Another crypto market crash is occurring, with Bitcoin, Ethereum, Solana, and the Dogecoin value witnessing vital declines. This growth comes amid the uncertainty available in the market, which is sparking a bearish sentiment amongst traders.

Crypto Market Crash: Why BTC, ETH, SOL, & DOGE Are Down

CoinMarketCap data exhibits {that a} crypto market crash has occurred, with the Bitcoin value sharply dropping beneath the psychological $95,000 degree. The flagship crypto has additionally dragged altcoins alongside as they’ve suffered vital declines. Ethereum and Solana are down over 4% and 9%, respectively. Meanwhile, the Dogecoin price is down over 7% within the final 24 hours.

This crash has occurred amid market uncertainty, with traders at present selecting to remain on the sidelines. Several developments have sparked this market uncertainty, together with Donald Trump’s proposed tariffs on a number of international locations.

Another macro issue is the Federal Reserve’s quantitative tightening (QT) insurance policies, which counsel that the US Central Bank is unlikely to chop rates of interest anytime quickly. Amid these developments, it stays unsure when or if Donald Trump and his administration will implement the Strategic Bitcoin Reserve, which may present an enormous enhance to the Bitcoin price.

It can also be value mentioning that the crash within the US inventory market may have additionally contributed to the crypto market crash, because the Bitcoin value is thought to correlate to those US shares at instances. The S&P 500 declined by virtually 2% final week on Friday, which was the worst day in two months.

Developments In The Market

Developments available in the market have additionally sparked this bearish sentiment amongst traders and contributed to the worth crash throughout the board. One is the Bybit hack, which has raised issues amongst crypto neighborhood members and likewise highlighted the safety points that persist within the trade.

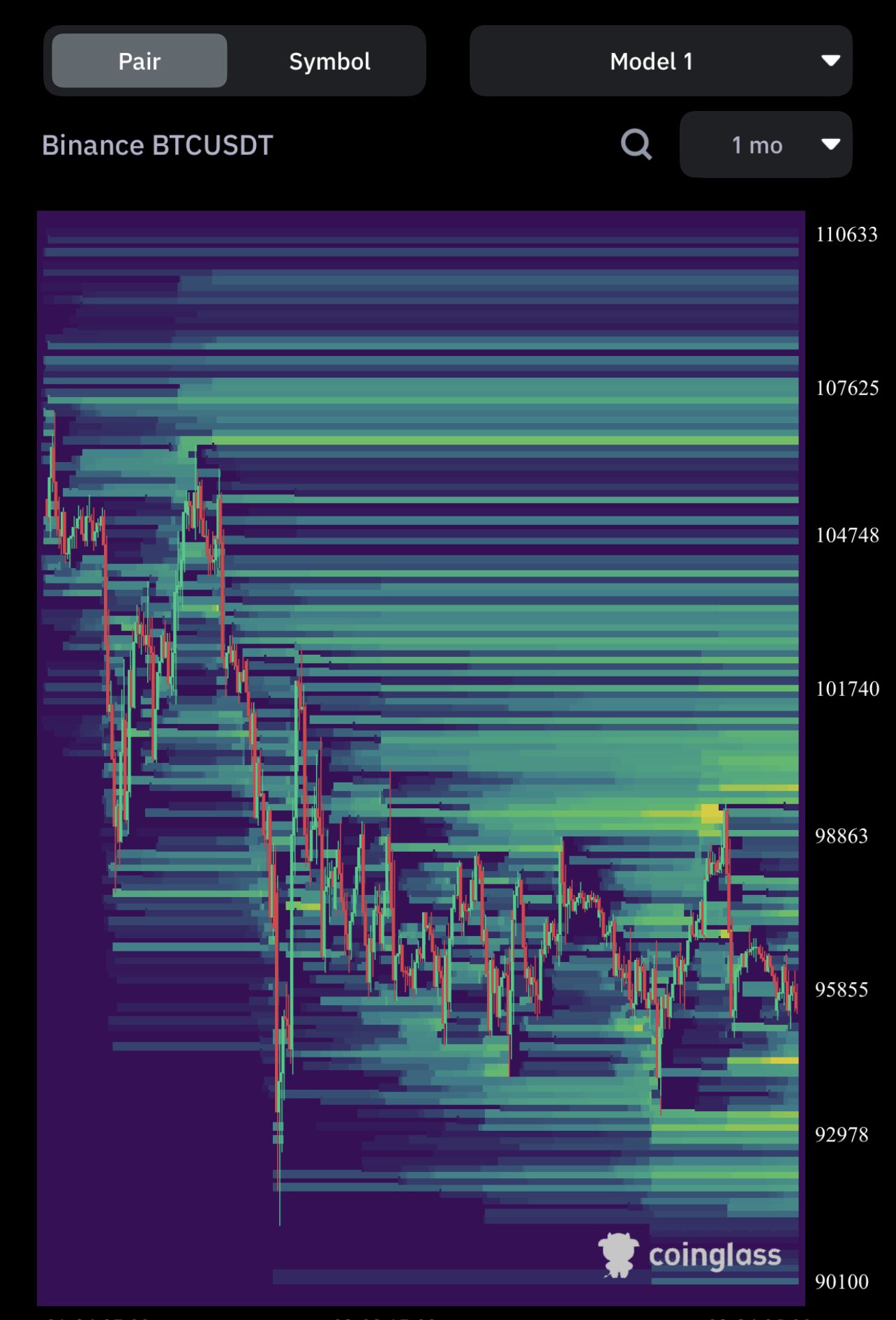

Furthermore, the market seems to be overleveraged in the mean time, which may be contributing to the crypto market crash. Crypto analyst Kevin Capital not too long ago highlighted the liquidity heatmap within the derivatives market and famous that there are a “ton of longs the built up below” is right down to $91,000.

The analyst remarked that BTC can head increased after liquidating these positions. He added that the flagship crypto wants extra time to reset the 3-day MACD, which is already taking place.

The Solana value has suffered one of many largest declines amid this market crash. This is as a result of token unlock of 11.2 million SOL, round $1.78 billion, which can occur on March 1. Some of those cash belong to institutional traders like Galaxy Digital, who purchased these cash as a part of the public sale of FTX’s property for a reduced value.

As such, SOL may face vital promoting strain as these traders transfer to safe earnings. Ahead of the token unlock, Solana whales already look to be offloading their cash. As CoinGape reported, Binance dumped 100,000 SOL by way of market maker Wintermute, additional sparking this bearish outlook for Solana.

Disclaimer: The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.