- The crypto market spent the better a part of final week buying and selling constantly decrease.

- Yearly profit-taking is a significant motive for value declines as establishments shut positions for the yr, though the Fed’s hawkish stance on the Dec. 18 coverage assembly additionally performed a job.

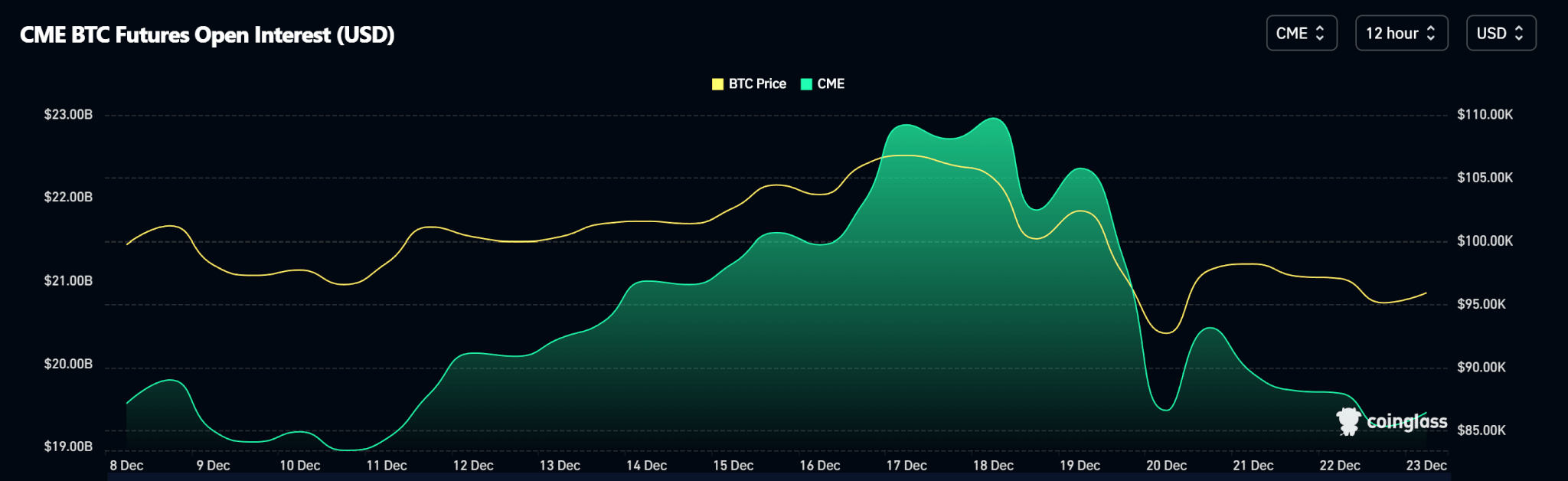

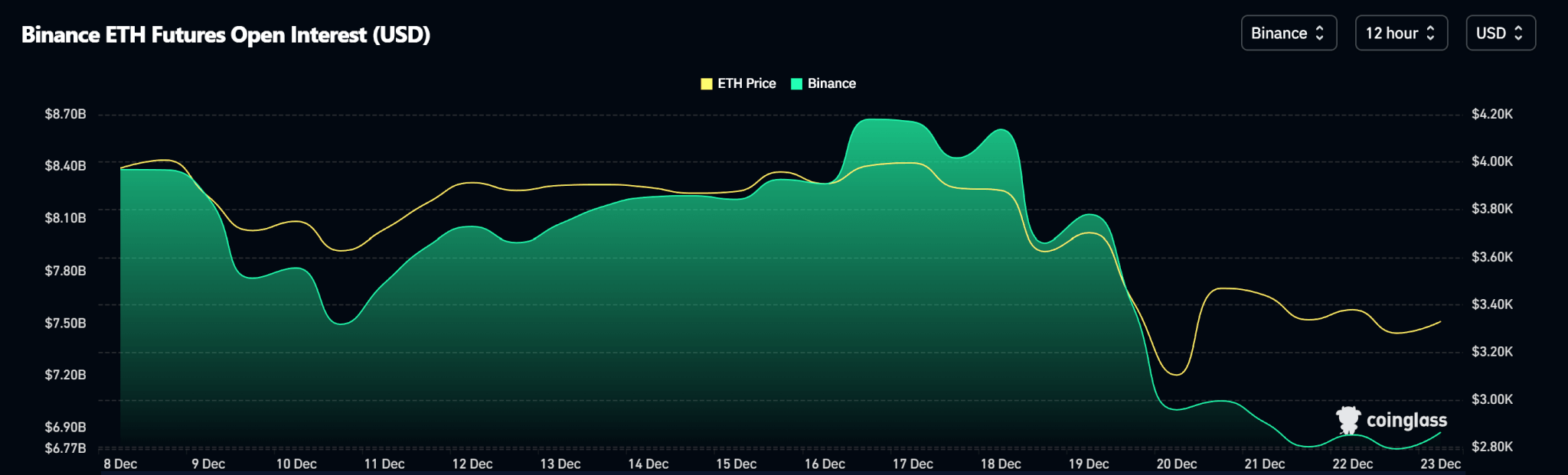

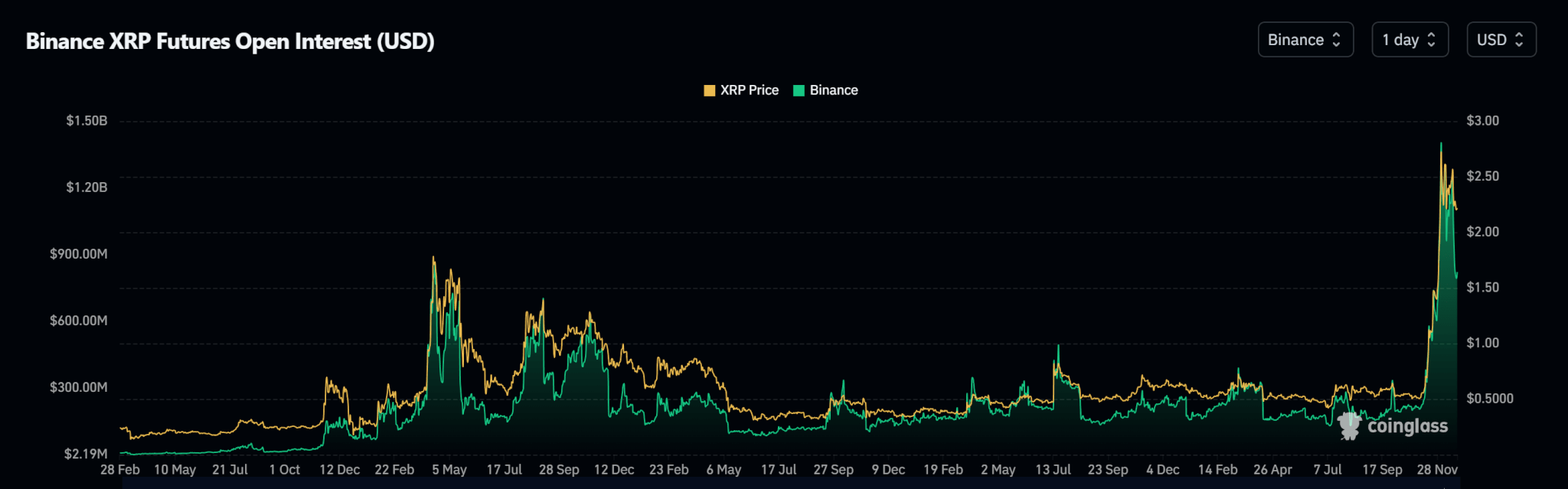

- Open Interest in main cryptos confirmed weekly declines.

Bitcoin

Bitcoin’s price fell from the weekly excessive of $108,372 on Dec. 17 to a low of $92,555 earlier than closing the week round $97,700. However, regardless of the 9.7% drop, Bitcoin’s value has not modified character to the draw back.

Open Interest knowledge reveals a discount in open contracts on the CME which correlates with value declines.

The Fed’s coverage resolution on Dec. 18 favoured a 25bps slash. However, Fed Chair Jerome Powell expressed hawkish sentiments regarding slashing plans subsequent yr, exacerbating selloffs.

Meanwhile, Bitcoin spot ETF inflows knowledge reveals outflows on Dec. 19 and 20 totalling $948.90Mn. Net inflows from Dec. 16 to Dec. 20 had been $447.00Mn.

Bitcoin trades at $95,700 as of publishing.

Ethereum

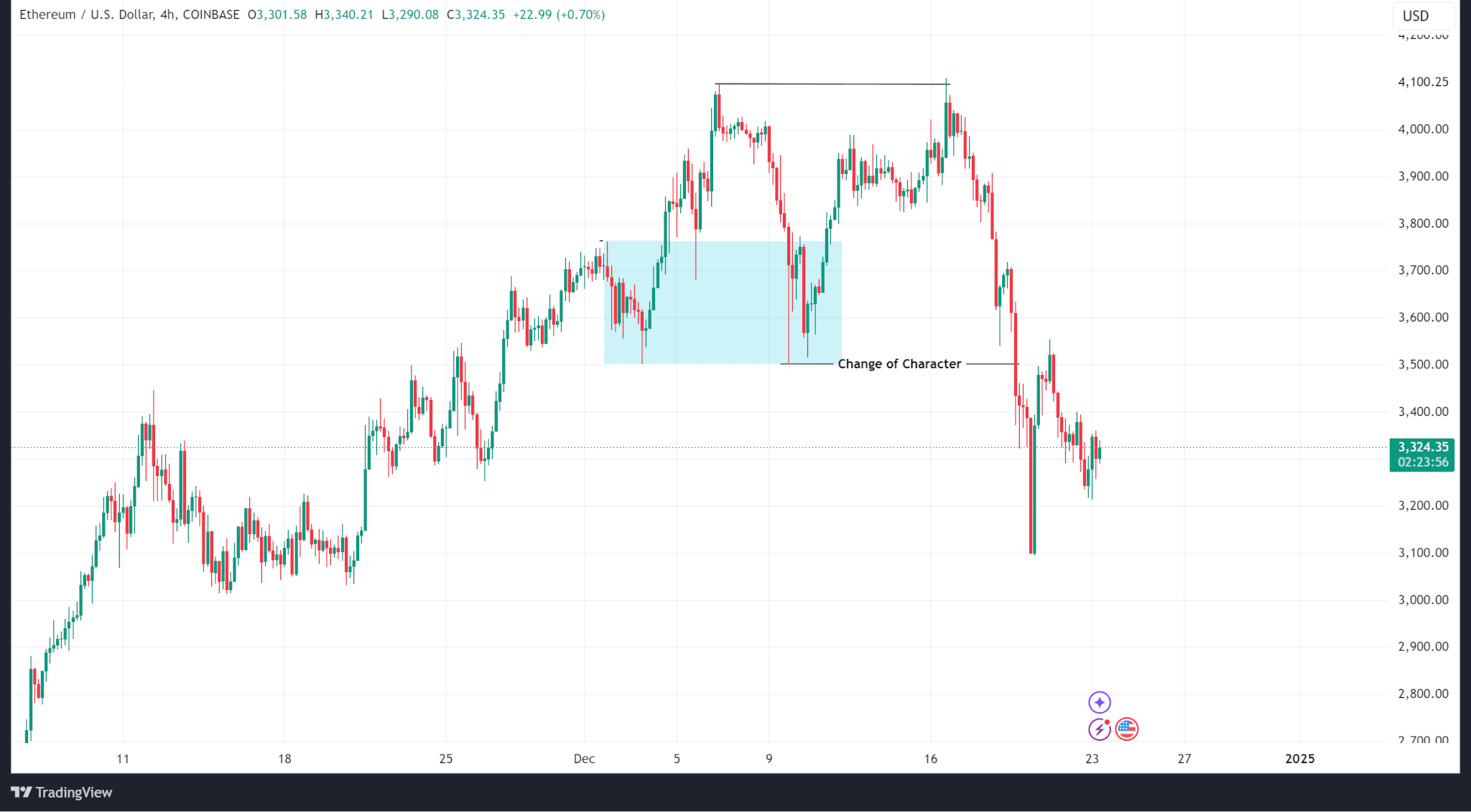

Unlike Bitcoin which maintained its bullish construction, Ethereum’s price modified character on the H4 time-frame to pattern decrease after testing (however failing to interrupt) the native excessive at $4,096.50.

Ethereum fell from a weekly excessive of $4,108.82 to a weekly low of $3,098.40 earlier than finally closing the week at $3,470.44 (a 15.51% drop).

Ethereum spot ETF inflows present an identical sample with Bitcoin’s with outflows on the final two days of the week.

Meanwhile, Ethereum’s open curiosity reveals a steep decline correlated with value.

Ethereum trades at $3,330.78 as of publishing.

Solana

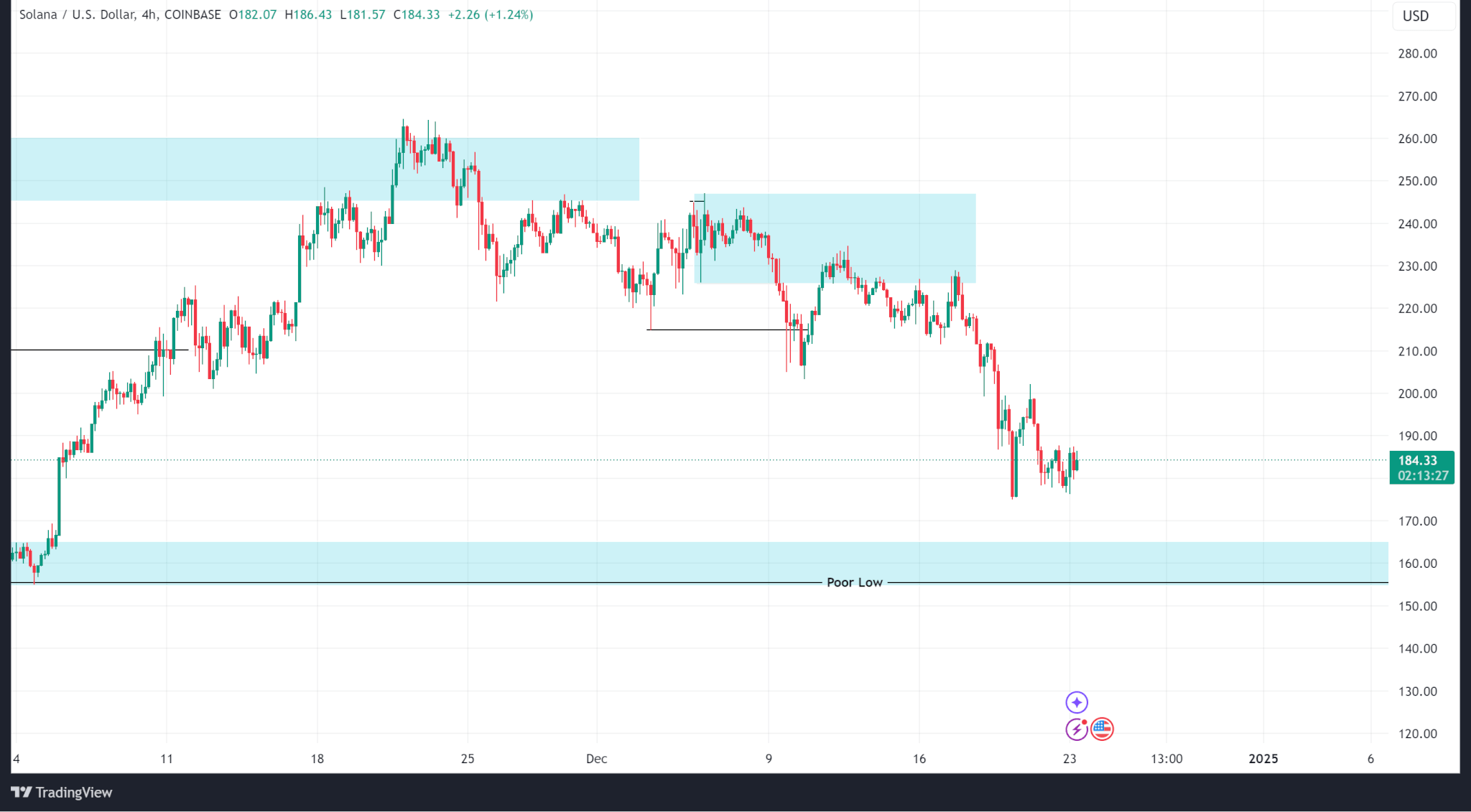

Solana’s price motion continued a decline that started two weeks in the past after it failed to interrupt above the all-time excessive of $260.02.

Last week, value motion traded into an inner provide zone round $227.71, continued promoting to a weekly low of $175.12 and finally closed at $194.44 (a 15.07% drop).

The demand zone round $160 (talked about final week) stays the primary logical assist zone as open curiosity continues to fall.

Solana trades at $184.82 as of publishing.

Ripple

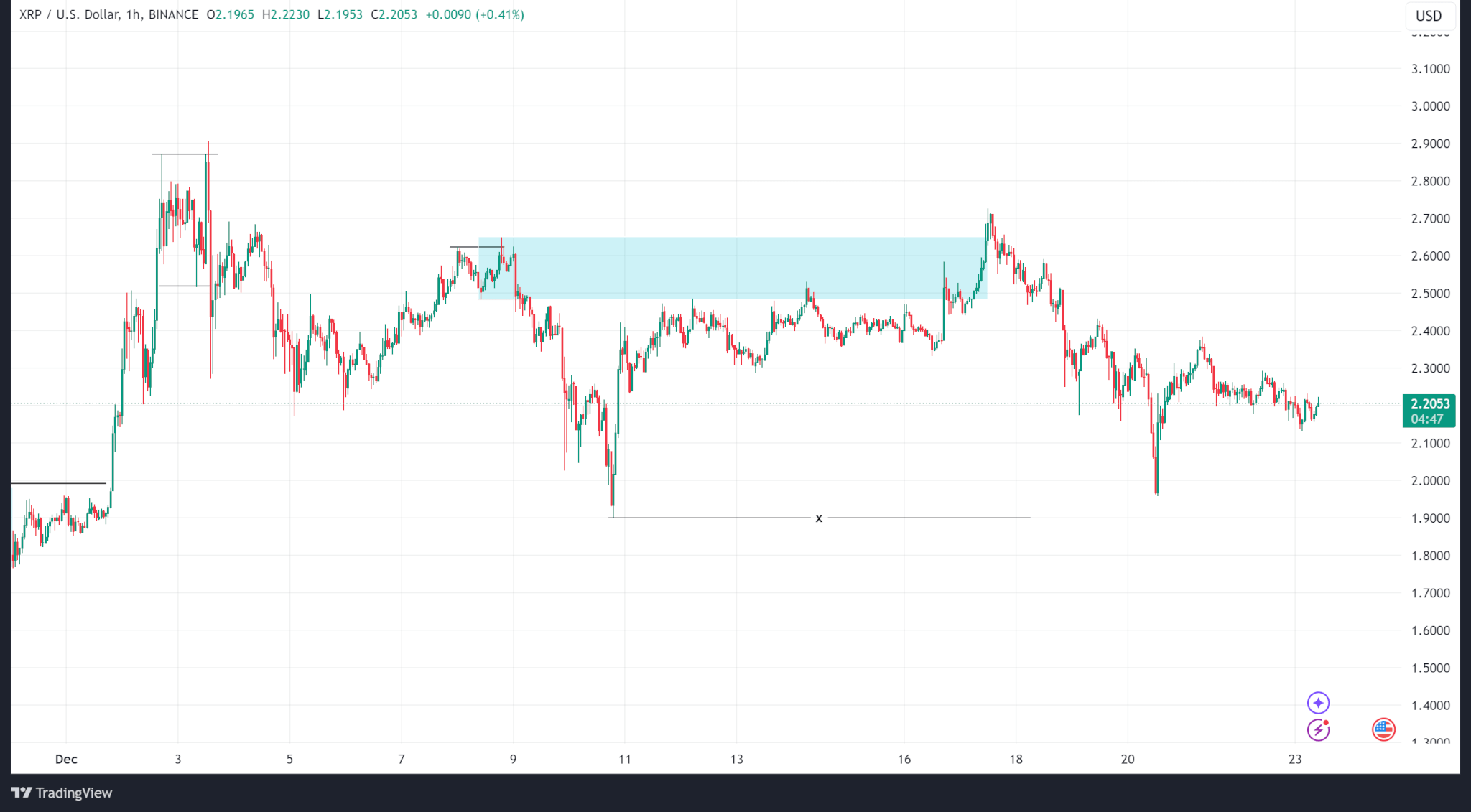

Since breaking earlier all-time highs two weeks in the past, Ripple’s price motion has largely ranged between $1.89 and $2.90. However, inside this vary, the worth has logged decrease lows.

Ripple’s value traded into an inner provide zone and broke above it on Dec. 17 however melted to a weekly low of $1.95 earlier than finally closing at $2.27 (a 16.42% drop).

Ripple’s open curiosity knowledge reveals a decline in open contracts since Dec. 3.

Ripple trades at $2.21 as of publishing.