Bitcoin (BTC) stays the middle of traders’ consideration and concern particularly following the latest nonfarm payrolls data from the US Bureau Of Labor Statistics (BLS). While the overall market sentiment stays bullish, latest developments within the US economic system point out that macroeconomic components could also be in opposition to the premier cryptocurrency in 2025.

Currently, Bitcoin trades above $94,000 following one other turbulent value efficiency which produced a lack of 3.45% up to now seven days.

Fed’s Pivot To Rate Cuts Is Dead – Analysts

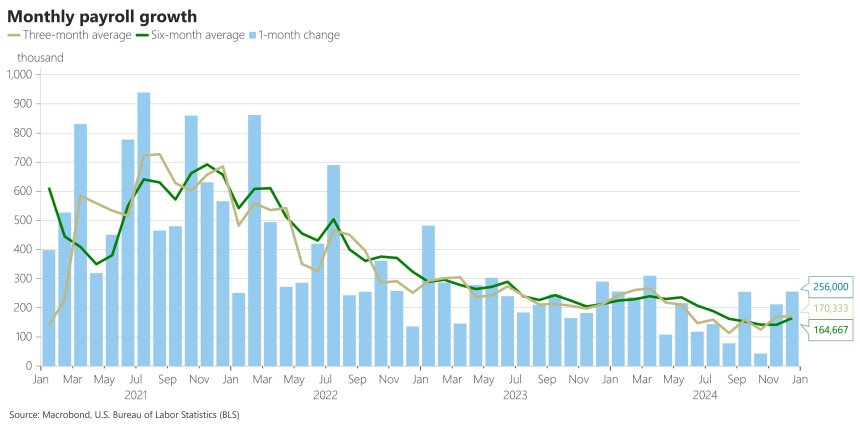

In an X post on December 10, market specialists at world capital market evaluation agency The Kobeissi Letter dissected the employment scenario abstract for December 2024. According to the BLS, nonfarm payrolls employment rose by 256,000 jobs on this month, indicating a further 100,000 jobs to the extensively predicted figures.

Following this report, The Kobeissi Letter analysts spotlight that the US economic system has gained a median of 165,000 jobs since July representing the best 6-month common since July 2024.

Considering the US Federal Reserve started implementing rate of interest cuts from September 2024 citing then a discount in jobs development and inflation, the analysts at The Kobeissi Letter acknowledged the Apex Bank’s strategy might have been misguided in mild of the latest developments.

Therefore, the Fed is predicted to halt rate of interest cuts to battle an anticipated heightened inflation resulting from a robust jobs information, with the potential of even adopting price hikes.

Generally, an absence of price cuts or introduction of price hikes is destructive for Bitcoin as decrease Interest charges afford traders the capability to deal In dangerous belongings akin to cryptocurrencies. Following the Fed’s earlier announcement of potential diminished price cuts in 2025, Bitcoin skilled a flash crash of over 9% mid-December as traders moved to shut their unstable positions in all monetary markets.

Currently, The Kobeissi Letter forecasts that the Fed’s pivot to price cuts is probably going over, with a 44% chance that there shall be no price cuts by June 2025.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $94,028 reflecting a 0.22% acquire up to now 24 hours. Meanwhile, the premier cryptocurrency is down by 3.72% and 6.35% up to now seven and thirty days respectively.

Despite the potential of diminished price cuts in 2025, Bitcoin traders are more likely to retain bullish sentiments resulting from different components together with historic value efficiency in a bull cycle, an anticipated pro-crypto US authorities and steady institutional investments through the spot ETFs.

With a market cap of $1.84 trillion, Bitcoin continues to rank as the most important cryptocurrency and world’s eight largest asset.

Featured picture from Investopedia, chart from Tradingview