Bitcoin’s value fell to $86,099 on February twenty sixth, wiping out nearly $1.06 billion from crypto’s market cap and sending ripples throughout the trade. According to Coinglass monitoring, round 230,000 positions have been liquidated for the day.

Related Reading

As an indication of bearish sentiment, the digital asset’s open curiosity has dipped to five%, reflecting deleveraging amongst traders and holders. On-chain knowledge additionally means that trade inflows surged to 14.2%, probably suggesting panic promoting amongst holders. Furthermore, funding charges are actually in unfavourable territory, indicating traders’ sentiments have shifted.

Massive Losses For Holders As BTC Tests $86K

As the world’s prime digital asset, Bitcoin’s hostile price action triggered loads of ripples in the trade. With its value testing beneath $90k, hundreds of positions have been liquidated, and powerful withdrawals from spot Bitcoin ETF funds have been recorded. According to a number of experiences, the five-day outflow for ETFs amounted to $1.1 billion, with $516 million misplaced on February twenty fourth.

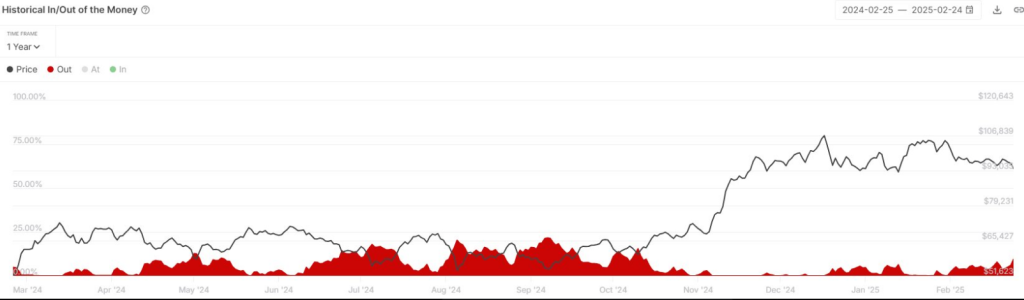

In a Twitter/X publish, InTheBlock famous that round 12% of all BTC addresses are in the pink. The publish added that it’s now the best unrealized loss share for Bitcoin since October 2024.

With Bitcoin briefly dropping beneath $90k, roughly 12% of all Bitcoin addresses are holding at a loss.

🔴This is the best unrealized loss share since October 2024 pic.twitter.com/pngLz4G4wc

— IntoTheBlock (@intotheblock) February 25, 2025

Crypto-Related Stocks Fall

Aside from particular person holders, crypto-related shares suffered from Bitcoin’s latest drop. Michael Saylor’s Strategy is without doubt one of the largest victims, with its inventory value dropping 11% in the previous 24 hours. The firm’s inventory has been declining since its peak in November and has now fallen 55% from its excessive.

Strategy boasts a portfolio value over $43 billion, together with 499,096 Bitcoin. With Bitcoin’s value falling, many crypto observers speculate the place Strategy will promote a few of its belongings. However, some specialists have shot down this concept, saying it’s uncertain that an organization will totally decide to crypto.

Other crypto-related shares additionally tumbled, with Robinhood (HOOD) dipping by 8%, Coinbase (COIN) struggling a 6.4% decline, and Marathon Digital (MARA) and Bitcoin miners Bitdeer (BTDR) dropping 9% and 29% respectively.

Traditional Stocks Also Suffered

Bitcoin’s underperformance was additionally felt in the broader market, with declines in the standard monetary markets. The Nasdaq Composite dropped by 2.8%, and the S&P 500 surrendered 2.1% of its market cap. Observers additionally famous the sudden energy of the US Dollar Index, suggesting that many traders are on the lookout for “safety havens” for his or her investments.

On-chain knowledge additionally signifies a latest surge in crypto whale actions. Bitcoin whales have bought over $1.2 billion value of digital belongings.

Related Reading

According to analysts, Bitcoin’s decline is brought on by macroeconomic situations. The market continues to be reeling from US President Donald Trump’s tariff announcement, and geopolitical tensions between China and the United States are pushing some traders to rethink their long-term plans.

Featured picture from Gemini Imagen, chart from TradingView