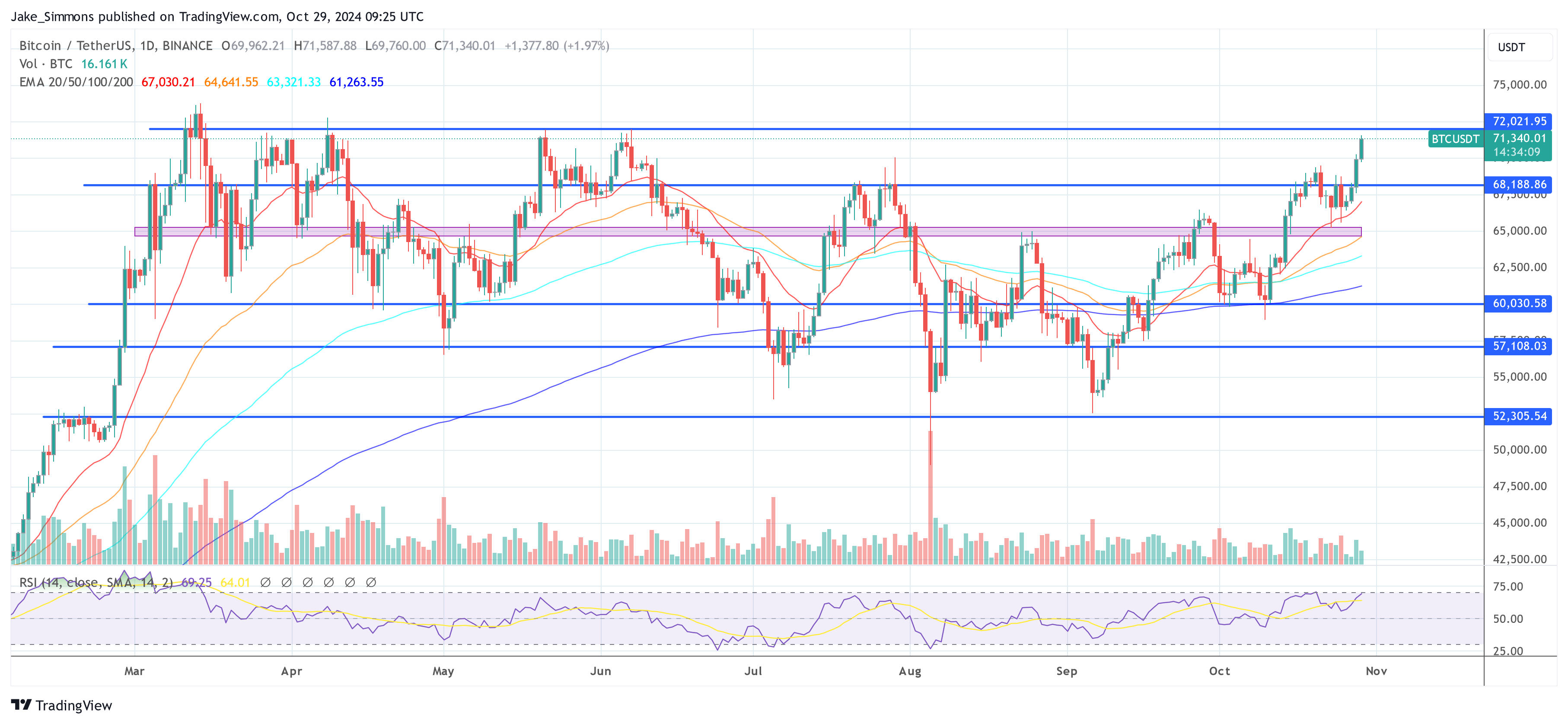

The Bitcoin value has surged previous the $71,000 mark right now. Over the previous 5 days, Bitcoin’s value has rallied by greater than 8.5%, climbing from $65,600 to as excessive as $71,118 on October 29. In the final 24 hours alone, the BTC value has elevated by 3.8%. This upward momentum might be attributed to 4 key elements:

#1 Bitcoin ETFs Attract Massive Inflows

The surge in Bitcoin’s value is intently linked to substantial inflows into Bitcoin Exchange-Traded Funds (ETFs). Yesterday witnessed huge ETF flows totaling $479.4 million. BlackRock led the inflows with $315.2 million, adopted by Fidelity at $44.1 million, Ark with $59.8 million, and Bitwise at $38.7 million. These important investments coincided with Bitcoin’s value motion from $68,000 to over $71,000.

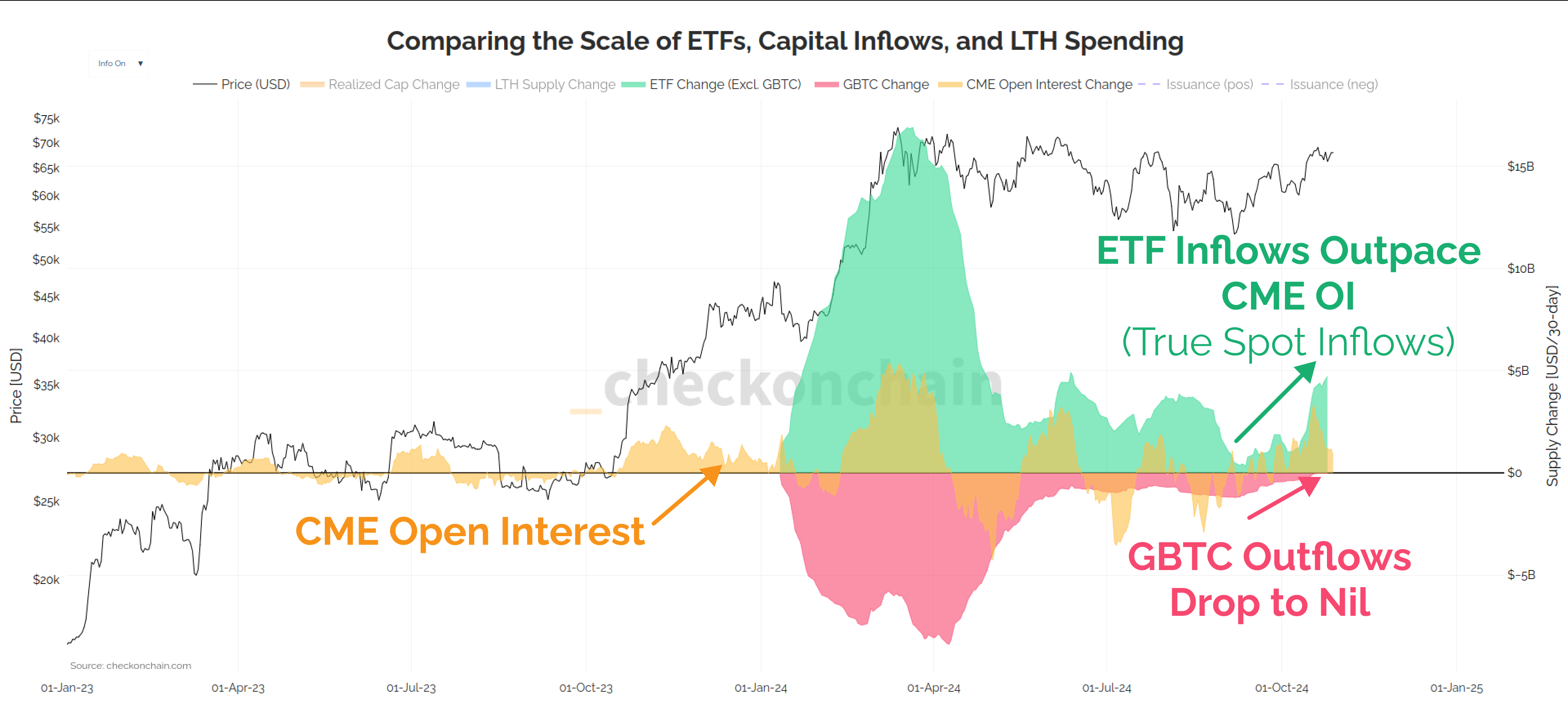

Leading on-chain analyst James “Checkmate” Check highlighted a divergence between Bitcoin ETF inflows and CME Open Interest. He noted “We have a divergence between Bitcoin ETF Inflows and CME Open Interest. ETF Inflows are ticking meaningfully higher, CME Open Interest is up, but not as much GBTC outflows are also minimal. We’re seeing true directional ETF inflows, and less so cash and carry trades.”

The divergence means that traders are favoring direct publicity to Bitcoin by way of ETFs somewhat than partaking in money and carry trades involving futures contracts. The carry commerce technique within the context of US spot Bitcoin ETFs and CME futures includes shopping for the ETF (monitoring the spot value of Bitcoin) and concurrently shorting Bitcoin futures on the CME.

This method goals to capitalize on value variations when futures commerce at a premium to the spot value (contango). The notable shift towards ETFs signifies a bullish sentiment amongst traders, anticipating additional value appreciation.

#2 The “Trump Trade”

Political developments are additionally influencing Bitcoin’s latest rally. Singapore-based QCP Capital commented on the affect of former President Donald Trump’s interview on the Joe Rogan Experience podcast, which has gained over 32 million views and pushed his Polymarket odds above 66%. Despite “crypto” being touted because the “Trump Trade,” Bitcoin’s correlation with Trump’s potential election victory appears to gas the Bitcoin value rally.

QCP Capital additionally famous that Bitcoin is up solely 8% this “Uptober,” in comparison with a median of 21% in earlier Octobers. They acknowledged, “If spot holds at these levels, this October would mark Bitcoin’s fourth-worst performance in the past decade.” With complete BTC perpetual futures open curiosity throughout exchanges standing at $27 billion—approaching this 12 months’s peak—a breakout above $70,000 might set off new all-time highs, particularly with extra leveraged longs becoming a member of in.

#3 Shorts Squeeze Amplifies Price Surge

Market information signifies a big shorts squeeze contributing to Bitcoin’s value spike. According to Coinglass, prior to now 24 hours, 65,622 merchants have been liquidated, with complete liquidations throughout the whole crypto market amounting to $228.51 million. Of this, $169.47 million have been brief liquidations. Specifically for Bitcoin, $83.61 million in shorts have been liquidated. The largest single liquidation order occurred on Binance’s BTCUSDT pair, valued at $18 million.

The substantial liquidation of brief positions means that many merchants have been betting on a value decline and have been pressured to shut their positions because the market moved in opposition to them. This mass unwinding of shorts can speed up upward value actions as merchants purchase again into the market to cowl their positions.

#4 Whales Increase Buying Activity

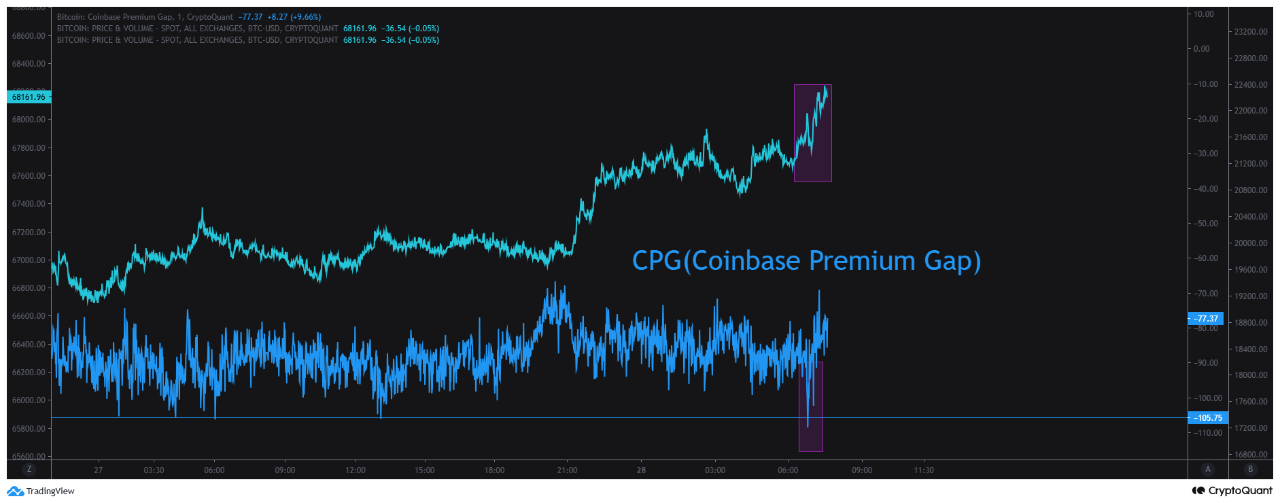

Large-scale traders, also known as “whales,” are taking part in a pivotal position within the present rally. CryptoQuant analyst Mignolet observed that Bitcoin’s rally continues, led by exercise on the Binance trade. He identified that Binance whales started important involvement available in the market two weeks in the past throughout Asian buying and selling hours, and up to date declines within the Coinbase Premium Gap (CPG) alongside value will increase are “a transparent signal of Binance whales’ intervention.

Mignolet emphasised that this shouldn’t be interpreted as a decline in US demand, however a good stronger shopping for stress from Binance. Over the previous two weeks, demand for US Bitcoin spot ETFs has surged, with a web influx of roughly 47,000 Bitcoin. Since most ETF merchandise use Coinbase, actions in CPG information are intently tied to ETF demand. He concluded, “The current Bitcoin price is being driven by Binance whales, with sustained inflows of US capital.”

At press time, BTC traded at $71,340.

Featured picture created with DALL.E, chart from TradingView.com