The Bitcoin (BTC) market continues to stay in consolidation following one other buying and selling week with no convincing value breakout. As a number of analysts proceed to invest on the asset’s subsequent motion, distinguished market skilled Ali Martinez has recognized two resistance zones that might be pivotal to reigniting a crypto bull run.

Bitcoin Must Break Past $85,470 And $92,950 – Here’s Why

Over the previous month, Bitcoin has struggled to keep up a sustained uptrend, with investor uncertainty dominating the market. During this era, the main cryptocurrency has confronted a number of rejections, most notably on the $85,000 and $88,000 resistance levels. However, in an X post on Friday, Martinez recognized the 2 resistance zones crucial to a Bitcoin bull rally utilizing on-chain knowledge from IntoTheBlock.

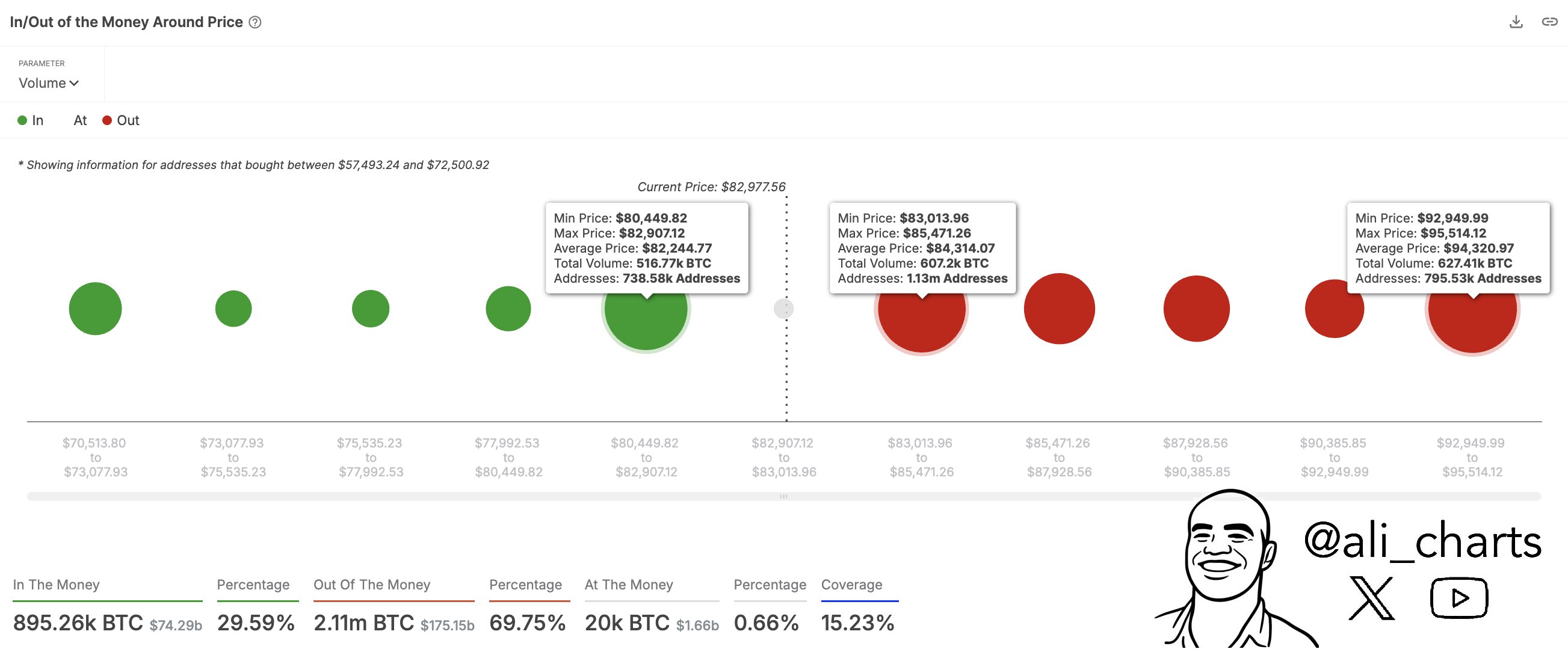

According to the crypto analyst, the primary resistance lies at $85,470 which marks the higher boundary of a value barrier that begins at $83,023. Notably, 1.13 million pockets addresses have traded 607,200 BTC inside this value vary suggesting a powerful historic exercise that backs potential heavy promoting stress at these ranges.

If Bitcoin bulls can push previous this preliminary threshold, the following resistance zone lies at $92,950 – the decrease boundary of one other value ceiling that extends to $95,514. Compared to the preliminary resistance, this zone has seen decrease investor participation, with 795,830 lively pockets addresses. However, its potential market impression is extra vital, as roughly 627,410 BTC have been traded inside this vary.

If Bitcoin can efficiently clear each resistance zones, Ali Martinez postulates the premier cryptocurrency may enter a protracted uptrend and resume its bull rally. However, Bitcoin bulls should keep away from any value fall beneath a vital assist zone on the $80,450 value degree.

According to the on-chain knowledge offered, the $80,450 degree represents the decrease boundary of a key assist zone, which extends as much as $82,907. Within this vary, roughly 516,770 BTC have been transacted, involving round 738,580 lively pockets addresses. This knowledge signifies substantial shopping for exercise that would function a buffer within the creation of a value fall.

Bitcoin Fees Fall By 57%

In different developments, IntoThe Block additionally reports that Bitcoin community charges dropped by 57.3% up to now week indicating a decline in consumer engagement and normal investor exercise. Albeit, the premier cryptocurrency has proven solely a minor 0.11% decline in value throughout this era.

Following the latest announcement of latest US tariffs on imports, Bitcoin and the broader crypto market have responded extra positively in comparison with earlier tariff-related information. Ryan Rasmussen, Head of Research at Bitwise Invest, notes that Bitcoin has risen by 2.2% because the announcement on April 2. In distinction, conventional inventory markets have seen notable losses, with the “Magnificent Seven” falling by a median of 12.18%.