Amid a general crypto market price fall up to now week, Ethereum (ETH) recorded a value correction of over 19.5% discovering assist at an area backside of $3,100. Since then, the outstanding altcoin has solely proven slight resilience rising by over 5% up to now two days. However, latest information on pockets exercise supplies a lot trigger to be bullish on Ethereum’s long-term future.

Ethereum HODL Addresses Increase Supply Dominance To 16%

In a latest QuickTake post, CryptoQuant analyst MAC_D shared some optimistic insights on the Ethereum market.

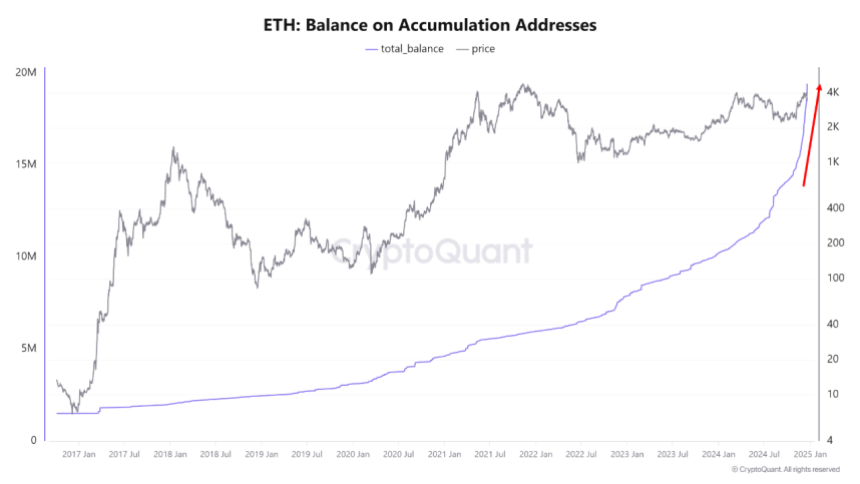

The crypto market professional stories that the steadiness of Ethereum Accumulation Addresses has surged by a exceptional 60% from August to December. During this time, these HODL wallets have boosted their portion of ETH provide from 10% to 16% i.e. 19.4 million ETH of 120 million ETH.

To clarify, the Accumulation Addresses are wallets that maintain Ethereum however not often transfer or promote their holdings. They are thought of a measure of long-term funding and confidence.

According to MAC_D, the fast enhance in these Ethereum HODL wallets’ holdings is a brand new growth absent from earlier bull cycles. The analyst attributed this huge accumulation charge to traders’ bullish expectations of the incoming Donald Trump administration within the US.

These expectations embrace extra favorable rules on the DeFi industry which represents a serious sector of the Ethereum ecosystem. Therefore, no matter Ethereum’s present value motion, these long-holding wallets are prone to preserve growing their holdings in anticipation of future value development.

In addition, MAC_D emphasizes the significance of those Accumulation Addresses in that the worth of Ethereum has by no means slipped under their realized value. Therefore, a steady buy by these wallets supplies a excessive potential for a long-term value achieve.

What’s Next For ETH?

In regards to Ethereum’s rapid motion, MAC_D warns that macroeconomic elements are prone to exert a stronger affect on ETH’s value within the short-term as illustrated by the latest value crash induced by potential lowered rate of interest cuts in 2025.

At the time of writing, the altcoin trades at $3,352 following a 3.07% decline up to now 24 hours. In tandem, ETH’s every day buying and selling quantity is down by 53.25% and valued at $31.15 billion.

Following latest value falls, Ethereum additionally presents a destructive efficiency on bigger charts with losses of 14.74% and 1.05% up to now seven and thirty days, respectively. On a optimistic notice, the asset’s value stays far above its preliminary value level ($2,397) in the beginning of the post-US elections value rally, indicating that long-term sentiment stays optimistic.

With a market cap of $401 billion, Ethereum continues to rank because the second-largest cryptocurrency and largest altcoin within the digital asset market.