It has not been all rosy previously week, however the digital asset market has reacted pretty properly to the beginning of Donald Trump’s new administration. Specifically, the Bitcoin value has been in a position to climate the unsure storm clouding the cryptocurrency market over the previous few days.

While the premier cryptocurrency might need slowed down in current days, the most recent on-chain remark reveals that BTC is prone to proceed its upward motion. Here’s how the token value is perhaps gearing for one more leg up over the approaching weeks.

Is There Room For Further BTC Price Growth?

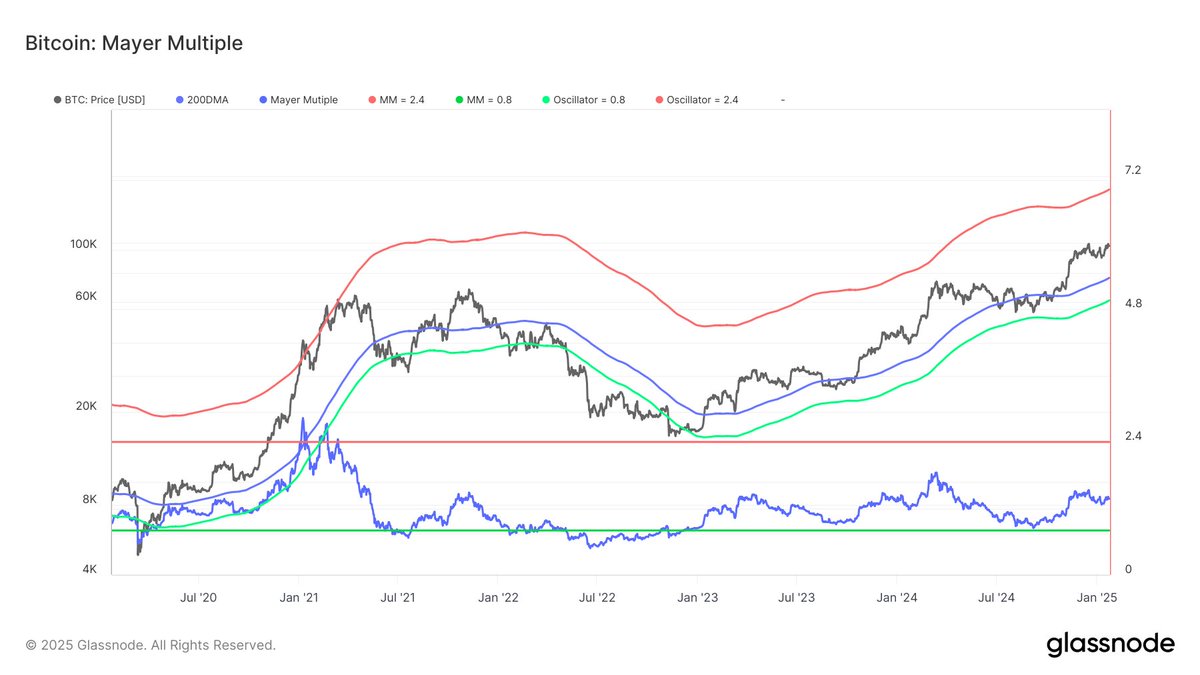

In a Jan. 24 publish on the X platform, market intelligence agency Glassnode explained that the Bitcoin value shouldn’t be but overheating and nonetheless has the potential for additional progress over the subsequent few weeks. This on-chain revelation is predicated on the Mayer Multiple indicator, which is calculated because the ratio between as asset value and the 200-day transferring common (200DMA).

The Mayer Multiple measures the space of the Bitcoin value from its long-term common to estimate overbought and oversold situations. This metric can be used to ascertain macro bull or bear bias when analyzing cyclical value actions.

Historically, the Mayer Multiple indicators an overbought market situation and a possible value high when its worth is above 2.4. On the opposite hand, a Mayer Multiple worth beneath 0.8 suggests an oversold situation and {that a} market backside is perhaps in.

Source: Glassnode

According to information from Glassnode, the worth of Bitcoin’s Mayer Multiple stands at 1.37, indicating that the premier cryptocurrency continues to be fairly a distance from the overbought territory. This piece of information implies that BTC nonetheless has room for additional progress on this cycle. Moreover, the Bitcoin value is at the least 35% above the 200-day transferring common, which is a bullish sign.

Glassnode highlighted that the value of Bitcoin would want to surge above $180,000 to change into overbought. This value degree represents the potential peak for the flagship cryptocurrency on this present cycle and may very well be adopted by a development reversal. With the oversold threshold at 0.8, the Mayer Multiple locations the Bitcoin value backside at round $60,000.

The Bitcoin value has not been notably spectacular since surpassing the $100,000 mark, resulting in shouts of a value high available in the market. This indicator considerably offers perception into the potential path of the premier cryptocurrency over the subsequent few months.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin sits slightly below $105,000, reflecting no important motion previously day.

The value of BTC on the each day timeframe | Source: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView