The worth of Bitcoin picked up this week from the place it left off within the earlier week, forging successive all-time highs previously seven-day span. Over the previous few days, the massive query on everybody’s thoughts has been — when will the premier cryptocurrency surpass the $100,000 stage?

While most traders are nervous a couple of short-term goal, some market members are extra involved in regards to the long-term prospects of the world’s largest cryptocurrency. According to the most recent on-chain information, it seems that the value of Bitcoin might see a shakeout prior to anticipated.

Will The Rising Bullish Sentiment Sustain The Rally?

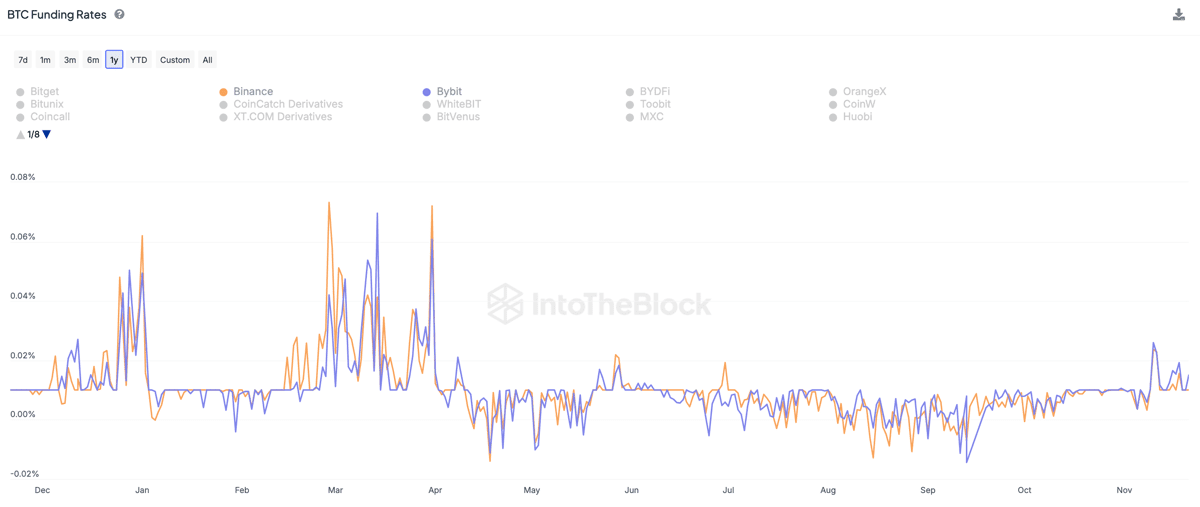

According to market intelligence platform IntoTheBlock, the Bitcoin funding charges have witnessed a notable upswing in current days. The related indicator right here is the “funding rate” metric, which tracks the periodic price exchanged between merchants within the derivatives (perpetual futures) market.

When the funding charge is excessive or optimistic, it implies that the lengthy merchants are paying merchants with brief positions. Typically, this path of the periodic cost suggests a powerful bullish sentiment out there.

On the opposite hand, a unfavourable worth of the funding charge metric signifies that traders with brief positions are paying merchants with purchase positions within the derivatives market. This development means that the market is shrouded by a bearish sentiment.

Data from IntoTheBlock exhibits that the Bitcoin funding charges for perpetual swaps have elevated by greater than 10% — and as much as 20% on main buying and selling platforms. However, the on-chain agency famous that this steady funding charge progress might trace at speculative overheating, doubtlessly leading to market corrections.

According to IntoTheBlock, one of many potential catalysts of this bullish sentiment is the United States authorities’s method to crypto beneath Donald Trump. With the “strategic Bitcoin reserves” extra of a risk beneath the incoming US president, traders are banking on Bitcoin surpassing a six-figure valuation.

As of this writing, the flagship cryptocurrency is valued at round $98,400, reflecting a 1% improve previously 24 hours.

Bitcoin Perpetual Futures Market Remains Restrained — What It Means

In a current submit on the X platform, Glassnode revealed that the Bitcoin perpetual futures market “remains restrained.” This means that a number of merchants are nonetheless approaching the market with warning regardless of the regular worth climb of BTC in current weeks.

Data from Glassnode exhibits that the Bitcoin funding charges are simply above 0.01%, which falls in need of the March 2024 stage (~0.07%) when the BTC worth reached an area high. Ultimately, this implies that there’s nonetheless room for progress within the worth of the premier cryptocurrency.