The price of Bitcoin seemed set to reclaim $100,000 on Friday, rallying on the again of the United States Securities and Exchange Commission’s (SEC) resolution to drop the lawsuit in opposition to crypto alternate Coinbase. However, the premier cryptocurrency didn’t capitalize on this momentum shift following the $1.4 billion exploit of the ByBit alternate.

With the Bitcoin value now hovering above $96,000, current on-chain information means that sure volatility metrics are nearing traditionally low ranges. Here’s how the newest volatility pattern may affect the BTC value efficiency over the approaching weeks.

Is A BTC Price Rally On The Horizon?

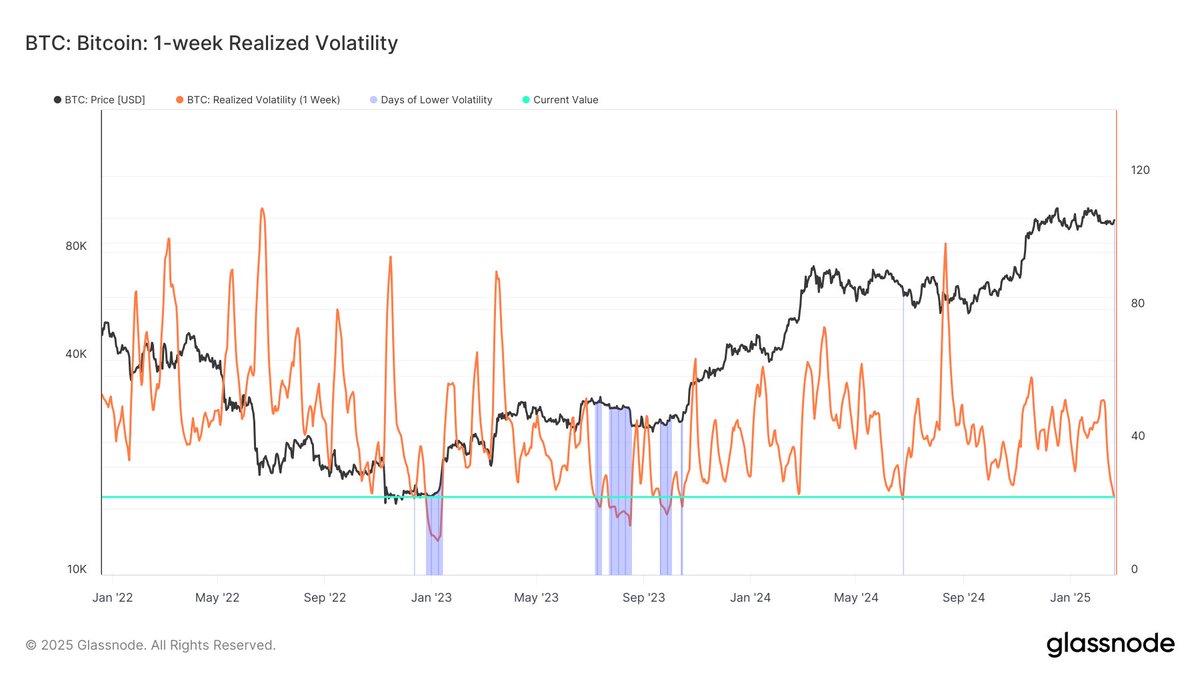

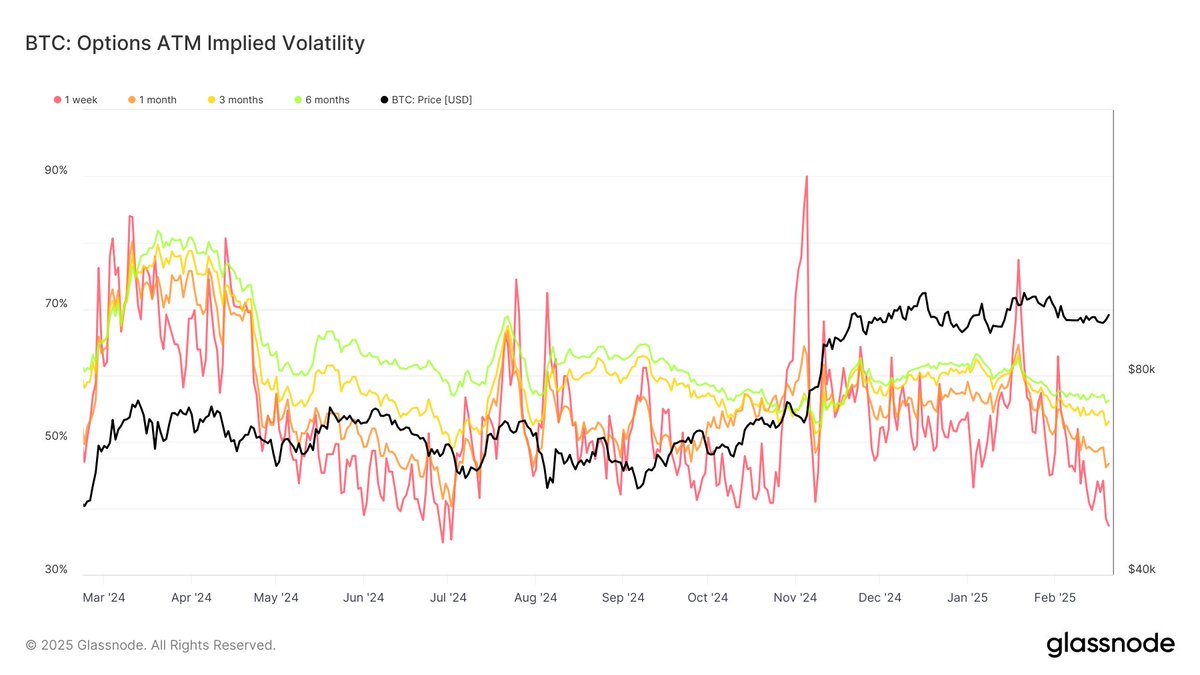

In a current submit on the X platform, crypto analytics agency Glassnode explained how two key volatility indicators nearing traditionally low ranges may affect the Bitcoin value and its future trajectory. The two related metrics listed here are the 1-week “realized volatility” and “options implied volatility.”

For context, realized volatility (additionally known as historic volatility) measures how a lot the value of an asset (BTC, on this case) has modified over a particular interval. Implied volatility, alternatively, is a metric that assesses the chance of future modifications in an asset’s value.

According to Glassnode information, Bitcoin’s 1-week realized volatility not too long ago dropped to 23.42%. The on-chain intelligence agency famous that the metric’s present worth is near historic lows, as BTC’s realized volatility has solely fallen beneath this degree a couple of instances up to now 4 years.

Source: Glassnode/X

Notably, the 1-week realized volatility metric dropped to 22.88% and 21.35% in October 2024 and November 2024, respectively. These factors have acted as bottoms, with the metric rebounding from this degree up to now. From a historic perspective, such declines in realized volatility have preceded significant price movements, rising the chances of a possible breakout – or perhaps a correction.

Source: Glassnode/X

At the identical time, Bitcoin’s 1-week choices implied volatility has additionally skilled a big decline to 37.39%. The indicator’s present degree is near multi-year lows — final seen in 2023 and early 2024. Similarly, the Bitcoin value witnessed substantial market strikes the final time the implied volatility was round this degree.

Moreover, it’s price noting that the longer-term choices implied volatility is at the moment exhibiting a special pattern. The 3-month implied volatility stands at round 53.1%, whereas the 6-month indicator is hovering at 56.25%. This means that market individuals count on elevated volatility over the approaching months.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at roughly $95,340, reflecting an over 3% decline up to now 24 hours.

The value of Bitcoin on the day by day timeframe | Source: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView