BlackRock’s iShares Bitcoin ETF (IBIT) has recorded its largest-ever $188.7 million in outflow on Tuesday, elevating issues over future implications. Also, US-based spot Bitcoin ETFs noticed consecutive outflows for the fourth day as Fidelity’s FBTC and Ark Invest’s ARKB continued weak efficiency amid holidays. Bitcoin ETFs have now recorded over $1.5 billion in outflow in final 4 days.

BlackRock Bitcoin ETF Sees Biggest Outflow Since Launch

The crypto market confirmed indicators of restoration as Bitcoin, Ethereum and different altcoins rebounded during the last 24 hours. Bitcoin price recovered from $94K to $99K as we speak doubtless as merchants FOMO Santa Claus rally. BTC at present holds above $98K, however a change in sentiment can set off revenue reserving.

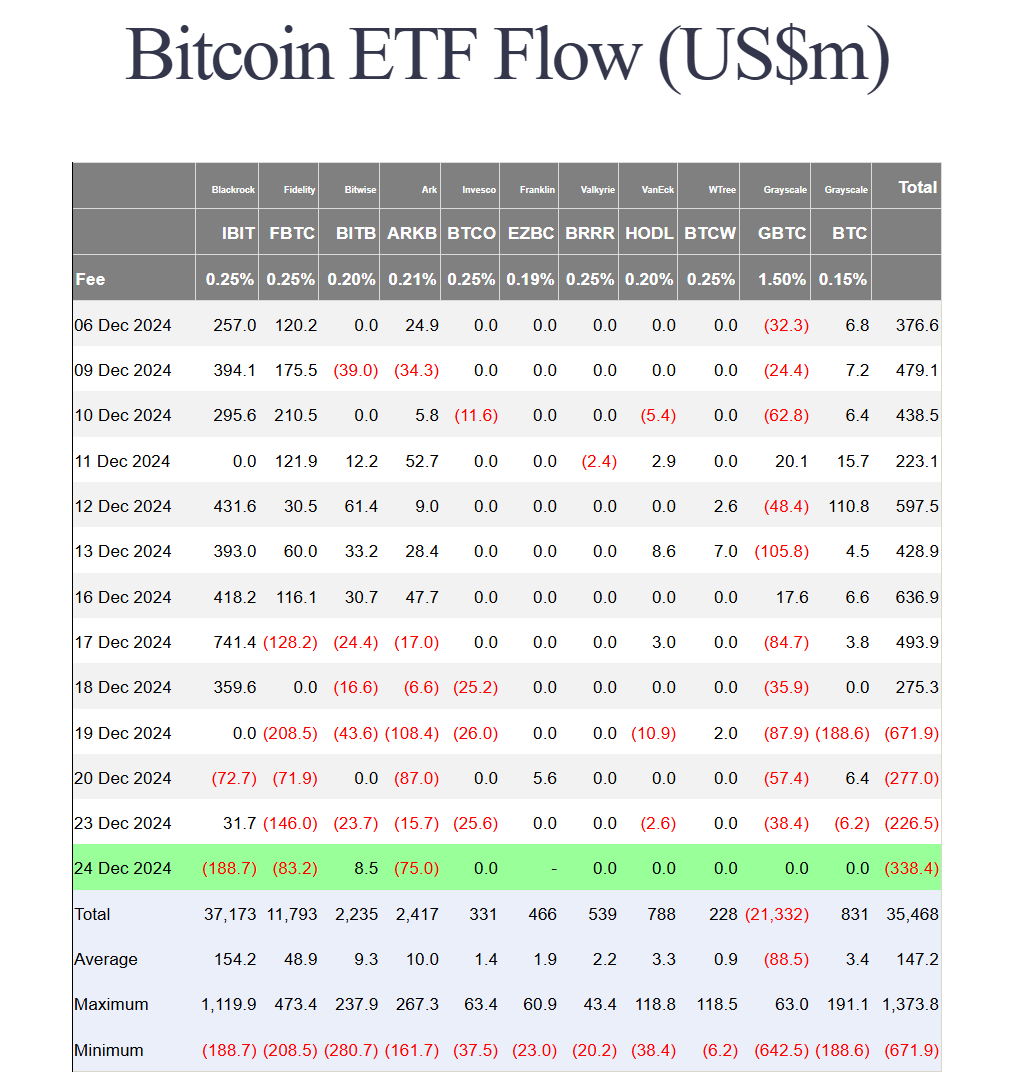

The promising components for the change in sentiment might come from BlackRock Bitcoin ETF, which recorded its largest-ever outflow since launch on Tuesday, as per Farside Investors data on December 25. iShares Bitcoin ETF (IBIT) witnessed $188.7 million in outflow, virtually double its previous largest outflow of $72.7 million final Friday.

The whole outflow from US spot Bitcoin ETFs was $338.4 million, the fourth consecutive outflow. Fidelity’s FBTC noticed $83.2 million and Ark 21Shares’ ARKB recorded $75 million in outflows. The flows for different crypto exchange-traded funds have been negligible.

This has raised issues amongst merchants, elevating issues for them because the year-end crypto expiry is sort of right here. While analysts and traders are primarily bullish, the current prediction by specialists together with BitMEX co-founder Arthur Hayes a couple of potential crypto market crash close to Donald Trump’s inauguration day sparked sell-offs.

However, crypto companies equivalent to MicroStrategy, Metaplanet, Matador Technologies, and others purchase the Bitcoin worth dip. In truth, MicroStrategy’s Michael Saylor announced a special shareholder meeting to vote on a proposal for its 21/21 Bitcoin plan and enhance its treasury.

What’s Next for Bitcoin Price?

BlackRock Bitcoin ETF’s largest-ever outflow and consecutive outflows from spot Bitcoin ETFs made traders to consider their subsequent transfer.

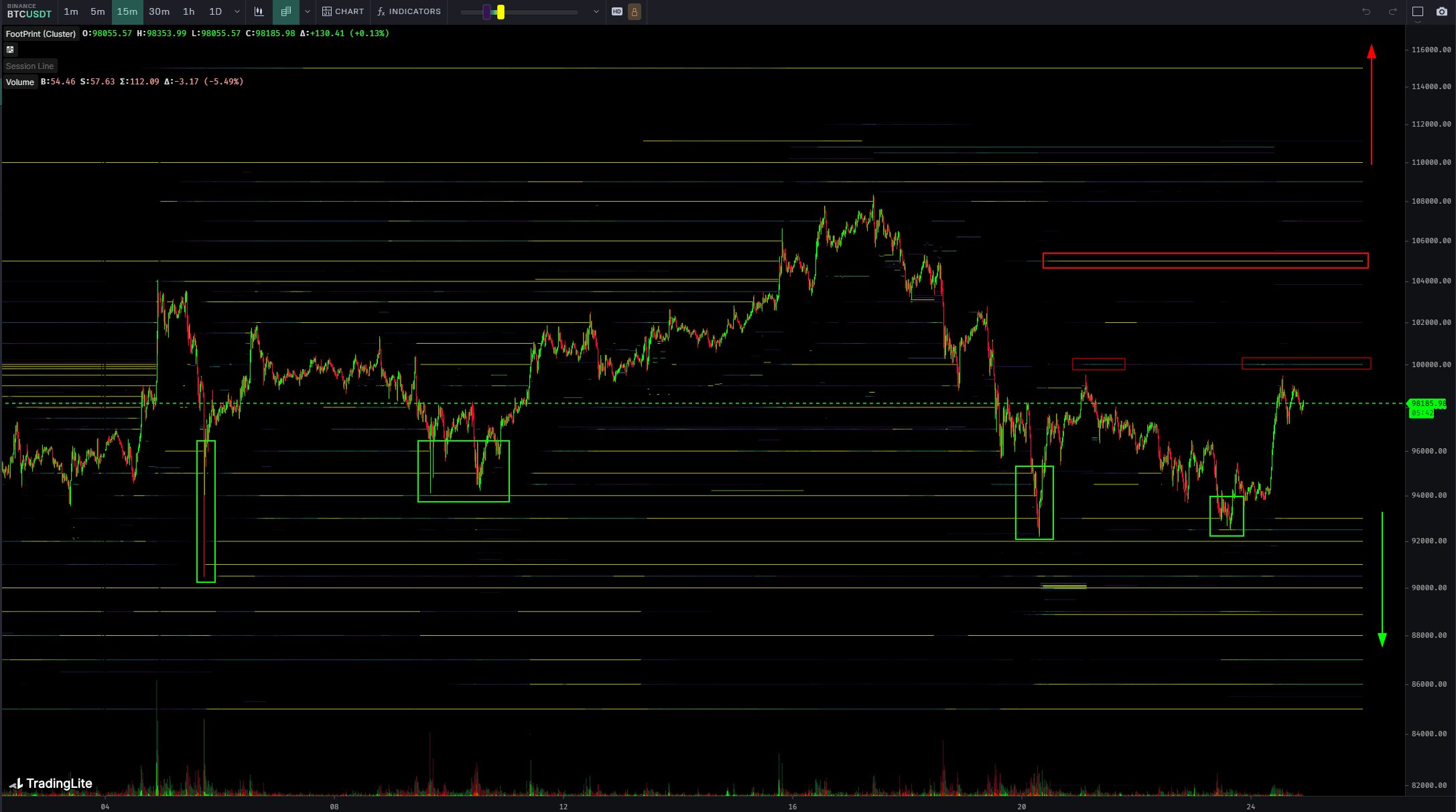

Crypto analyst Skew revealed that the present passive ask liquidity is round $100K given quoting and former LTF excessive, which is a crucial worth space. Besides, ask liquidity and spot provide is round $105K. He believes flows and volatility will likely be a key issue right here.

“Dynamic use of taker & limit bid for acquiring BTC here, likely a strategic play by some large market entity that expects higher prices into year end & early Q1.”

BTC price jumped 4% prior to now 24 hours, with the worth at present buying and selling at $98,014. The 24-hour high and low are $93,744 and $99,404, respectively. Furthermore, the buying and selling quantity has decreased by 24% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Traders should control quantity and sentiment out there for cues on path in upcoming days, with BlackRock Bitcoin ETF additionally a significant component. Notably, 147 BTC options with $14.40 billion in notional worth to run out on Deribit this Friday. The max ache worth is $84,000 and put-call ratio is 0.68.

Disclaimer: The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.