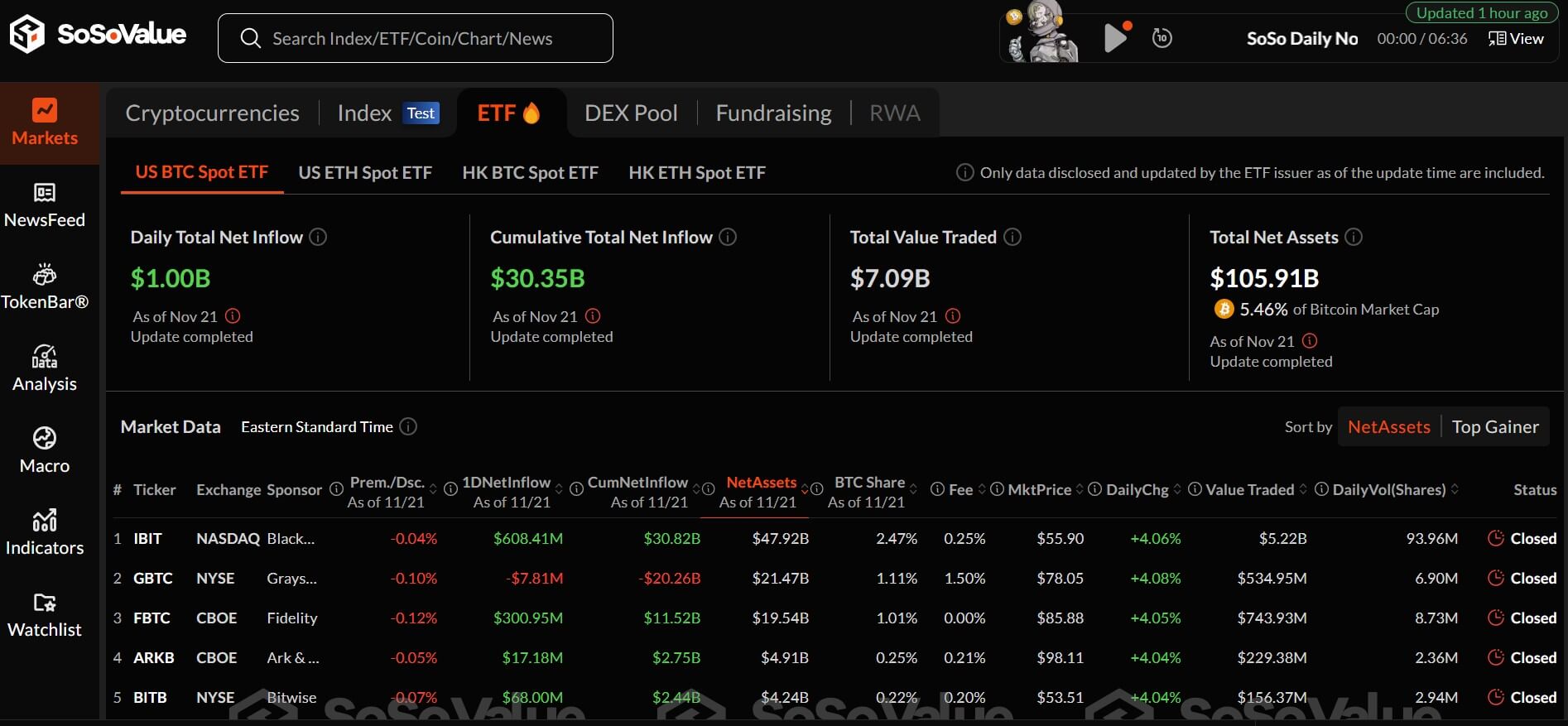

- BlackRock’s IBIT attracted essentially the most at over $600 million adopted by Fidelity’s FBTC with $301 million

- The 12 spot Bitcoin ETFs have introduced in a combined $30.35 billion since launching in January

US spot Bitcoin exchange-traded funds (ETFs) took in $1 billion in every day whole net inflows yesterday as Bitcoin inched nearer to the $100k mark.

BlackRock’s iShares Bitcoin Trust (IBIT) noticed essentially the most inflows, attracting $608.41 million, in response to SoSoValue data. Fidelity’s FBTC adopted with $300.95 million. Bitwise’s Bitcoin ETF introduced in $68 million and Ark and 21Shares’ ARKB attracted $17.18 million.

Grayscale’s GBTC was the one one with damaging net flows, recording $7.8 million outflows.

The 12 spot Bitcoin ETFs have earned a combined $30.35 billion since launching in January following approval from the US Securities and Commission (SEC).

Elevated commerce among the many spot Bitcoin ETFs adopted as Bitcoin climbed to the $100k mark on November 22, persevering with its bull run.

The inflows additionally come after BlackRock launched its choices contracts earlier this week. During buying and selling on day one, BlackRock’s options brought in nearly $2 billion, serving to to push Bitcoin to greater than $94,000.

Grayscale introduced this week that it was additionally launching Bitcoin ETF choices following BlackRock’s spectacular debut and a surge in investor curiosity.

As commerce continues by means of spot Bitcoin ETFs, it’s turning into clear that these avenues are one of many important methods for traders to carry Bitcoin. According to Bloomberg analyst Eric Balchunas, US Bitcoin ETFs hit $100 billion in belongings, including on X:

“They’re now 97% of [the] way to passing Satoshi as [the] biggest holder and 82% of [the] way to passing gold ETFs.”

Speaking of “100” milestones, the US bitcoin ETFs hit $100b in belongings (altho extra like $104b given the worth surge in a single day) w/ YTD flows flirting with $30b (double our estimate). They’re now 97% of approach to passing Satoshi as greatest holder and 82% of approach to passing gold ETFs. pic.twitter.com/Y3070yW7Jx

— Eric Balchunas (@EricBalchunas) November 21, 2024

Elsewhere, in the market, Ethereum is up by greater than 7% over the previous week at $3,285, Solana has seen an almost 20% improve at $253, and XRP has risen near 60% to $1.44 in the identical time, in response to CoinMarketCap.