The US Securities and Exchange Commission (SEC) appears more likely to approve a Solana exchange-traded fund (ETF) below Donald Trump’s administration. With this Solana ETF approval wanting imminent, there are tokens which can be able to get pleasure from a 5x worth improve as soon as this occurs.

5 Tokens That Could 20x After A Solana ETF

Bloomberg analysts recently suggested {that a} Solana ETF may launch in some unspecified time in the future subsequent 12 months, though the precise timing stays unsure as a result of some advanced authorized points. Ahead of this potential launch, these are 5 tokens that might witness a major worth improve after the SEC approves a Solana ETF.

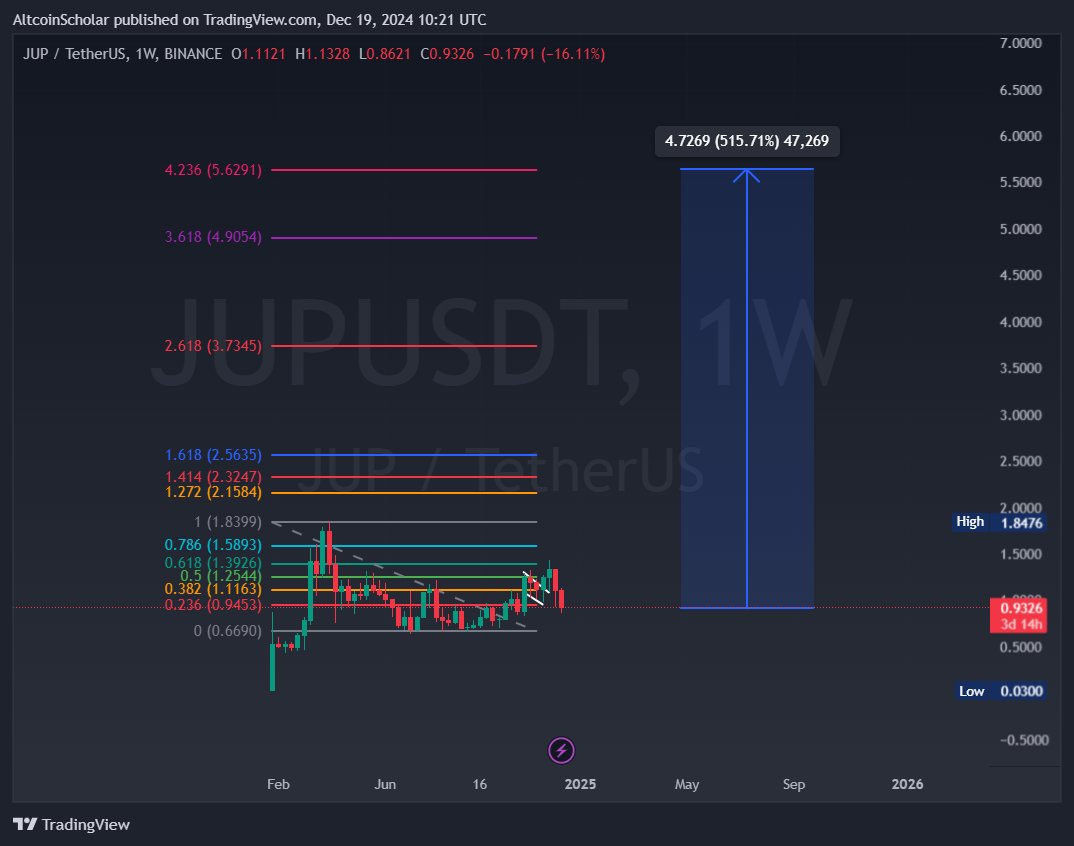

Jupiter (JUP)

Jupiter (JUP) is without doubt one of the tokens that’s prepared for a 20x worth improve after a Solana ETF approval. The JUP worth is in a superb place to profit from such bullish improvement, contemplating its standing as one of many top Solana coins.

As such, the DeFi token will possible witness a parabolic surge on the again of an ETF approval. Crypto analyst Altcoin Scholar predicted that JUP may rally to $10 or increased on this bull run.

NebulaStride Token (NST)

NebulaStride Token (NST) is in a superb place to witness a major worth improve after a Solana ETF approval. This ETF approval supplies a bullish outlook for the crypto and NST, as a more recent token, may get pleasure from one of the crucial beneficial properties.

(*5*)

(*5*)

As a more recent token, NST may even file greater than a 20x worth improve because it has extra room to run to the upside than these older cash. the token’s fundamentals additionally supplies a bullish outlook for its as NebulaStride is revolutionizing the finance area.

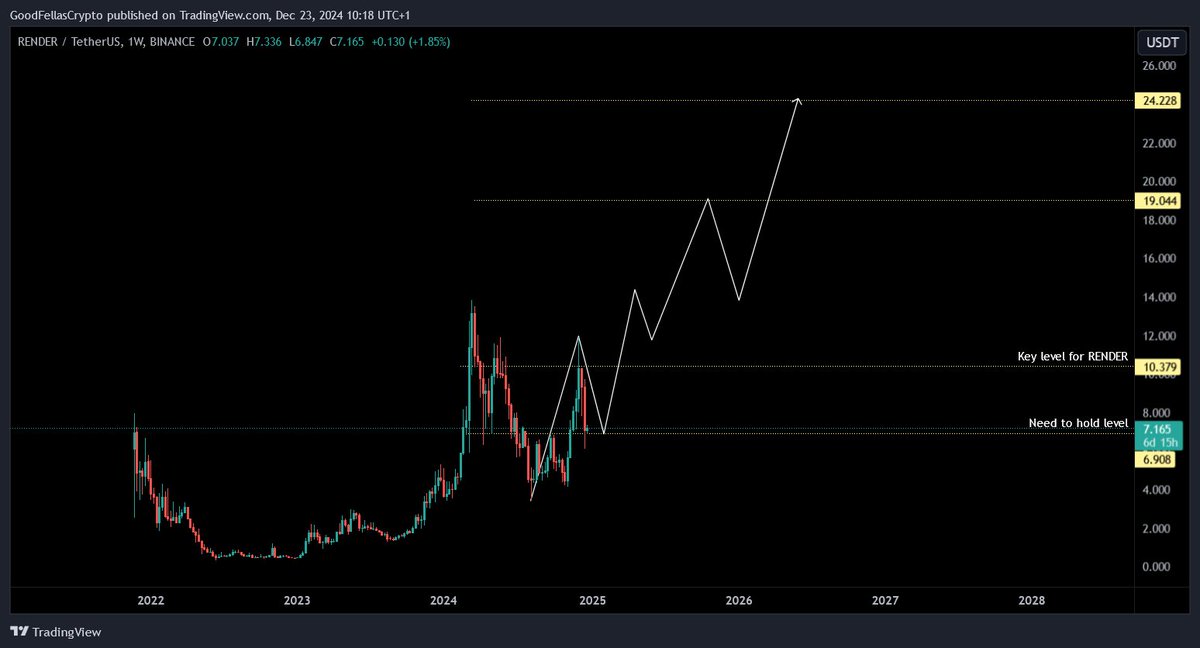

Render (RENDER)

Render (RENDER) is one other prime Solana coin that’s prepared for a 20x worth improve after a SOL ETF approval. The token already boasts a bullish outlook primarily based on its ties to the factitious intelligence (AI) narrative.

Meanwhile, from a technical evaluation perspective, crypto analysts have prompt that RENDER is effectively primed for a parabolic surge. In an X post, crypto analyst Exotrader predicted that the AI coin couuld rally to as excessive as $24 so long as it holds the $6.9 help stage on the weekly shut.

Bonk (BONK)

Bonk (BONK) has develop into greater than only a meme coin within the Solana ecosystem. The top meme coin has gained a number of use circumstances and even boasts an exchange-traded product (ETP).

Meanwhile, it’s price mentioning the upcoming BONK token burn with 1 trillions cash set to be burnt. With this 1 trillion token burn on the horizon, the meme coin eyes a $0.11 worth goal.

XRP

XRP appears like an apparent play if the SEC had been to approve a Solana ETF, particularly if this approval comes earlier than the one for an XRP ETF. In a scanario the place a SOL ETF will get authorized an XRP ETF, XRP will possible witness a 20x worth improve as merchants anticipate the XRP ETF subsequent.

Moreover, crypto analysts have already offered a bullish outlook for the XRP worth. One of those analysts is Dark Defender who predicted that XRP may rally to as excessive as $18 on this market cycle.

Conclusion

A Solana ETF approval is undoubtedly bullish for JUP, NST, RENDER, BONK, and XRP. These cash, most particularly NST, are able to get pleasure from a 20x worth improve as soon as these SEC approves the SOL ETF.

Disclaimer: The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.