On Monday, the crypto market skilled what was billed as the largest liquidation occasion in historical past, destroying upwards of $2 billion in positions. Amid requires the colloquial ‘altcoin season,’ analysts are divided on whether or not February is the month or if crypto markets should wait till April.

The arguments and projections discuss with previous market crashes, reminiscent of these in 2020 and 2022, and the way the sector responded.

Analysts Weigh In on the Crypto Market Recovery Timeline

BeInCrypto reported on Monday’s historic $2 billion liquidation occasion, provoked by US President Donald Trump’s tariffs. As it occurred, the president reached an settlement with Canada and Mexico, prompting some stage of restoration in the market.

However, analysts stay unconvinced {that a} full-blown market restoration is right here, whilst others name for an altcoin season.

Mathew Hyland, a blockchain analyst, shared his insights on the market downturn, emphasizing that restoration will take time. He highlighted that though Bitcoin (BTC) didn’t break down, altcoins suffered considerably, leading to the historic liquidation occasion. He says this means the extent of injury sustained by the altcoin market.

According to Hyland, whereas the large liquidation occasion signified the market’s bottoming out, it isn’t but ripe for a bounce again.

“Considering this was the largest liquidation event in Crypto history, it likely means the low is in. However, in 2020 & 2022, it took over two months for the full recovery to take place,” Hyland said.

The controversial analyst additionally identified that December highs for many altcoins might not return for at the least two months, if not longer. Based on this outlook, Hyland cautions merchants to mood their expectations, including that even V-shaped recoveries like in 2020 took weeks with a number of dips alongside the method.

Another technical analyst, CryptoCon, echoed Hyland’s sentiments. He described the occasion as a serious shakeout for overleveraged merchants. While the analyst acknowledges that the cycle is properly on observe, he didn’t recommend an imminent restoration.

“What happened to a good-performing February? Still inbound, the cycle is well on track. It is clear that certain entities do not want people longing altcoins from their bottoms at 100X for the entire bull market,” the analyst stated.

CryptoCon’s outlook aligns with a number of different analysts, together with Rover, who maintain that the trajectory stays intact. In a publish on X, CryptoRover highlighted that altcoins would go “parabolic” quickly.

Arguments for Altcoin Season in February

Meanwhile, like CryptoCon, sentiment for February stays optimistic amongst different analysts, together with Merlijn The Trader. In a associated publish, the analyst predicts that February will sign the begin of an altcoin season and, due to this fact, market restoration. The analyst cites historic information suggesting that altcoin rallies have persistently begun in February, and this cycle must be no completely different.

“Altcoin season starts in February! History doesn’t lie, and neither do the charts,” said Merlijin in a publish.

Others level to Bitcoin’s dominance as a key indicator, noting that the prime is sort of in for this metric, setting the stage for an altcoin season. Similarly, Coinvo, an analyst, reiterated the sentiment.

“Altcoin season has always started in February, and this cycle will be no different,” chimed Coinvo.

Another crypto analyst, DevKhabib, supplied a contrasting perspective, highlighting February as a superb month for Bitcoin. The analyst recognized the $91,000 stage as a vital assist flooring for the Bitcoin value. He emphasised that the value rebounded strongly, expressing optimism about the market’s future.

“$91,000 seems to be a strong support for BTC as we bounced directly off it. Let us hope we continue to range above $94,000 so the market can recover a little bit. February usually is green, and I think we will still get a bullish February. A bad beginning makes a good ending,” the analyst expressed.

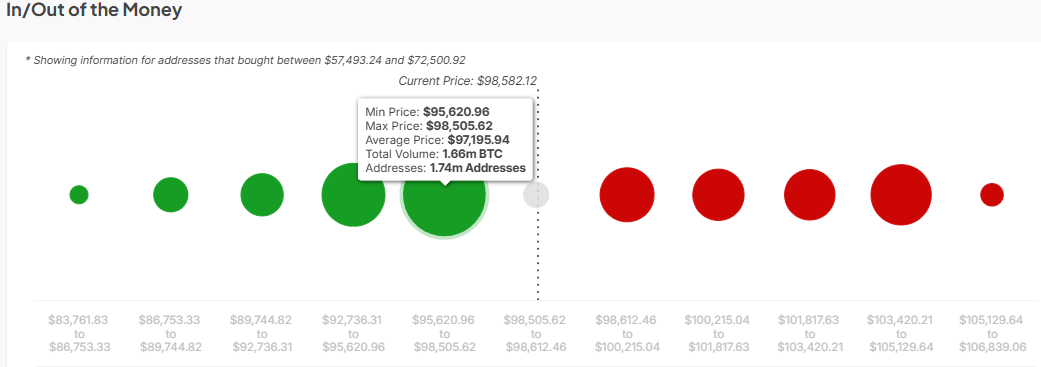

Moreover, in keeping with information from IntoTheBlock, the vary between $95,620 and $98,505 represents vital assist for Bitcoin value

Any efforts by the bears to push the value beneath this stage could be met by shopping for stress from roughly 1.74 million addresses who purchased BTC at a mean value of $97,195.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. However, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.