This week was one among two distinct halves for the value of Bitcoin, with the premier cryptocurrency rising to a new all-time high and dropping by about 13% a number of days later. On Friday, December 20, the BTC value dropped to as little as $92,000.

This abrupt Bitcoin value decline got here following the US Federal Reserve’s fee lower, which additionally pushed different monetary markets to the crimson. However, it’s value mentioning that the premier cryptocurrency is starting to indicate indicators of restoration, at present hovering round $97,000.

Can Growing Demand Push BTC Price Back Above $100,000?

In a current December 20 report, market analytics platform CryptoQuant revealed an attention-grabbing on-chain growth with the Bitcoin supply-demand dynamics. According to the blockchain agency, the BTC market appears to be having fun with renewed investor curiosity.

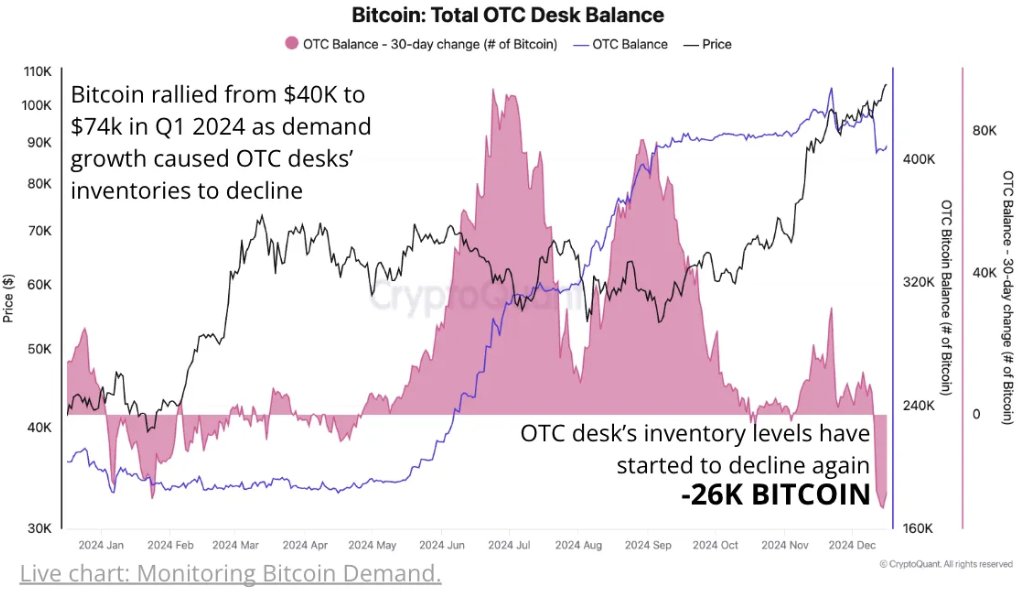

The related indicator right here is the Total OTC Desk Balance, which tracks the quantity of Bitcoin held in addresses related to Over-The-Counter (OTC) desks. This metric offers an perception into the availability of BTC readily to giant buyers and institutional gamers.

According to information from CryptoQuant, the OTC desks are witnessing their largest month-to-month stock decline of 2024, declining by over 26,000 BTC thus far in December. This decline has been much more important prior to now 30 days, with the stability dropping by 40,000 BTC since November 20.

This decline within the Total OTC Desk Balance is a bullish indicator, which displays the hovering demand for Bitcoin and the concurrently shrinking provide. Typically, the contracting BTC provide on the open market might set the stage for a interval of great value appreciation.

CryptoQuant famous that the value of Bitcoin rallied from $40,000 to round $74,000 within the 2024 first quarter after demand development brought on the Over-The-Counter desks’ inventories to fall. According to the market intelligence, the OTC desk’s stock is starting to close the degrees seen through the first-quarter rally.

Data from CryptoQuant exhibits that Bitcoin’s obvious demand is at present rising at a month-to-month fee of 228,000 BTC after getting into the enlargement territory in late September. At the identical time, the stability of accumulation addresses is swelling at a record-high fee of 495,000 BTC per 30 days.

Bitcoin Price At A Glance

As of this writing, the value of Bitcoin stands at round $97,655, reflecting a 0.1% decline prior to now 24 hours. The premier cryptocurrency is down by almost 4% on the weekly timeframe, in keeping with information from CoinGecko.

Featured picture created by DALL-E, chart from TradingView

Source link