Bitcoin worth has continued to make new information on daily basis, indicating a powerful market confidence in direction of the asset. Notably, this rally comes amid hovering institutional curiosity and whale accumulation, which means that the demand for BTC stays sturdy regardless of the current rally. On the opposite hand, veteran dealer and market knowledgeable Peter Brandt has shared a daring forecast for BTC amid this, sparking additional discussions out there.

Bitcoin Price To Hit $125K, Peter Brandt Says

Bitcoin price has recorded a robust rally not too long ago, which has caught the eyes of traders. Notably, it is because the institutional curiosity remained sturdy and continued to develop after Donald Trump’s election win. Notably, Trump has pledged to make the US a crypto capital whereas voicing sturdy assist for BTC throughout his campaigns.

In addition, he has not too long ago mentioned “We’re gonna do something great with crypto,” indicating its aggressive focus within the digital belongings area. Besides, he additionally reiterated his deal with making BTC the US strategic reserve.

On the opposite hand, the institutional curiosity can be evidenced by the sturdy US Spot Bitcoin ETF influx not too long ago. Notably, the general inflow into the funding instrument has continued over the previous few weeks, with BlackRock’s IBIT offering the largest increase. According to Farside Investors data, the general inflow into the US Spot BTC ETF was $636.9 million on December 16.

Meanwhile, this sturdy influx means that the Wall Street gamers in addition to the traders remained assured within the asset. Besides, the BTC worth efficiency and the current on-chain knowledge additionally point out a powerful BTC demand, which may additional gasoline the rally within the coming days. Amid this, veteran dealer Peter Brandt has shared a bullish BTC forecast.

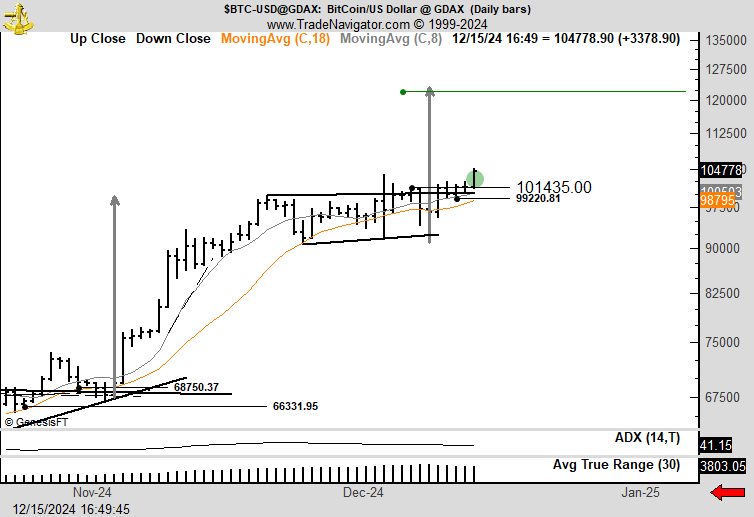

Sharing a worth chart for BTC in a current X publish, he has set $125K as the subsequent goal for BTC. Besides, he additionally mentioned that “everything else is a pretender”, reflecting the knowledgeable’s sturdy confidence in direction of the flagship crypto.

What’s Next For BTC?

With Peter Brandt’s daring forecast and Donald Trump’s current trace in direction of making BTC the US strategic reserve, BTC has recorded a strong rally. The latest BTC price confirmed a spike of two% from yesterday to $106,729, with its buying and selling quantity hovering 25% to $79 billion.

Notably, the crypto has not too long ago touched an ATH of $107,780 within the final 24 hours, whereas offering a month-to-month achieve of practically 18%. Furthermore, CoinGlass knowledge confirmed that BTC Futures Open Interest rose 2%, suggesting a seamless sturdy momentum forward. Besides, a Bitcoin price prediction signifies a possible rally for the flagship crypto to $115,208 this month, boosting market sentiments.

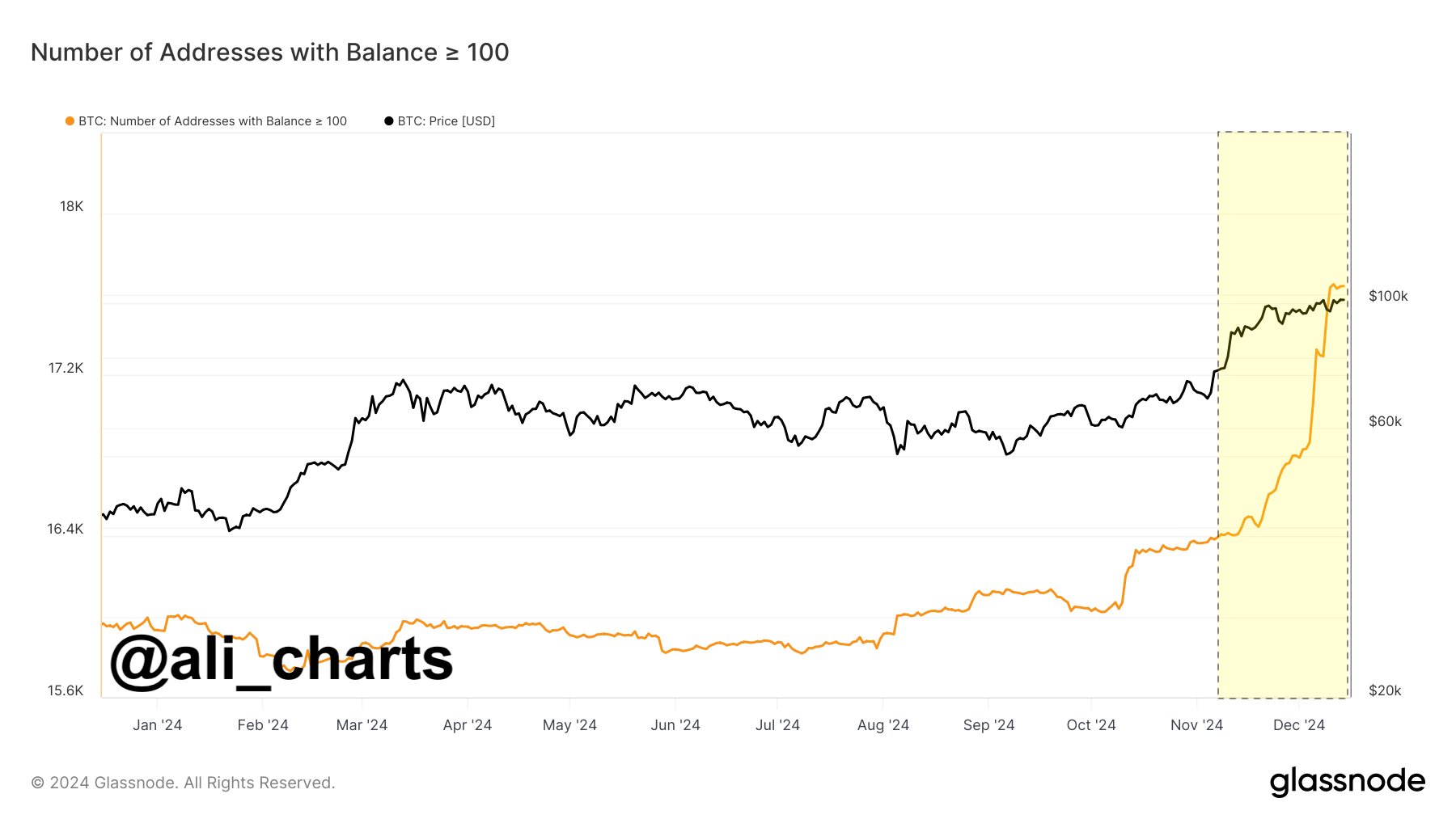

Meanwhile, distinguished crypto market analyst Ali Martinez has not too long ago highlighted the BTC whale pattern. In a current X publish, he mentioned that the “number of Bitcoin (BTC) whales on the network went parabolic ever since Donald Trump won the US presidential elections!” This showcases the rising whale confidence within the asset, which may set off additional rallies for the asset forward.

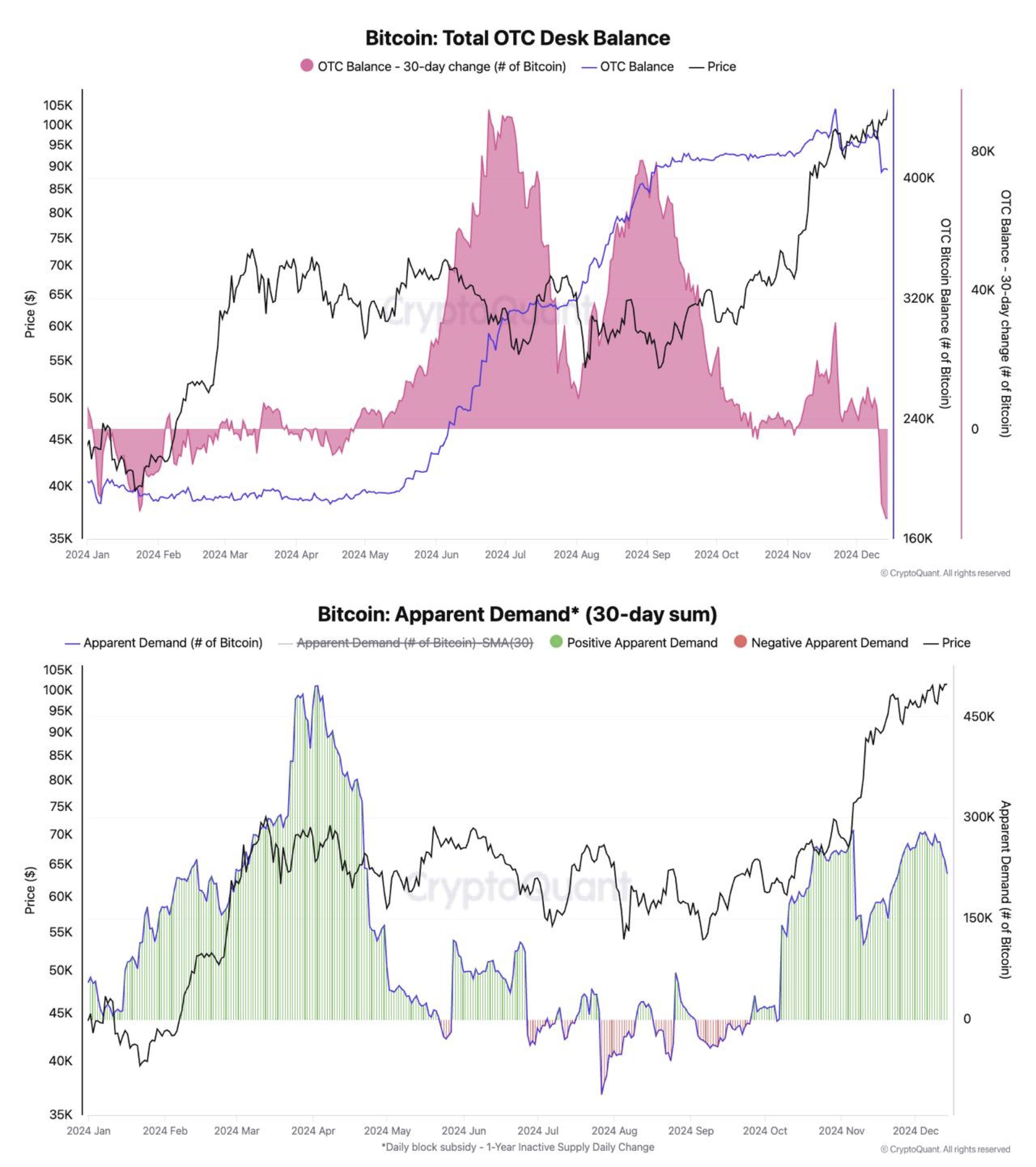

In addition, prime on-chain analytics agency CrytoQuant has additionally highlighted a bullish pattern not too long ago. In a current X publish, CryptoQuant mentioned that as Bitcoin worth touched its ATH not too long ago, the demand is constant to outpace provide. The agency’s head of Research Julio Moreno mentioned that BTC OTC Desks are witnessing their highest month-to-month stability decline to date in 2024 amid hovering BTC demand. Since November 20, the stability has slumped by 40K BTC, indicating a bullish pattern forward.

Disclaimer: The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.