Veteran dealer Peter Brandt has reignited the Bitcoin vs Gold debate, highlighting how the flagship crypto has carried out in opposition to gold. Renowned economist Peter Schiff has additionally fuelled this debate by arguing that gold deserves extra consideration than BTC.

Bitcoin Vs. Gold: How BTC Is Performing

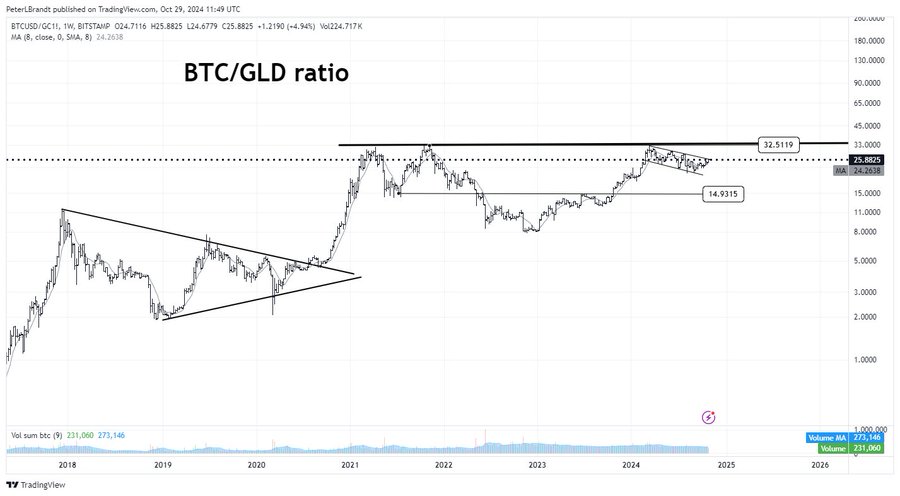

Peter Brandt claimed in an X submit that Bitcoin has made “no progress” in 42 months in its Gold pair. He remarked that the flagship crypto stays under the March 2024 excessive and the double highs in 2021.

Indeed, the Bitcoin price stays under its present all-time excessive (ATH) of $73,000, which it reached earlier this 12 months in March. Meanwhile, gold continues to succeed in new highs, rising to a brand new ATH of $2771. BTC and gold have all the time been in contrast, as consultants view each property as a retailer of worth.

Some consultants have additionally argued that the flagship crypto has an edge in opposition to gold, though it’s generally known as ‘digital gold.’ Peter Brandt additionally highlighted the importance of those property whereas noting that they’re within the “heavyweight division” within the battle in opposition to fiat depreciation.

Given BTC’s underperformance in opposition to gold, the latter appears to reside as much as the hype extra as a retailer of worth. There can also be the argument that crypto’s correlation with the inventory market exhibits that buyers view it extra as a threat asset than a hedge in opposition to inflation.

Peter Schiff Also Fuels The Debate

Gold proponent and famend economist Peter Schiff has additionally sparked the Bitcoin vs. gold debate. Following the BTC value rally above $71,000 for the primary time in 4 months, Schiff mentioned that gold is buying and selling at one other report excessive, simply shy of its ATH. However, Schiff remarked that nobody will discover as a result of the flagship crypto is buying and selling again above $71,000.

The economist believes that gold ought to obtain extra consideration than it presently does, particularly because it reaches new highs whereas BTC makes an attempt to interrupt its present ATH of $73,000. However, regardless of Schiff’s reservations, it’s value mentioning that the flagship crypto is a sufferer of its success.

Bitcoin hit a brand new ATH earlier within the 12 months, simply earlier than the halving occasion in April, which was uncommon contemplating it had by no means reached a brand new ATH till after the halving. As such, that improvement weighed on the flagship crypto since analysts like Rekt Capital claimed that it needed to consolidate for this lengthy so it might synchronize with previous halving cycles.

For context, regardless of consolidating for this lengthy, BTC is up over 62% year-to-date (YTD) whereas gold is up simply over 33% since this 12 months started.

Meanwhile, it’s value mentioning that Peter Schiff has additionally prolonged the BTC vs gold debate to their associated shares. The economist compared MicroStrategy to gold shares. He famous that MSTR stock is value greater than the shares of all gold mining corporations besides Newmont.

However, Schiff questioned MicroStrategy’s worth and advised it might endure a value crash quickly sufficient. MSTR is likely one of the best-performing property this 12 months, outperforming even BTC and gold.

Disclaimer: The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.