Fundstrat Head of Research Tom Lee has emphasised that Bitcoin’s current surge may mark the start of a sustained rally. With Bitcoin’s value climbing 34% in November and presently buying and selling close to $91,395, Tom Lee outlined a number of elements suggesting the cryptocurrency’s upward momentum might persist.

Tom Lee Highlights Why Bitcoin Price Rally May Continue

Speaking in an interview with CNBC, Fundstrat Head of Research Tom Lee famous that Bitcoin’s current value beneficial properties are supported by sturdy market demand and enhancing technical indicators.

He identified that Bitcoin value has entered a consolidation section close to $90,000, which is supported by a collection of bullish elements, together with elevated investor curiosity and the cryptocurrency’s historic efficiency throughout related market situations.

According to Fundstrat’s Tom Lee, the present value rally aligns with broader developments in danger belongings, with Bitcoin exhibiting resilience amid market corrections. He said, “Most major indices, including the NASDAQ and S&P 500, have pulled back to key support levels, which often provides a foundation for renewed growth. Bitcoin’s technical setup appears similar, suggesting the possibility of further gains.”

Fundstrat’s Tom Lee additionally linked Bitcoin’s performance to broader market developments, significantly the “Trump trade.” He remarked that insurance policies like ‘D.O.G.E’ emphasizing deregulation, decrease taxes, and decreased authorities spending may benefit danger belongings, together with Bitcoin value.

He added that sectors like small-cap shares and financials are additionally seeing renewed curiosity as buyers anticipate coverage readability following current political developments. This optimism is bolstered by expectations that the Federal Reserve’s financial tightening cycle is nearing its finish, which may drive demand for each conventional and digital belongings.

Bitcoin as a Strategic Asset Amid Economic Concerns

Fundstrat’s Tom Lee additionally highlighted Bitcoin’s potential function as a strategic asset in addressing financial challenges. While he didn’t immediately revisit his earlier suggestion that Bitcoin may function a “treasury reserve asset,” Lee emphasised its attraction as a hedge in opposition to macroeconomic uncertainty.

He defined that ongoing discussions about U.S. financial coverage, together with the Federal Reserve’s potential slowdown in rate of interest hikes, are contributing to a good atmosphere for Bitcoin.

“When uncertainty clears around monetary policy, demand for Bitcoin and other risk assets could increase further,” he famous.

During the interview, Tom Lee addressed the continuing discussions surrounding the U.S. Treasury Secretary place beneath the Biden administration. Among the names into consideration hinted at by Elon Musk is Cantor Fitzgerald CEO Howard Lutnick, an advocated for Bitcoin’s recognition as a commodity akin to gold and oil.

Institutional and Retail Momentum Behind Bitcoin’s Growth

Institutional and retail participation has performed a key function in Bitcoin price current surge. Data from CryptoQuant signifies a spike in Coinbase’s premium index earlier within the rally, signaling heightened curiosity from U.S. retail buyers. However, the index has since cooled, suggesting that retail exercise has slowed within the quick time period.

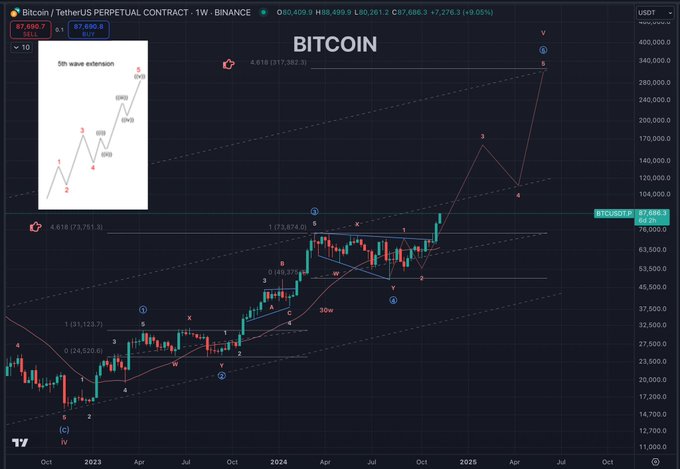

Technical analyst Coosh Alemzadeh has noticed patterns in Bitcoin’s chart that point out the potential for additional progress. According to Alemzadeh, Bitcoin is presently within the fifth wave of an Elliott Wave cycle, which generally alerts the steepest a part of a value rally. His projection suggests Bitcoin’s value may attain between $130,000 and $145,000 by late 2024.

Despite the optimistic outlook, consultants warning that Bitcoin’s volatility stays excessive. The success price for bullish patterns just like the one presently forming is simply round 54%, highlighting the necessity for measured optimism amongst merchants.

Disclaimer: The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.