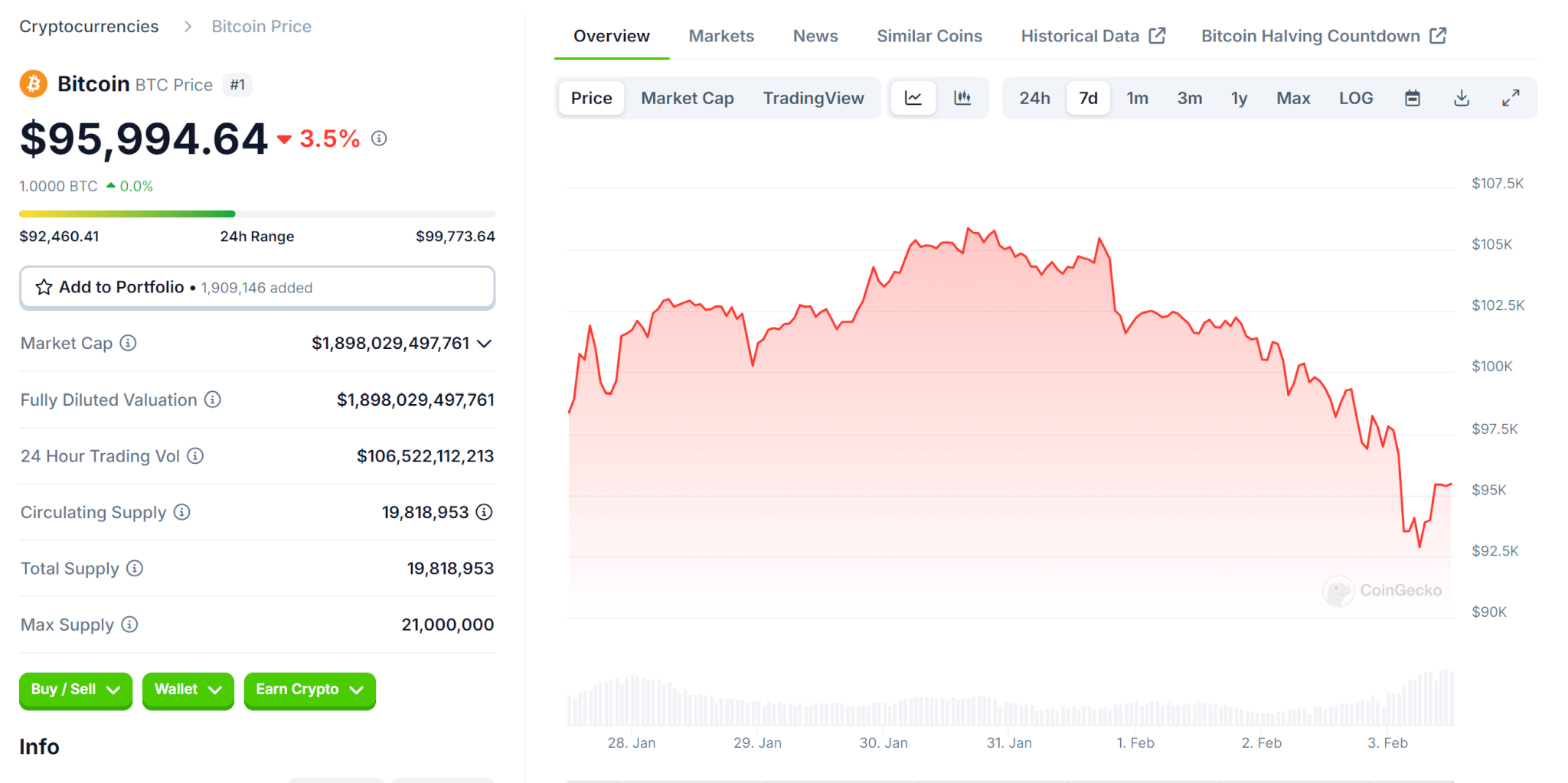

- Bitcoin fell 4.72% over the weekend and one other 3.50% throughout Monday’s Asian session as tensions pushed by Trump’s tariffs have buyers derisking their positions.

- Over the weekend, China responded to Trump’s tariffs by indicating curiosity in imposing tariffs on US items, whereas Canada imposed a 25% tariff on CA$155 billion value of US items.

Bitcoin tumbled beneath $100,000 over the weekend, extending losses into at the moment as threats of a potential commerce warfare rock markets worldwide.

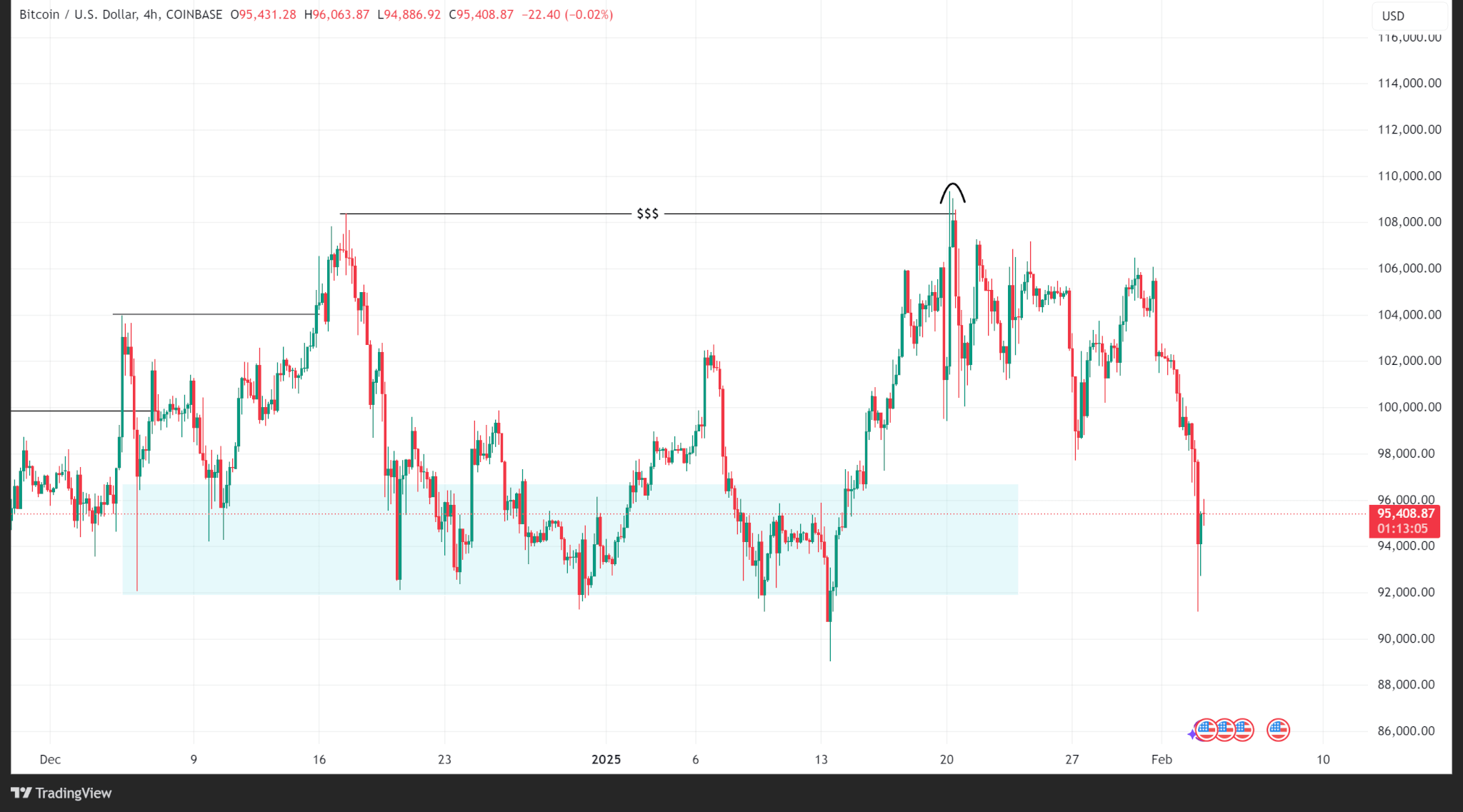

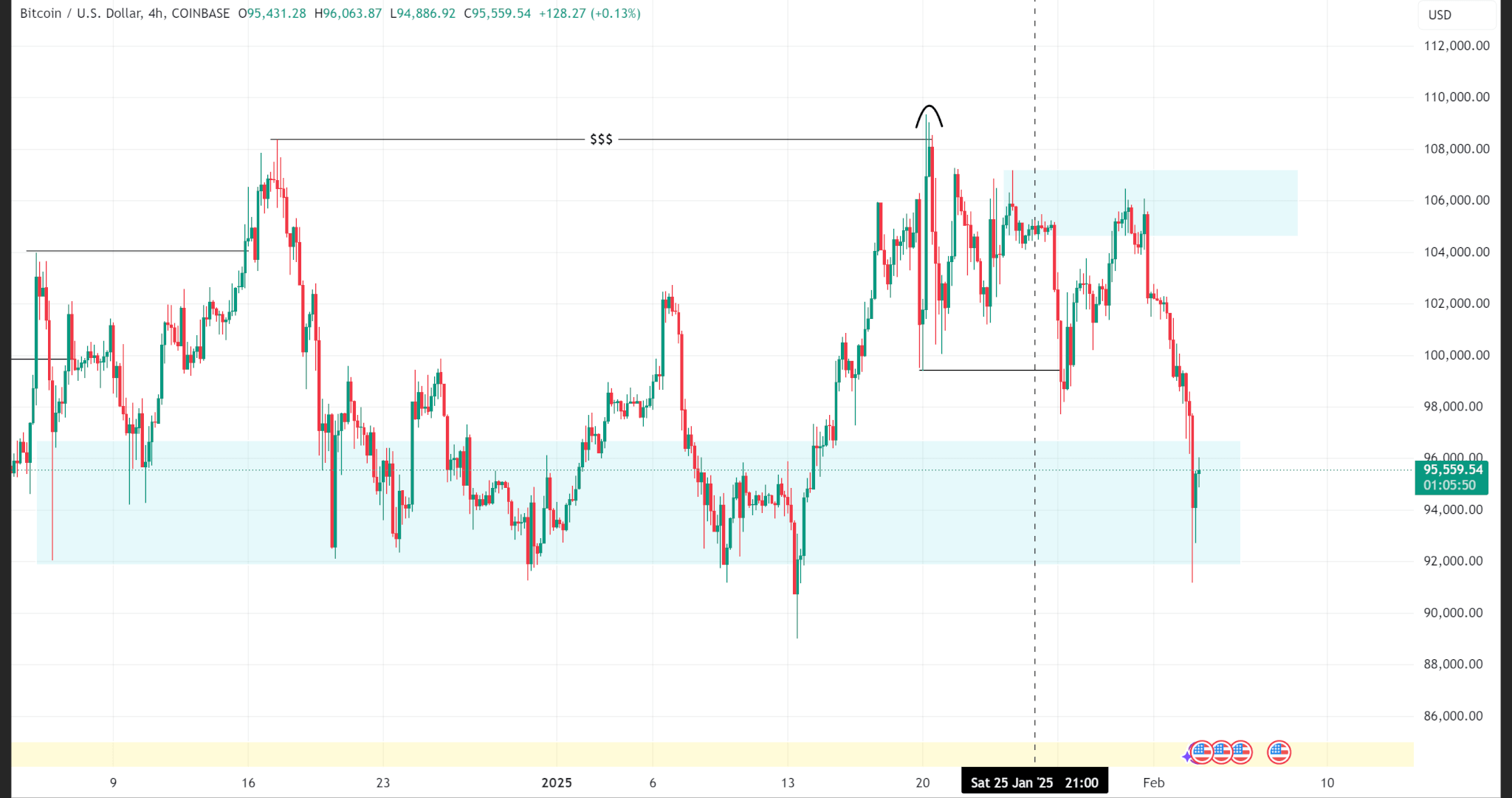

While most of Bitcoin’s worth decline got here this weekend, weak spot started when its worth failed to swing increased than the $108,000 stage two weeks in the past (Jan. 20).

A failure to swing increased can signify inadequate purchase stress to push costs increased. If that’s the case, costs will search the subsequent main liquidity stage, which might imply decrease costs within the interim, as seen during the last two weeks.

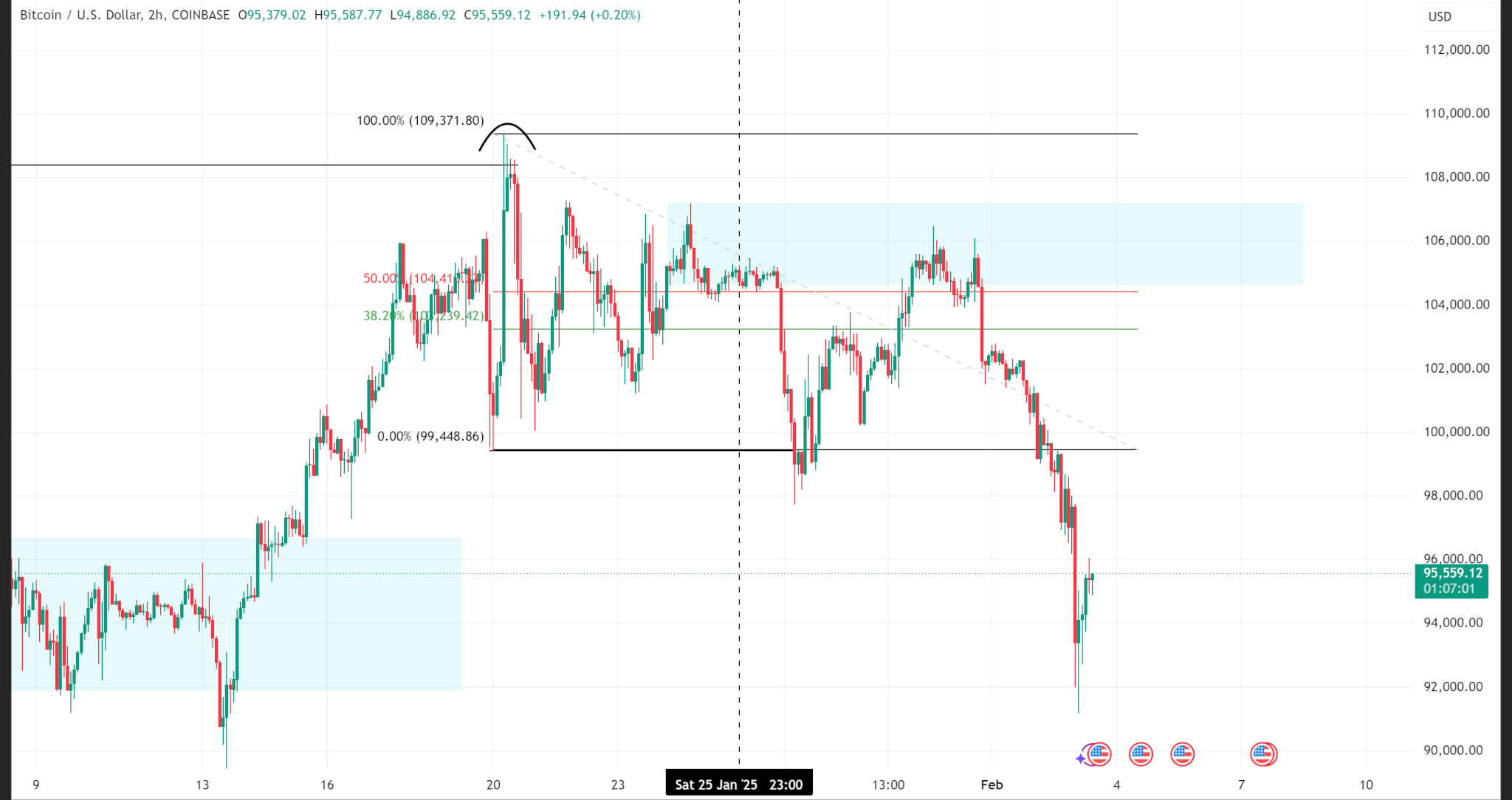

Scaling down to a decrease timeframe, worth continued to break decrease beneath $99,000 earlier than retracing to an inside provide zone between the 50.00% and 61.80% Fibonacci ranges (the golden zone for retracements) on Thursday, Jan. 30.

After being rejected by inside provide, the value broke down additional on Friday, Jan. 31, and over the weekend to settle on the subsequent main demand stage, between $92,000 and $96,000.

Bitcoin’s worth has discovered some help at $92,000 and is presently up 4.92% from Asian lows of $91,176.

Wider commerce wars stifle markets

Meanwhile, the broader financial panorama faces uncertainty as a brewing commerce warfare between the US and a number of other of its commerce companions, together with Canada, Mexico, and China rocks numerous markets.

The US tariffs on its largest commerce companions, which embody a 25% tariff on imports from Canada and Mexico, and a ten% tariff on Chinese imports have sparked tensions between nations.

In response, Canada imposed a 25% tariff on CA$155 billion value of US items, Mexico has introduced tariffs on US items however has not supplied particulars, whereas China additionally introduced plans to impose retaliatory tariffs on US items.

The result’s uncertainty across the enlargement of worldwide commerce and a derisking of portfolios, with cryptos being one of many first on the chopping block.