Ethereum is at a crucial juncture after failing to interrupt above the $2,500 mark yesterday, leaving traders unsure about its subsequent transfer. As the broader crypto market anticipates a rally, Ethereum merchants carefully monitor indicators of power throughout the community. Despite current worth struggles, there are promising alerts from the blockchain.

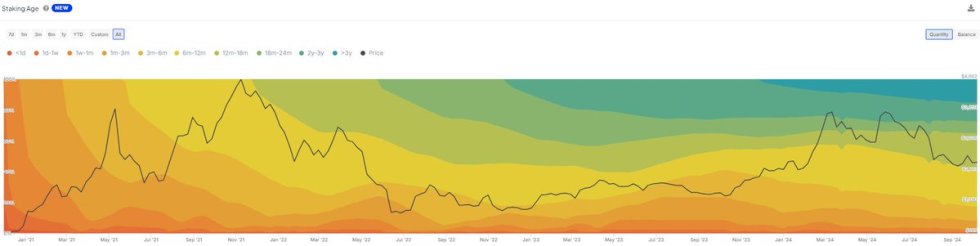

Key information from IntoTheBlock suggests a rising demand for ETH staking, reflecting long-term confidence within the community’s future. This surge in staking exercise signifies that traders are nonetheless optimistic about Ethereum’s potential, notably with upcoming developments like staking rewards and community upgrades.

However, the current worth motion has raised issues, as many had anticipated ETH to climb larger by now, particularly following a interval of optimistic sentiment throughout the market.

With the crypto market poised for a doable rally, Ethereum’s next moves might set the tone for broader market efficiency. Investors are actually watching carefully to see if ETH can regain momentum or if it would proceed to wrestle at present resistance ranges. The coming days might be pivotal in figuring out whether or not ETH can break by way of and provoke a sustained upward pattern.

Ethereum Staking Signals Long-Term Confidence

Ethereum is buying and selling under a key resistance degree because the broader crypto market prepares for a possible rally within the coming weeks. The market sentiment has been more and more bullish, with traders anticipating Ethereum to play an important position within the subsequent upward transfer.

According to key data from IntoTheBlock, 28.9% of all ETH is now staked, a big enhance from the 23.8% recorded in January. This surge in staking exercise is a transparent indicator of rising long-term confidence within the Ethereum community.

Interestingly, over 15.3% of Ethereum has been staked for over three years, displaying that many traders are dedicated to holding their ETH for the lengthy haul. This robust staking exercise reinforces the narrative that ETH is considered as a priceless asset within the evolving crypto panorama and that many traders are betting on its long-term success.

The current enhance in staking and Ethereum’s upcoming community upgrades counsel that ETH is well-positioned for a possible surge. As market fundamentals proceed to enhance, all the crypto market appears poised for a rally, and ETH may lead the cost. If ETH breaks previous its resistance ranges, the momentum might set off a big upward motion within the weeks forward.

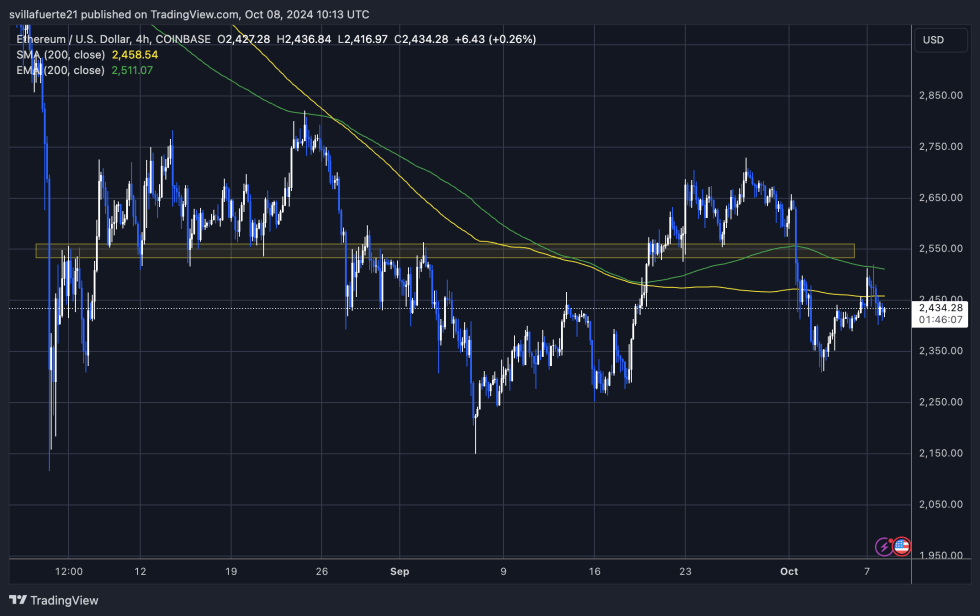

ETH Testing Supply Levels

Ethereum is buying and selling at $2,434 after failing to interrupt above the 4-hour 200 transferring common (MA) at $2,458. This technical degree has acted as a big resistance level, and bulls have to reclaim it to take care of upward momentum.

A key goal for Ethereum’s worth motion is surpassing the 4-hour 200 MA and breaking above the 200 exponential transferring common (EMA) at $2,511. Doing so would strengthen the bullish case and open the door for a possible rally.

However, if ETH continues to wrestle and fails to interrupt previous these crucial resistance ranges, a deeper retracement may very well be on the horizon. In such a situation, the subsequent important demand zone lies round $2,150, which might present a stable basis for a possible rebound.

With Ethereum traders carefully watching these ranges, the worth motion within the coming days might be essential in figuring out whether or not ETH can regain its bullish momentum or face additional draw back dangers. Bulls should reclaim key technical indicators or danger shedding management of the pattern, resulting in a retest of decrease assist zones.

Featured picture from Dall-E, chart from TradingView