The crypto market entered an important week with eyes on essential scheduled occasions just like the US Presidential election 2024 and the FOMC rate of interest lower resolution. Notably, the market individuals are bracing for extremely unstable buying and selling this week, with consultants supporting the anticipation with historic tendencies. However, with hovering expectations of unstable buying and selling, some additionally grew involved over a possible market crash on the day of the election.

Will the Crypto Market Crash On US Election Day?

According to a current report by The Kobeissi Letter on the X platform, the monetary market is poised to witness extremely unstable buying and selling, regardless of who wins the US election. Having mentioned that, the crypto market buyers are additionally showing to remain on the sideline, looking for extra readability on the way forward for the market.

Notably, crypto has been one of many main points on the US Presidential Election 2024 this yr. Donald Trump has actively backed Bitcoin and the crypto market forward of the election, with Kamala Harris additionally showcasing a powerful curiosity within the expertise sector.

Besides, Bitcoin and different high altcoins additionally showcase a constructive efficiency after the US presidential election. Considering that, the market anticipates an analogous image this yr, with Bitcoin doubtlessly hitting a brand new ATH after the election.

US Election & Its Impact On The Crypto Market

The US political panorama has not too long ago been carefully related to the cryptocurrency business. Donald Trump’s current backing of Bitcoin, with a flurry of politicians revealing their curiosity within the digital property area, is predicted the business to witness robust features after the election.

Meanwhile, the US election would provide cues on the long run crypto market laws. The US SEC and CFTC have completely different approaches on the subject of regulating digital property. Besides, the US SEC and its Chair Gary Gensler have confronted heavy backlash from the crypto group, with many blaming the company for his or her regulatory overreach.

Having mentioned that, the buyers are actually eyeing in the direction of the upcoming election. Notably, many anticipate a change in administration to foster innovation within the digital property area. Simultaneously, the buyers are additionally anticipating an analogous stance by the Democrats as effectively, if Kamala Harris secures a victory within the election.

Previously, former US President Donald Trump publicly introduced that he would fireplace Gary Gensler on his first day on the White House. This has sparked vital optimism amongst crypto market buyers, who deems Gensler as an anti-crypto regulator.

On the opposite hand, merchants have additionally lauded Donald Trump’s pledge to make Bitcoin a strategic reserve for the US. This growth, if it occurs, may considerably push the BTC worth increased within the coming days. Besides, his vocal assist in the direction of the digital property sector and calling himself “Crypto President” has bolstered optimism amongst buyers.

How US Election Impact the Stock Market?

The Kobeissi Letter has not too long ago shared an evaluation of the election and historic inventory market efficiency. Now, because the crypto market and shares transfer in tandem recently, let’s check out the evaluation and see the way it may affect digital property.

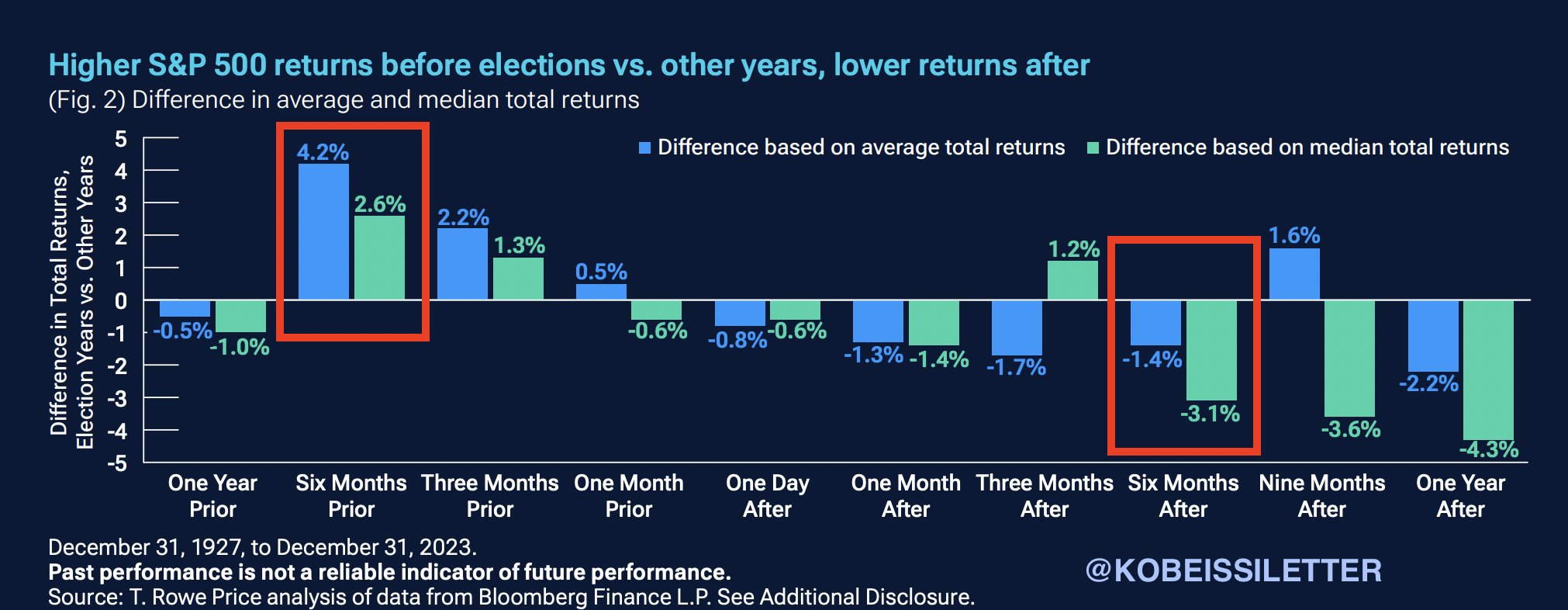

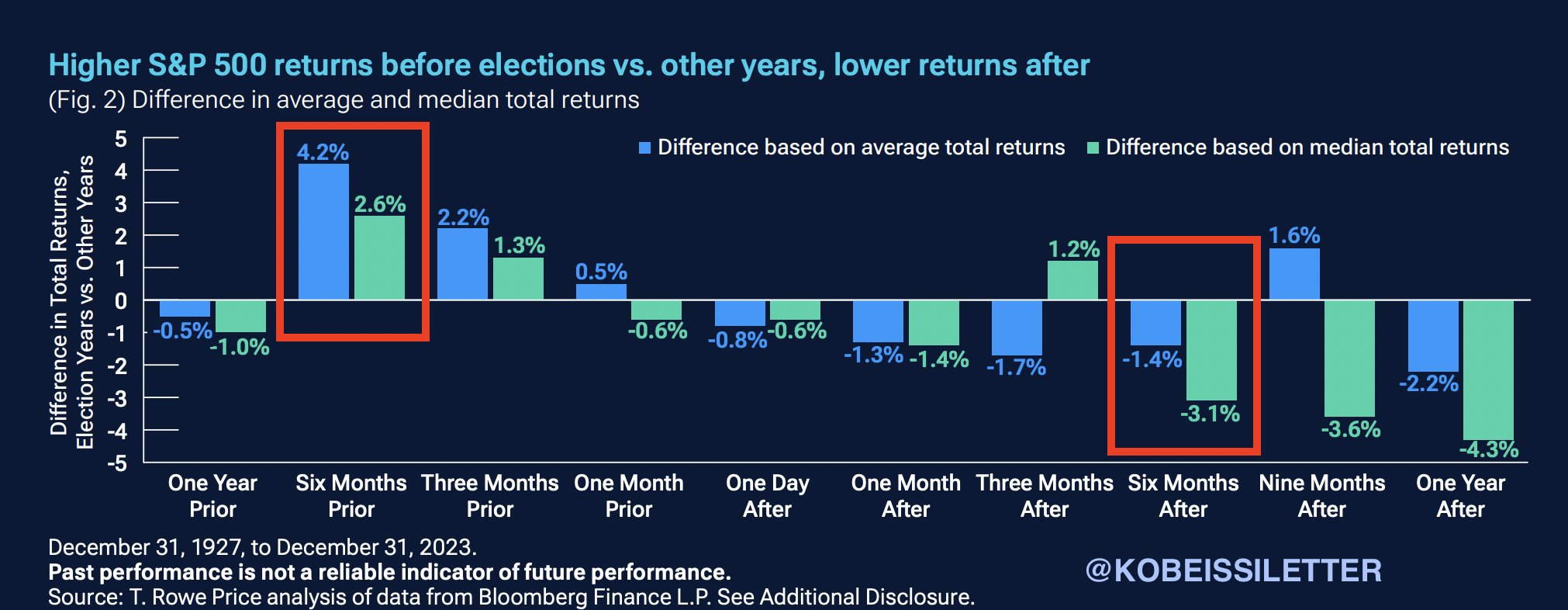

As the election approaches, analysts are scrutinizing the potential affect on the inventory market and crypto efficiency. The Kobeissi Letter’s evaluation reveals vital variations in inventory market returns earlier than and after Election Day, courting again to 1920.

Here are among the necessary findings from the evaluation:

- Election Year Trends: 83% of election years noticed constructive returns main as much as Election Day, whereas solely 67% had constructive returns afterward.

- Stock Performance: Stocks carry out 4.2% higher on common within the six months previous an election in comparison with non-election years, however 1.4% worse within the six months following.

- Economic Influence: The economic system performs an important function in election outcomes, with just one occasion of an incumbent social gathering successful throughout a recession yr since 1948.

- Market Volatility: Elevated volatility is predicted whatever the election end result, with the VIX index up 65% year-to-date.

Historically, the S&P 500 has averaged an 11.3% return throughout election years since 1928, with 83% of years yielding constructive efficiency. As the crypto market strikes in tandem with shares, buyers are bracing for potential fluctuations. With gold costs surging and the VIX index elevated, merchants are poised for a worthwhile journey amid the uncertainty.

What’s Next For Bitcoin And Altcoins?

Bitcoin is poised for unstable buying and selling forward of the election and the top altcoins are additionally anticipated to comply with go well with. Currently, BTC worth traded close to the $69K mark, after touching a excessive of $73,577.21 within the final seven days.

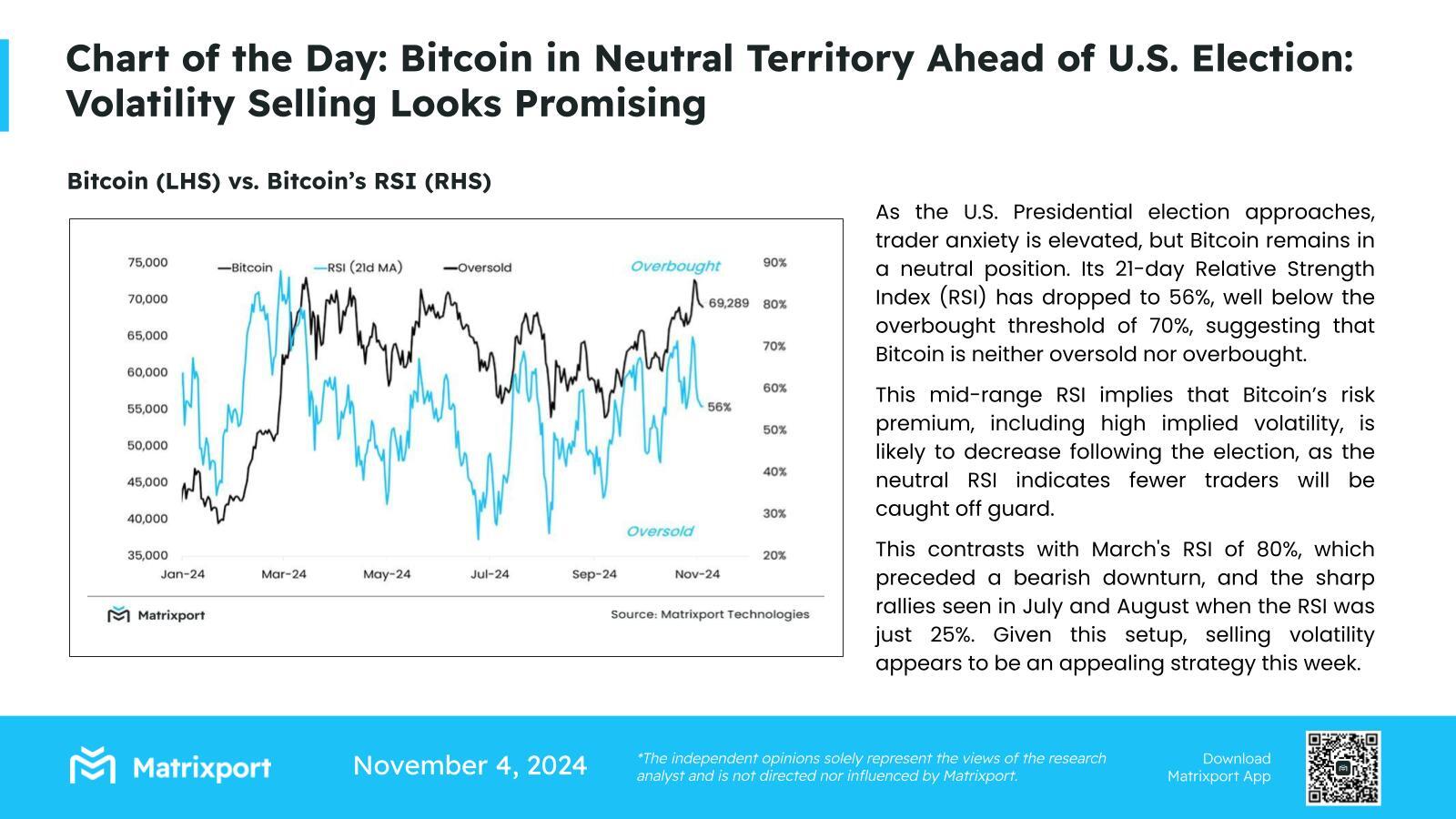

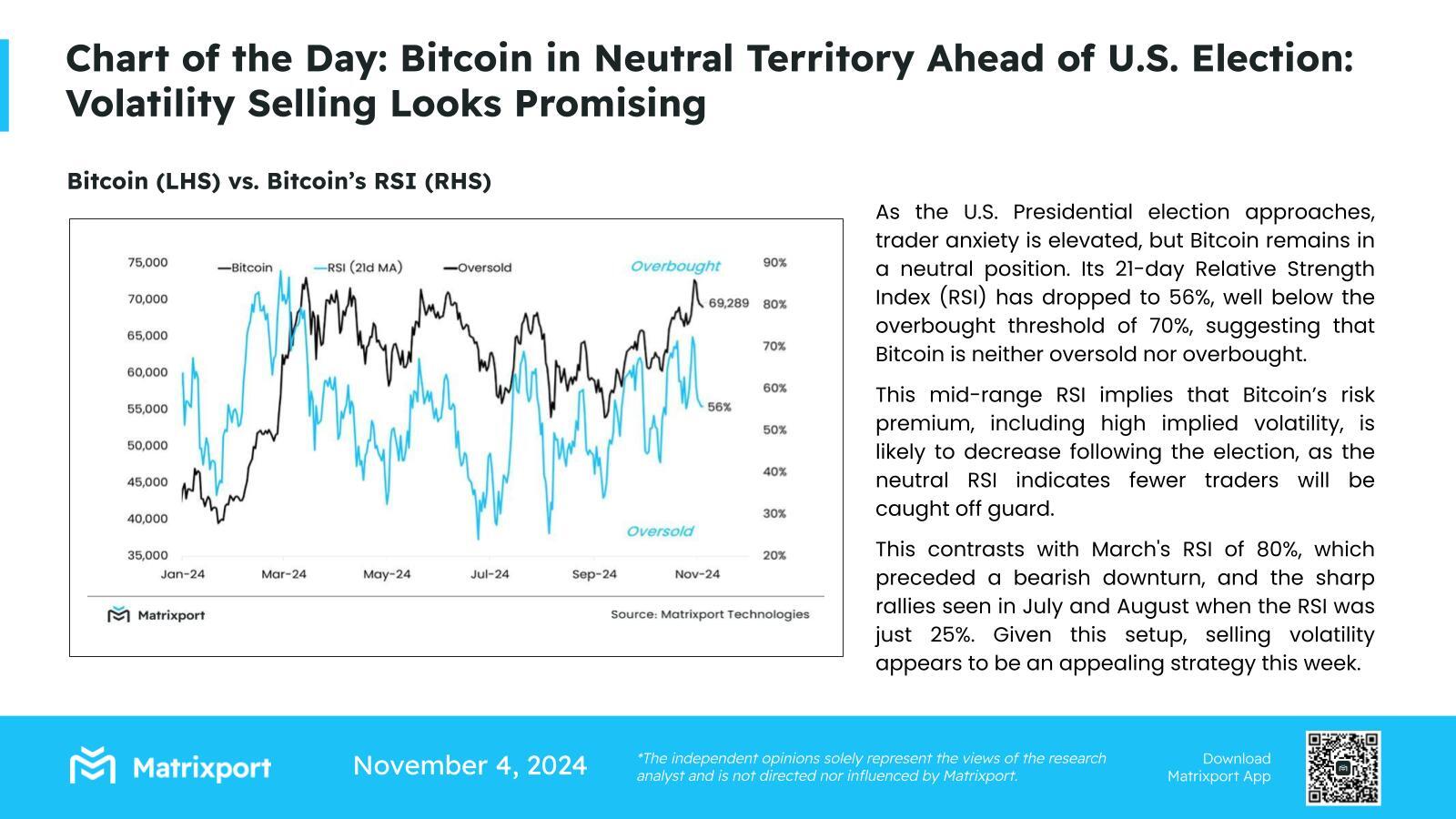

A current Matrixport report confirmed that because the US presidential election approaches, Bitcoin stays impartial. Its 21-day Relative Strength Index (RSI) dropped to 56%, under the overbought threshold of 70%. This suggests Bitcoin is neither oversold nor overbought, making it a gorgeous alternative for promoting volatility.

Historically, Bitcoin has adopted the S&P 500’s efficiency after the US presidential elections, with vital features within the yr following the election. In 2012, 2016, and 2020, the S&P 500 noticed notable development, and Bitcoin adopted go well with.

While previous tendencies don’t assure future outcomes, they provide priceless insights. As the election unfolds, buyers can be watching carefully to see how Bitcoin performs. Besides, the crypto market additionally anticipates an analogous efficiency for the highest altcoins.

Notably, a current Bitcoin price analysis hints that the crypto is poised to witness a powerful rally, regardless of who wins the election. Although the market will doubtless report unstable buying and selling or perhaps a crash on the Election date, it’s anticipated to make a fast rebound within the coming days. On the opposite hand, the US FOMC can be prone to increase the market sentiment, with the newest financial information indicating a 25bps Fed charge lower this week.

Disclaimer: The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.