Per week after its final try and reclaim the $100,000 barrier, Bitcoin (BTC) continues transferring inside its native vary. Following its latest efficiency, some analysts take into account that BTC might be close to a breakout and a large rally towards a brand new excessive.

Related Reading

Bitcoin Ready For A Breakout Or a Breakdown?

Amid the market volatility, Bitcoin has found value stability, staying inside the mid-zone of its post-election breakout degree. During the latest 12% correction, BTC noticed its value retest the vary lows as help, bouncing towards the $100,000 barrier.

However, it did not regain this zone as help and continued its sideways transfer inside this vary. Over the final week, the flagship crypto has hovered between $94,000 and $98,000, incapable of holding the $99,000 mark since late January.

Crypto dealer EliZ noted that Bitcoin has been inside this “mini range” for practically two weeks, suggesting that the cryptocurrency is poised for “a big move” out of this consolidation zone. He cautioned buyers that the route the flagship crypto might take “is almost impossible to predict.”

It is value noting that market sentiment has not too long ago divided, as Bitcoin’s value motion doesn’t appear to replicate bullish information. A Nansem analyst suggested that the market seems momentarily satiated and extra “reactive to negative sentiment than positive news.”

Ali Martinez mentioned Bitcoin appears to be like “primed for a breakout,” highlighting an virtually two-week symmetrical triangle in BTC’s chart. After the latest value efficiency, the cryptocurrency examined the sample’s higher trendline, suggesting one other retest might be close to.

Nonetheless, the analyst acknowledged {that a} affirmation of the breakout can be key earlier than the subsequent BTC transfer.

BTC Price Eyes $150,000 Cycle Top

Crypto Jelle additionally considers that Bitcoin is getting ready to begin its subsequent leg up. BTC’s “explosive moves generally kick off after the first price-discovery consolidation is completed,” which, in accordance with different analysts, it has.

Rekt Capital has acknowledged that Bitcoin is about to embark on its second value discovery uptrend, as BTC has accomplished the primary price-discovery correction of its post-halving parabolic part.

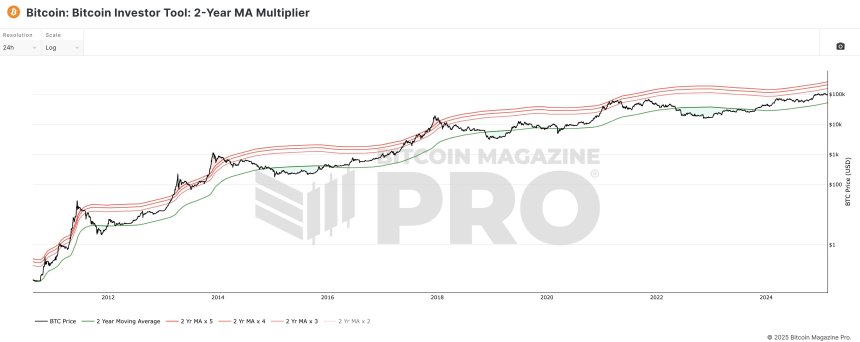

According to Jelle’s X submit, Bitcoin gained 577% in 133 days in 2017, whereas it recorded a 70% improve in 56 days in 2021. Moreover, he identified one other sign that would shed some mild on BTC’s high this cycle. The analyst affirmed, “Bitcoin crossing above its 2-year MA multiplier has historically been a great top signal.”

Bitcoin topped after crossing above the 5X multiplier within the first two cycles. Meanwhile, it didn’t hit final cycle’s high till “tagging the 5x multiplier – well above the 4x multiplier,” suggesting {that a} diminishing pattern might be forming.

Related Reading

However, Jelle affirms that even when BTC’s value solely hits the 3x multiplier this cycle, the worth continues to be poised for a major rise. According to the chart, the potential multiplier for the cycle targets the $152,000 mark.

As of this writing, Bitcoin trades at $98,243, a 1.7% improve on the day by day timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com