Bitcoin Options ETF is reportedly set to start buying and selling in the present day, sparking optimism within the broader crypto market. Notably, the anticipated approval has additionally bolstered market sentiment over a possible BTC rally to $200K within the coming days. Besides, it additionally comes because the US Spot Bitcoin ETF has regained momentum, beginning the continued week with a robust inflow, indicating rising institutional curiosity within the digital property house.

Bitcoin Options ETF Set To Start Trading Today

A current report by Bloomberg stated that Nasdaq Inc. is planning to permit choices buying and selling on BlackRock Inc’s BTC ETF in the present day. The Bitcoin Options ETF approval would allow merchants to leverage derivatives to wager on or in opposition to the highest crypto by market cap.

This transfer has sparked optimism within the broader market, particularly after the success and hovering curiosity within the US Spot Bitcoin ETF. According to Farside Investors information, the US Spot Bitcoin ETF famous an inflow of $254.8 million on November 18, after noting outflow for the 2 consecutive days final week.

Notably, in a Monday Bloomberg’s ETF IQ, Nasdaq ETP Listings head Alison Hennessy stated that the agency plans to record and start buying and selling of the choices ETP as quickly as “tomorrow”. Besides, she additionally confirmed confidence in the direction of gaining vital consideration from the merchants as soon as these “options listed on IBIT.”

In addition, one other Nasdaq spokesperson additionally confirmed the launch in the present day. It’s additionally price noting that this improvement comes simply after the US Commodity and Futures Trading Commission (CFTC) recently green light the BTC Options ETF, which has sparked market discussions.

Meanwhile, the BTC has famous a robust rally over the previous few days, touching a brand new ATH, after Donald Trump’s election win. The anticipation over a transparent regulatory path for the digital property house and pro-crypto insurance policies within the US after the Republican victory has fueled market sentiment. Having stated that, a flurry of buyers anticipates the rally will proceed within the coming days.

BTC To Hit $200K?

BTC worth in the present day traded close to the flatline at $91,800, whereas its one-day buying and selling quantity jumped 52% to $73.59 billion. The flagship crypto has touched a 24-hour excessive of $92,596 whereas noting a month-to-month acquire of 34%. Besides, BTC Futures Open Interest rose greater than 1.5% throughout writing, indicating a robust market confidence in the direction of the crypto.

Amid this, the optimism over a possible Bitcoin Options ETF launch within the US has additional fueled market sentiment. Besides, in a current report, BCA Research predicts Bitcoin worth to hit $200K because the crypto nears the $100K mark.

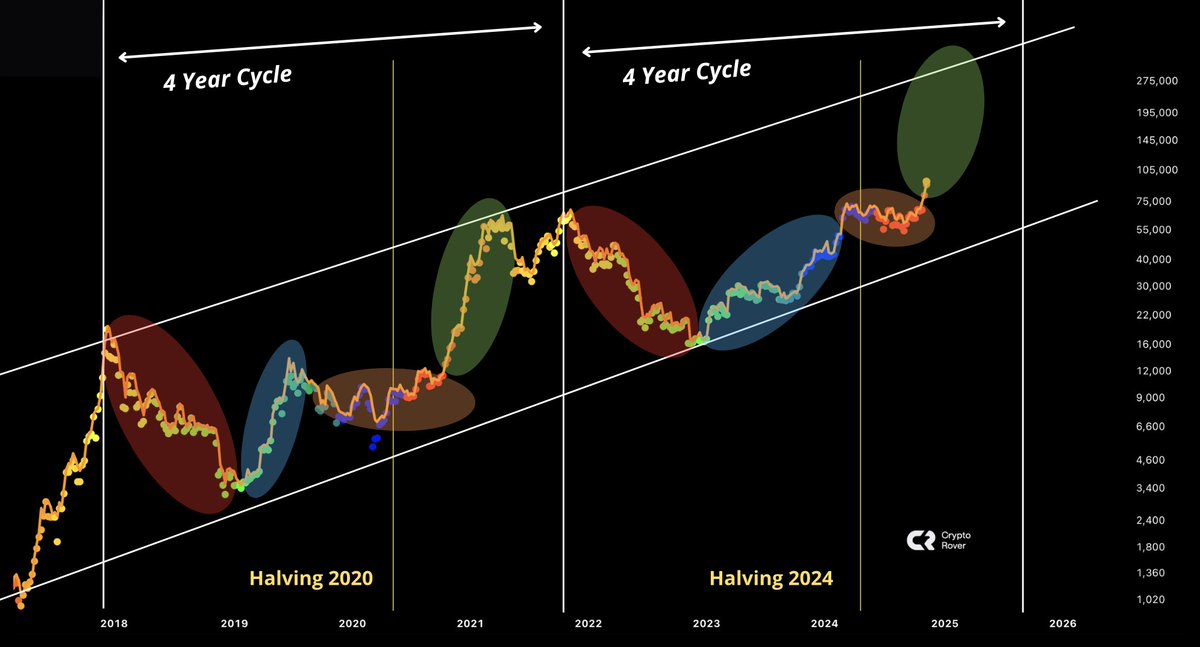

Simultaneously, outstanding crypto market skilled Ali Martinez has additionally shared a bullish prediction for BTC lately. In a current X submit, Martinez highlighted the historic traits of BTC, saying that if the crypto follows the earlier cycles, it’s poised to hit $150K subsequent.

Echoing the identical sentiment, one other crypto market analyst Crypto Rover additionally shared an analogous chart for BTC, predicting the crypto to soar previous the $200K mark. In addition, Fundstrat Head of Research Tom Lee also predicts that the crypto is poised to proceed its rally within the coming days, additional fueling market curiosity.

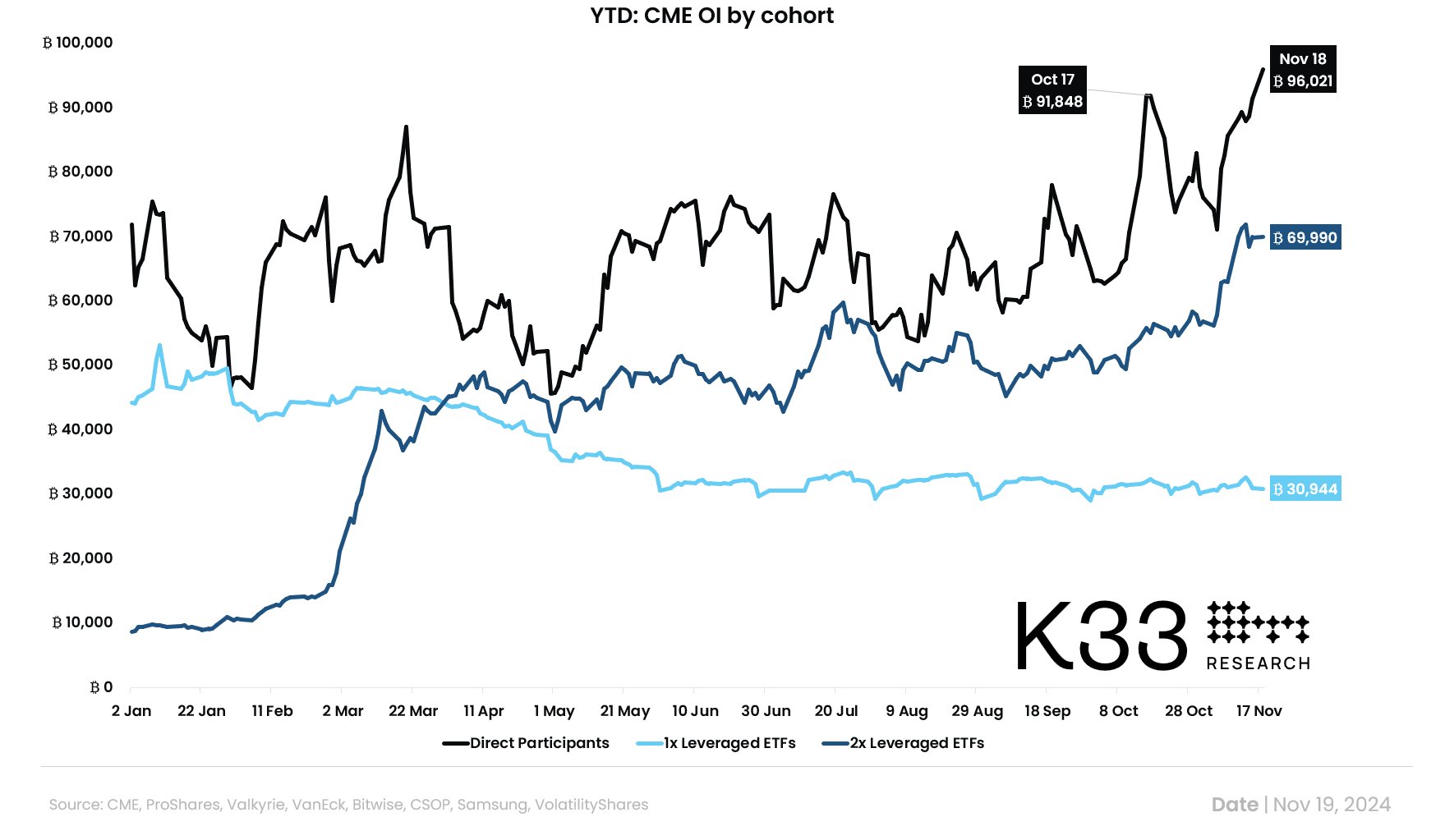

Vetle Lunde, Head of Research at K33 Research, predicts a possible surge to $100,000. Citing the BlackRock Bitcoin ETF IBIT choices launch as a “clear catalyst,” Lunde notes rising open curiosity (OI) on CME, pushed by elevated market participation. With 96,000 BTC in lively contracts, CME aggression has shifted towards lengthy positions, indicating bullish momentum with foundation printing at 22%.

Disclaimer: The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.