Bloomberg analyst Eric Balchunas has weighed in on the continuing debate surrounding Bitcoin’s lackluster worth efficiency regardless of massive inflows into Bitcoin ETFs. Balchunas argues that these ETFs are having a optimistic impression on Bitcoin’s worth, despite the fact that the worth has not soared as many anticipated.

Jim Bianco Raises Concerns Over Bitcoin’s Price Stability

In a sequence of posts on X (previously Twitter), monetary analyst Jim Bianco expressed his considerations about Bitcoin’s worth stagnation regardless of report inflows into Bitcoin spot ETFs. Bianco famous that whereas Bitcoin has seen inflows exceeding $12 billion since its all-time excessive in March, the worth stays down 4%.

He identified that, traditionally, components just like the latest halving, elevated institutional involvement, and rising curiosity in digital belongings ought to have pushed Bitcoin’s worth to new highs, but the cryptocurrency has lagged behind conventional belongings like gold, which is up 25% since March.

Bianco attributed Bitcoin’s restricted worth development to the truth that a lot of the cash flowing into ETFs will not be new capital. According to him, these inflows are largely coming from present crypto holders shifting funds from exchanges or private wallets into ETFs slightly than contemporary funding.

He warned that this pattern might have longer-term penalties for the crypto market, as cash shifts from decentralized exchanges and wallets into conventional finance buildings, probably giving extra management to establishments and regulators.

Bloomberg Analyst Argues Bitcoin ETFs Have Positive Effects

In response, Bloomberg analyst Eric Balchunas countered Bianco’s argument, stating that Bitcoin ETFs are already positively impacting the asset, even when the worth development isn’t as dramatic as some buyers anticipated. Balchunas highlighted that Bitcoin has doubled in worth since BlackRock’s ETF submitting in early 2023, regardless of main market disruptions and “several significant dumps.”

He attributed a few of Bitcoin’s resilience and present stability to the accessibility and low-cost construction of those ETFs, which give a regulated gateway for buyers beforehand hesitant about coming into the crypto market.

Balchunas dismissed the notion that Bitcoin’s worth needs to be considerably greater by now, noting that ETFs are highly effective instruments however don’t essentially result in immediate worth surges. He emphasised that the existence of brand-name ETFs like these from BlackRock might present long-term advantages for Bitcoin’s mainstream adoption, even when short-term worth motion stays subdued.

Cash-and-Carry Strategies Impacting Price Movement

Some analysts consider that buying and selling methods like cash-and-carry are additionally taking part in a task in limiting Bitcoin’s price growth. A cash-and-carry technique includes shopping for Bitcoin within the spot market whereas concurrently promoting futures contracts, making a delta-neutral place that captures the unfold between spot and futures costs with out publicity to cost volatility.

This kind of arbitrage permits merchants to revenue with out influencing Bitcoin’s worth, which can clarify why vital ETF inflows haven’t translated into worth positive aspects.

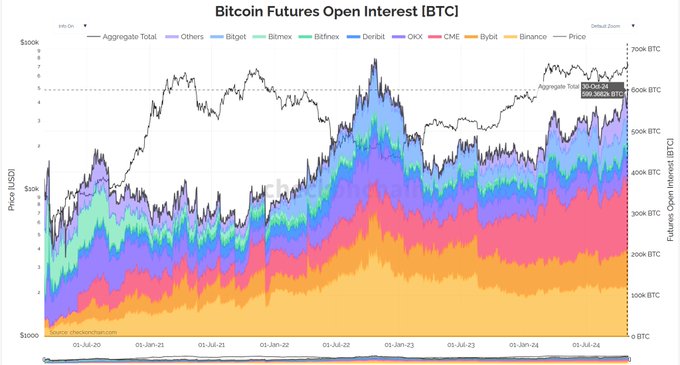

Analysts from Ryze Labs famous that institutional merchants on platforms just like the CME are actively utilizing cash-and-carry methods. These trades could also be decreasing upward stress on Bitcoin’s worth, as they preserve capital tied up in low-risk positions slightly than driving further demand. This transfer has prompted the CME to be a serious institutional platform for Bitcoin futures buying and selling, with open curiosity at an all-time excessive.

Despite the present worth stability, some specialists consider that Bitcoin’s fundamentals stay sturdy, and the demand for the cryptocurrency might ultimately overcome the stabilizing results of cash-and-carry trades. “The long-term viability of Bitcoin is solid,” BlackRock CEO Larry Fink stated not too long ago, expressing his optimism concerning the asset’s future.

He indicated that as extra buyers flip to Bitcoin as a hedge in opposition to inflation and fiat forex devaluation, actual demand may ultimately outweigh the impression of arbitrage methods, probably resulting in sustainable worth development.

Disclaimer: The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.