Bitcoin’s latest value crash took the entire market by surprise, leaving bullish buyers reeling in losses. Particularly, this crash noticed Bitcoin dropping its foothold on the $90,000 value degree and extended a crash across a number of cryptocurrencies.

Technical analyst Rekt Capital recognized this pullback as a draw back deviation inside a re-accumulation vary, hinting at potential market changes within the coming weeks.

Bitcoin’s Drop Below $90,000: A Necessary Reset?

Bitcoin’s break under $90,000 previously few days marks its first time buying and selling under this degree since November 2024. After months of sustained upward momentum, Bitcoin began to consolidate under the $100,000 value degree, spending most weeks buying and selling between $90,000 and $100,000.

Related Reading

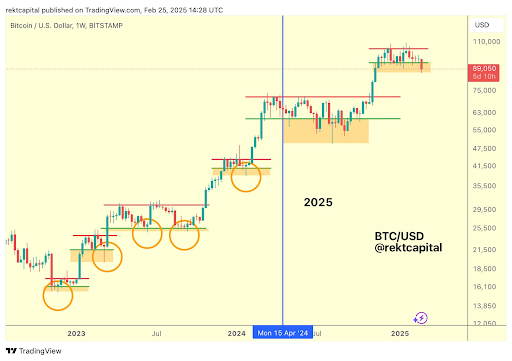

This consolidation part, whereas unsettling to some buyers, was interpreted by some analysts as a natural part of Bitcoin’s broader market cycle. Crypto analyst Rekt Capital has pointed out that Bitcoin often undergoes phases of re-accumulation throughout bull cycles, permitting the market to reset earlier than the subsequent leg upward. According to his evaluation, the present value motion aligns with historic tendencies, the place Bitcoin establishes an accumulation flooring earlier than one other rally.

Interestingly, Bitcoin’s recent break below $90,000 is a part of this reaccumulation vary phenomenon. Rekt Capital describes this as a “downside deviation” under the vary low, which is a sample Bitcoin has exhibited a number of instances in previous cycles.

What To Expect From BTC’s Next Move

Re-accumulation phases are usually highlighted by shopping for strain amongst just a few whales and retail buyers whereas the bigger market continues to promote. According to data from on-chain analytics platform Glassnode, some long-term Bitcoin holders have remained unfazed by the latest value crash. In reality, the most recent selloff has introduced them with a key accumulation alternative, with these long-term addresses rising their whole Bitcoin holdings by 20,400 BTC previously 48 hours.

Related Reading

Bitcoin’s future trajectory will depend upon the way it reacts inside this re-accumulation vary. If Bitcoin efficiently reclaims $90,000, it might affirm that the break under was merely a shakeout earlier than additional positive factors. A powerful rebound from this degree would probably reignite bullish sentiment, doubtlessly paving the way in which for a considerable break above $100,000.

However, an prolonged decline under $90,000 might be very devastating for Bitcoin and its long-term holders who’re presently accumulating within the reaccumulation zone, as there isn’t much of a support level to prop up any downtrend till the $70,000 value degree.

At the time of writing, BTC is buying and selling at $88,628, reflecting a 7.5% decline over the previous seven days. However, the cryptocurrency has proven early indicators of stabilization, having rebounded by roughly 2% after hitting an intraday low of $86,867.

Featured picture from Adobe Stock, chart from Tradingview.com