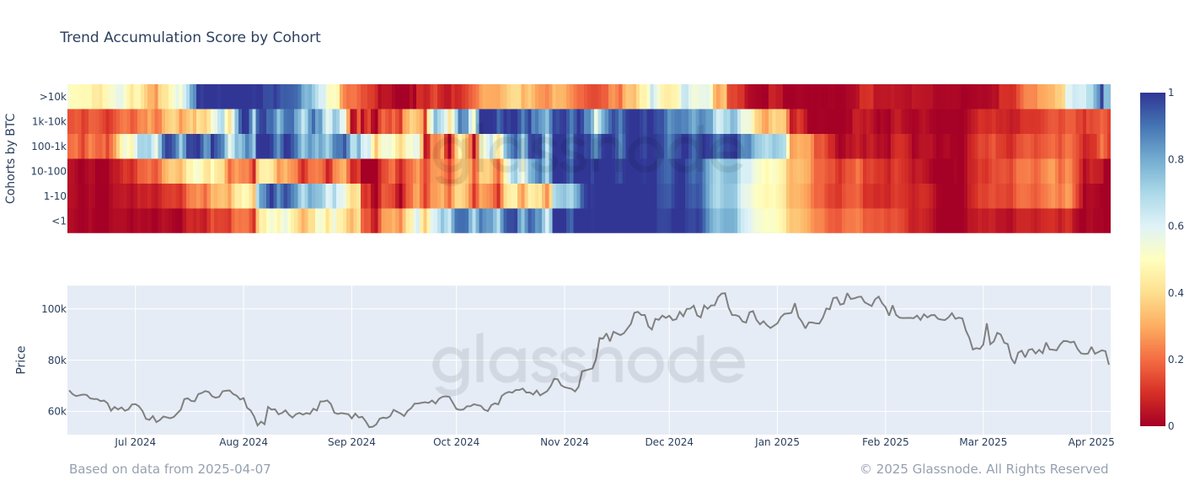

While MicroStrategy has halted its Bitcoin buy, different BTC whales are nonetheless accumulating. Onchain analytics platform Glassnode revealed that whales holding over 10,000 BTC briefly hit an ideal accumulation rating in the beginning of the month, reflecting intense 15-day shopping for.

Although the buildup rating has dropped to 0.65, Glassnode said that this indicators regular accumulation. However, these whales might need to watch out, as CryptoQuant CEO Ki Young Ju warned that the Bitcoin bull market is over.

Disclaimer: The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.