Crypto analyst Trader Tardigrade has drawn the neighborhood’s consideration to the truth that the Bitcoin value is mirroring 2023 actions. The analyst additional supplied insights into what this implies for the flagship crypto.

Bitcoin Price Mirroring 2023 Movements

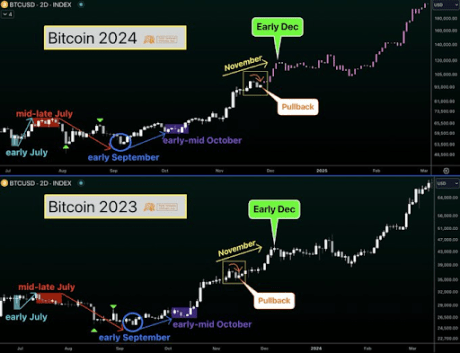

In an X publish, Trader Tardigrade mentioned that the Bitcoin value stays on monitor with the 2023 strikes. He additional remarked that the flagship crypto has simply accomplished the pullback. With the pullback full, the crypto analyst asserted there will likely be a surge above 100,000, adopted by a consolidation round that stage.

Interestingly, Trader Tardigrade additionally predicted that the Bitcoin value would attain $200,000 in early 2025. The analyst’s accompanying chart confirmed that this value rally to this goal will occur by March 2025.

This parabolic rally to $200,000 is predicted to reflect an identical rally that BTC loved from early December that yr because it rose to the earlier all-time high (ATH) of $73,000 in March earlier this yr. Meanwhile, it’s value mentioning that Trader Tardigrade isn’t the one one who has predicted that the Bitcoin value can attain this stage on this market cycle.

Bernstein analysts additionally beforehand predicted that the BTC value would attain $200,000 by year-end 2025, though they claimed that was a ‘conservative’ goal. Geoffrey Kendrick, Standard Chartered’s Head of Research, additionally predicted that Bitcoin might attain this value goal and gave an identical timeline as Bernstein analysts.

However, crypto analyst Tony Severino is skeptical that the Bitcoin value might attain $200,000 on this bull cycle. Instead, he has made a extra conservative prediction, stating that the flagship crypto would seemingly peak someplace within the $160,000 range. The analyst famous this was a extra possible goal, contemplating that the golden ratio is on this vary.

BTC Is “Far Away” From A Market Top

In an X publish, crypto analyst Ali Martinez asserted that the BTC value remains to be “far away” from a market prime. He made this assertion whereas highlighting the market worth to realized worth (MVRV) indicator, which exhibits whether or not the asset is overvalued or undervalued. The chart confirmed that Bitcoin has but to achieve its true worth.

Related Reading

The Bitcoin value is at present dealing with a major value correction, having been pumping nonstop since Donald Trump’s victory. However, Martinez recommended this is likely to be a good time to purchase this dip. According to him, the TD Sequential presents a purchase sign on the Bitcoin hourly chart, whereas a bullish divergence types in opposition to the Relative Strength Index (RSI). He added that this might assist Bitcoin rebound to between $95,000 and $96,000.

At the time of writing, the Bitcoin value is buying and selling at round $93,400, down within the final 24 hours, in keeping with data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com