The crypto market enters an important week with a flurry of key financial occasions just like the US FOMC, Fed Chair Jerome Powell’s speech, and others, scheduled. Notably, the buyers will hold shut observe of the occasions as they might considerably influence the Bitcoin value in addition to the broader crypto market forward. Besides, the US PCE inflation information can also be awaited, as final week’s information confirmed a spike in inflationary pressures whereas sparking issues over a possible hawkish transfer forward by the Fed.

Crypto Market Awaits US FOMC & Other Key Events

As Bitcoin value famous a robust rally not too long ago, crossing the temporary $100K mark, buyers at the moment are eyeing the upcoming key financial occasions. The occasions are prone to form the sentiment of the broader monetary sector forward, not to mention the crypto market.

Notably, the week will kick off with S&P US Manufacturing PMI on Monday, December 16, which would supply cues on the financial well being of the nation. In addition, it might be adopted by the US Retail Sales information, which is scheduled for Tuesday, December 17.

Following that, one of the crucial awaited occasions, the US FOMC interest-rate resolution will come on Wednesday, December 18. The buyers will hold shut observe of the occasion for readability on the Fed’s stance with their rate-cut plans. According to the CME FedWatch Tool, there’s a 96% likelihood of a 25 bps Fed price reduce on the upcoming FOMC this week.

Jerome Powell’s Speech & PCE Inflation In Focus

Meanwhile, the Fed Chair Jerome Powell’s press convention after the FOMC would even be intently watched by the merchants. The feedback from Jerome Powell would supply additional insights into the Fed’s upcoming stance with their financial coverage plans. While dovish feedback would gasoline the Bitcoin value larger together with the top altcoins, any hawkish remarks would possibly dampen the market sentiment.

On the opposite hand, the second revision of the US Gross Domestic Product (GDP) information for the third quarter is scheduled for Thursday. This would additionally make clear the financial well being of the nation to the buyers. Lastly, the US PCE inflation information is scheduled for Friday, December 20. This PCE information would supply insights on the present inflationary stress within the nation.

The market individuals eagerly awaited the PCE inflation figures this week, particularly after final week’s US PPI data came in hotter-than-anticipated at 3%. On the opposite hand, the US CPI inflation data last week additionally confirmed a spike, nevertheless it comes as per the market expectations.

What’s Next For Bitcoin Price?

The financial occasions are prone to influence the broader market sentiment, which in flip may additionally have an effect on the Bitcoin value’s run forward. However, regardless of the hovering inflation, the rate-cut bets remained fixed amongst merchants, which hints at a bullish momentum forward. Besides, the hovering institutional curiosity, as evidenced by the sturdy US Spot BTC ETF influx, has additionally fueled market sentiment. Recently, a high knowledgeable predicted Bitcoin ETF AUM to overtake Gold ETF by year-end, boosting market optimism.

Also, historical data by CoinGlass confirmed that BTC has normally showcased a constructive efficiency within the closing quarter. Although historic information doesn’t assure future efficiency, the market hope stays excessive. Despite risky buying and selling final week, the flagship crypto has maintained its place above the $100K mark, indicating its robust attraction amongst merchants.

Besides, the market consultants have additionally remained bullish on BTC’s trajectory forward. For context, Matrixport has recently predicted BTC to hit $160K by 2025, sparking market optimism. Echoing an identical sentiment, widespread market knowledgeable Crypto Rover stated that if BTC holds above the $102 mark, it’s poised to hit the $120K mark subsequent.

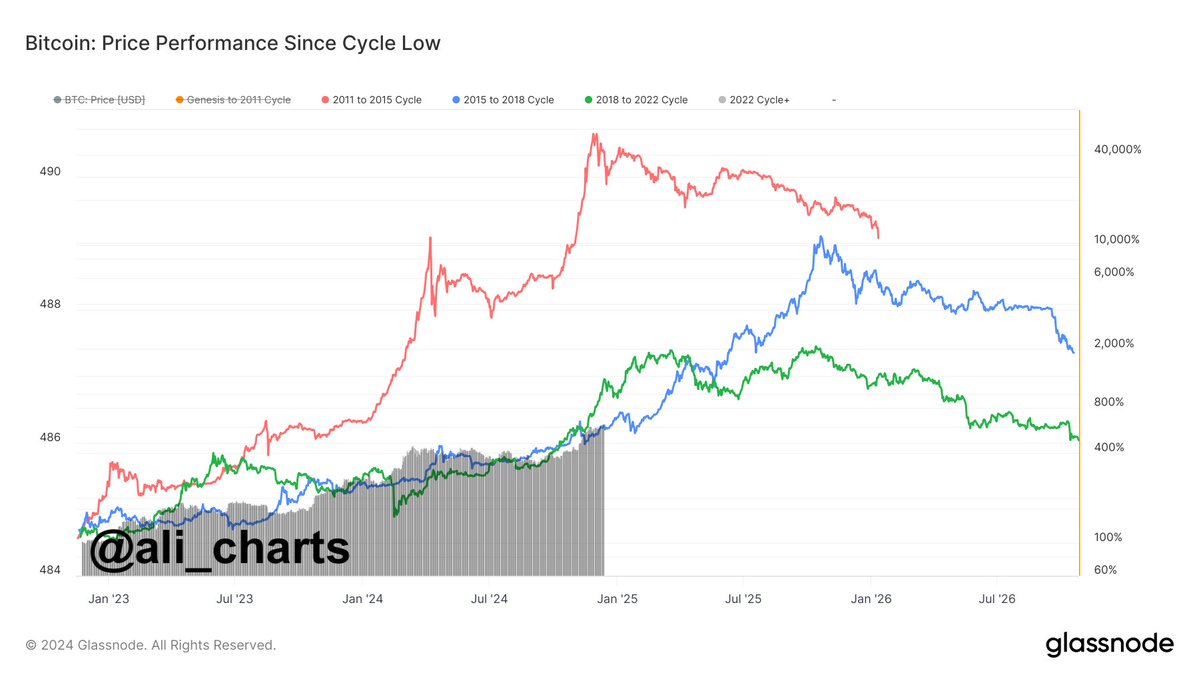

Meanwhile, one other widespread market knowledgeable Ali Martinez has not too long ago shared a possible timeline for Bitcoin value to achieve its high. In a latest X publish, Martinez stated that if the flagship crypto follows its historic path, it may doubtlessly attain its high in October 2025 amid this bull run.

Disclaimer: The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.