Bitwise’s Chief Investment Officer (CIO) Matt Hougan has predicted that the Bitcoin worth might attain a brand new all-time excessive (ATH) even earlier than the US election. The Bitwise CIO’s prediction got here as he acknowledged the affect Kamala Harris’ assist might have in the marketplace because the US presidential elections draw nearer.

Bitwise Predicts New Bitcoin ATH Before US Elections

Matt Hougan steered in his newest weekly memo that BTC might hit a brand new ATH earlier than the US elections. In the weekly memo launched final week, the Bitwise CIO implied that market individuals may need to attend till after the elections earlier than Bitcoin runs to $80,000, representing a brand new ATH for the flagship crypto.

However, Hougan acknowledged that after the Monday BTC rally to $67,000, he was now not positive that market individuals must wait that lengthy earlier than the worth rally to that focus on occurred. He claimed the rally confirmed that many individuals don’t need to be left behind if and when crypto takes off.

He added,

There is a whole lot of dry powder on the sidelines. As quickly as we get any whiff of readability, I feel we go increased quick.

Matt Hougan indicated that Monday’s Bitcoin rally was primarily because of Kamala Harris declaring her assist for crypto. CoinGape reported that Harris finally affirmed her assist for crypto, as she promised to guard black males who spend money on and personal cryptocurrencies.

Although this wasn’t the form of assist many within the crypto trade hoped for, the Bitwise CIO acknowledged that it’s nonetheless excellent news because it reveals that Kamala Harris is aware of that crypto exists and isn’t going away.

According to him,

…That little sliver of fine information was sufficient to ship bitcoin up 5%. Enough to push greater than $500 million into bitcoin ETFs. Enough for individuals to begin questioning if crypto is lastly going to make an assault on all-time highs.

Standard Chartered Makes Similar Prediction

Standard Chartered additionally made a prediction much like the Bitwise CIO. The Bank’s Head of Research, Geoff Kendrick, predicted that Bitcoin might rise to $73,800 earlier than the November 5 US elections. He defined that this might occur resulting from a number of components, together with the elevated curiosity within the Spot Bitcoin ETFs and Donald Trump main within the polls.

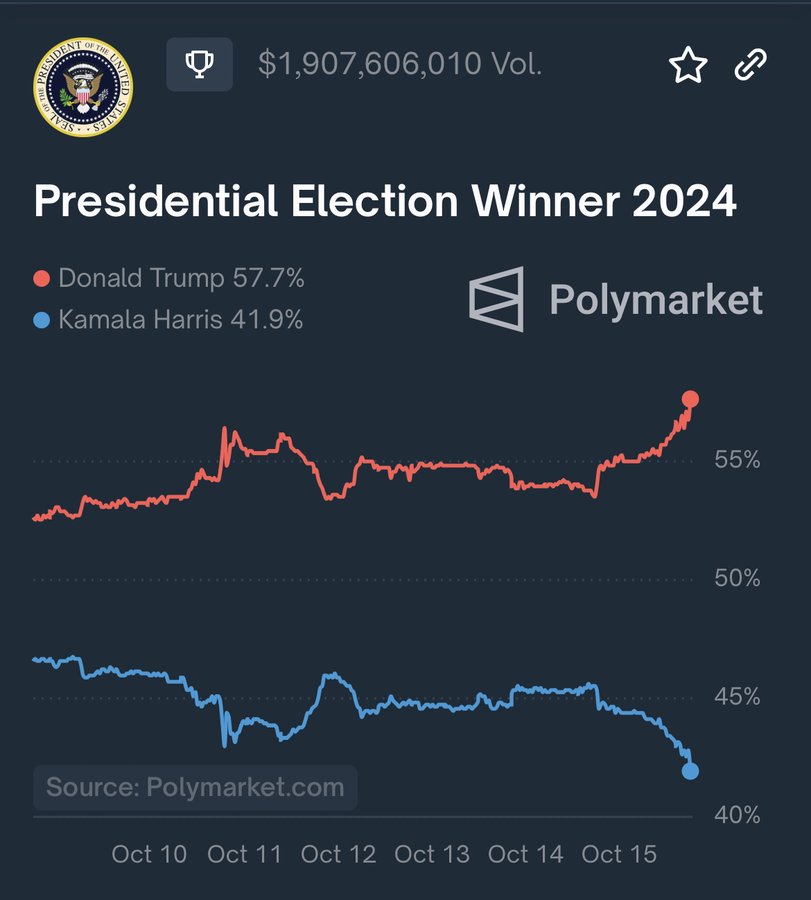

Like Matt Hougan, Kendrick raised the potential for BTC rising to $80,000, noting that there are presently name choices at that worth goal. Kendrick had earlier within the 12 months predicted that the flagship crypto might attain $150,000 by year-end if Trump wins the election. The newest Polymarket data reveals that Donald Trump has a 57.7% probability of changing into the subsequent US President.

Meanwhile, based mostly on buying and selling agency QCP Capital’s analysis, Bitcoin is unlikely to achieve a brand new ATH till January of subsequent 12 months. QCP Capital famous that the Monday BTC rally signifies that the crypto is once more following historic tendencies. In the 2016 and 2020 election years, the crypto started its worth rally about three weeks earlier than the elections however didn’t attain a brand new ATH till January subsequent 12 months.

Disclaimer: The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.