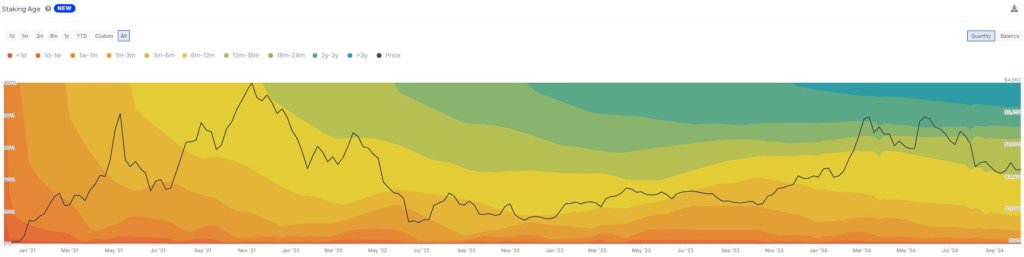

Ethereum bulls would possibly battle for momentum at press time, however different onchain information factors to attention-grabbing developments. While ETH is buying and selling above $2,400 however capped by decided sellers, IntoTheBlock information reveals that just about 30% of all circulating ETH has been staked.

Over 34.4 Million ETH Staked In 9 Months

As of October 8, IntoTheBlock analysts note that 28.9% of all ETH has been staked. At this stage, extra holders are committing to tie their stash. The determine is up, rising from 23.8% recorded in January 2024. More than 15.3% of ETH has been staked out of this quantity for over three years.

Related Reading: Dogecoin Preparing For Another Monumental Surge, New All-Time High Incoming?

Ethereum switched the proof-of-work consensus algorithm in September 2022, formally transitioning to a proof-of-stake community like Cardano. The migration permitted the platform to cast off energy-intensive miners who have been changed by validators.

Parallel information from Ethereum shows that over 1 million community validators have cumulatively locked in additional than 34.4 million ETH. Each validator earns an APR of three.3%, a non-compounding annual yield that falls relying on the quantity locked.

All community validators should lock at the least 32 ETH and function a node that ensures the community operates every single day of the week with out downtime. There are penalties for validators who collude to, for instance, verify invalid transactions or try to take over the chain in a majority assault.

That Ethereum is attracting extra validators regardless of costs contracting from Q1 2024 highs of round $4,100 to as little as $2,100 in early August is an endorsement of the platform’s long-term prospects.

Presently, Ethereum stays the second largest platform after Bitcoin and the one different crypto venture after Bitcoin to get the node for a spot ETF from the United States SEC. Even so, ETH stays underneath strain under $2,800, dashing hope.

EIP 7781 Seeks To Boost Ethereum Scalability

Beyond this, Ethereum builders proceed to construct, seeking to improve person expertise and enhance scalability. After the Dencun improve in March 2024, a brand new Ethereum Improvement Proposal (EIP) 7781 was lately floated.

The proposer seeks to additional enhance Ethereum’s processing speeds by lowering slot instances and growing the blob capability. Specifically, the objective is to finally cut back the slot time from round 12 seconds to eight seconds, which might enhance the transaction throughput by over 30%.

If this proposal goes by means of, decentralized exchanges, together with Curve or Uniswap, would profit. Of notice is that customers, as a consequence of increased throughput, will see the price of mainnet transactions shrink. Although the proposal is welcomed, solo stakers should purchase new gear and strengthen their web connections.

Feature picture from Canva, chart from TradingView