Bitcoin has been slowing down on its bullish momentum after crossing the barrier at $22,000 and $23,000. The cryptocurrency nonetheless holds a few of its good points from final week however is likely to be poised for a re-test of decrease ranges.

At the time of writing, BTC’s worth trades at $22,900 with a 2% loss within the final 24 hours and an 8% revenue over the previous week.

This Bitcoin Bear Market Might Not Be Like 2020

Crypto market contributors appear to be in pursuit of a fast and protracted uptrend, just like the one seen in 2020. At that point, BTC’s worth drop to a low of $3,000 after which started an ascend to its present all-time highs.

However, buying and selling agency QCP Capital believes the worth of Bitcoin and different giant cryptocurrencies may see extra sideways motion and draw back stress earlier than reclaiming misplaced territory. This worth motion is likely to be extra just like the 2018 bear market.

The agency believes BTC’s worth will profit throughout Q3, 2022. During this era, the cryptocurrency may try to reclaim increased ranges, however with a possible to interrupt above important resistance areas capped by elevated promoting stress from the Bitcoin mining sector and crypto corporations struggling as a result of bearish pattern.

BTC’s worth motion may proceed to function on unsure grounds with “choppy moves” with another narrative between bullish and bearish with a important resistance at $28,700 to the upside and important help at $10,000 to the draw back.

The latter matches the 85% crash that BTC’s worth skilled throughout the 2018 bear market.

Crypto Recovery Will Be Slow But Spells Long-Term Bullishness

In 2017 when the worth of Bitcoin reached its earlier all-time excessive at $20,000, the crypto market adopted with an enormous rally. By 2018, the sector entered a multi-year bear market with the worth of main cryptocurrencies shedding over 80% of their worth taking down buying and selling liquidity with it.

QCP Capital believes the sector has entered a brand new age of extra maturity and resilience. The present draw back promoting stress has seen excessive liquidity in a strong surroundings with much less volatility throughout giant cryptocurrencies.

In addition, institutional curiosity in Bitcoin and Ethereum has been persistent regardless of the draw back worth motion. In reality, QCP data a rise in “both trading and investments” from these entities.

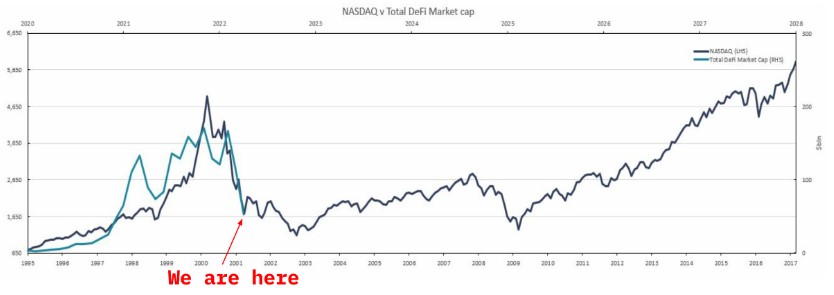

In the long run, this resilience within the face of excessive inflation and a hawkish Federal Reserve will translate into an enormous rally. The buying and selling agency in contrast the potential development of the crypto ecosystem, for the decentralized finance sector, with the Nasdaq 100.

As seen beneath, the crypto sector has been following the preliminary years of the Index and may pattern decrease over the approaching years earlier than it lastly reaches international adoption. Over the subsequent decade that implies:

(…) that the long run might be a crypto-dominated one. The similar means each firm on the planet as we speak is, to some extent, an web firm. We imagine in a 5-10 years from now, each firm might be, in a roundabout way, a crypto firm.