Reason to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The highest requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Open curiosity in Bitcoin buying and selling is a vital metric to evaluate the market’s present sentiment on the digital asset, together with potential value actions.

In concept, a rise in Bitcoin’s open interest suggests liquidity, which might additionally assist an ongoing value pattern.

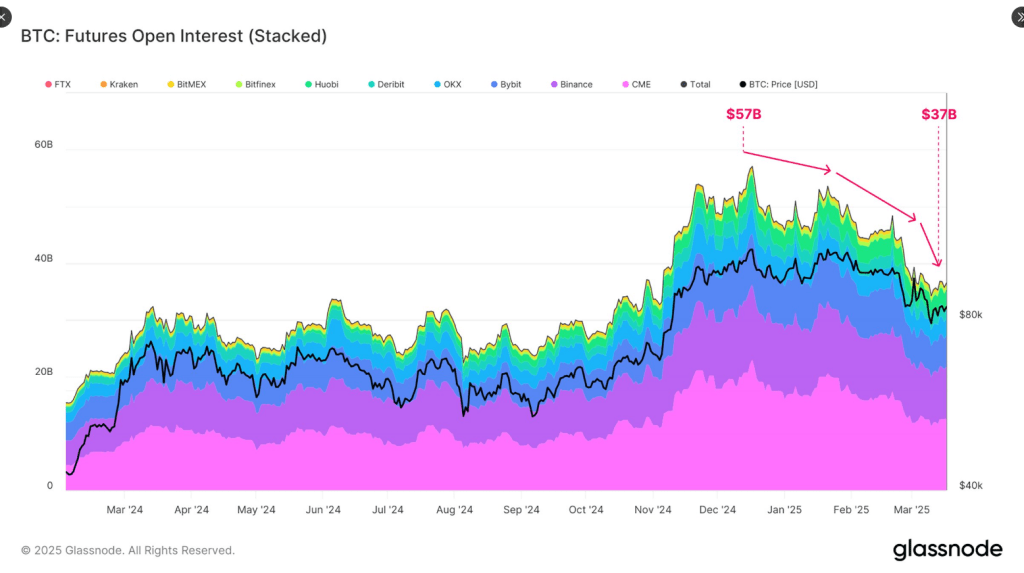

According to the newest Glassnode knowledge, Bitcoin’s OI has dipped from $57 billion to $37 billion, or a lack of 35%, because the world’s high digital asset hit its all-time excessive.

Related Reading

Interestingly, Bitcoin hit an all-time excessive of $108,786 on January twentieth, the day United States President Donald Trump was inaugurated for a second time period.

Bitcoin is buying and selling between $83k and $86k, down greater than 22% from its peak, on the time of writing.

Bitcoin Open Interest And Its Possible Impact On Price

Investors and holders use the open curiosity metric to evaluate the sentiment and potential market efficiency of the asset.

A digital asset with a falling open curiosity implies that merchants and traders are closing their positions attributable to uncertainties or insecurity or are transferring away from leveraged buying and selling.

Futures open curiosity has dropped from $57B to $37B (-35%) since #Bitcoin’s ATH, signaling decreased hypothesis and hedging exercise. This decline mirrors the contraction seen in on-chain liquidity, pointing to broader risk-off conduct. pic.twitter.com/XPbXiHXlRS

— glassnode (@glassnode) March 20, 2025

In Glassnode’s evaluation, the drop in Bitcoin’s OI displays a broader pattern of lowering on-chain actions and liquidities, the place traders have much less confidence within the asset.

Bitcoin’s present standing suggests that almost all traders are actually short-term trades for fast features on the expense of long-term positions.

There’s A Shifting In Positions – Glassnode

According to Glassnode, merchants and traders are actually within the cash-and-carry commerce, with a weakening of lengthy positions. It provides that the CME futures closures and ETF outflows replicate a shift in traders’ technique and likewise add to the promoting strain.

Also, the supply of ETFs, which have much less liquidity than futures, could impression the alpha crypto’s short-term market volatility.

Data Highlights Hot Supply Metric

Glassnode additionally highlighted the asset’s Hot Supply metric. This is one other necessary metric that tracks the Bitcoin holdings at one week or much less.

According to the identical Twitter/X thread, the numbers have dropped from 5.9% of the full BTC in circulation to 2.8%, reflecting a drop of greater than 50% within the final three months.

The decline within the sizzling provide means that fewer new Bitcoins are traded out there, lowering the asset’s liquidity.

Related Reading

Glassnode additional painted a depressing image for Bitcoin by explaining that alternate inflows have dropped from 58,600 Bitcoins every day to 26,900 Bitcoins, a 54% lower.

This Bitcoin pattern suggests weaker demand since fewer belongings are transferring to crypto exchanges.

Featured picture from Olhar Digital, chart from TradingView