The crypto market just lately suffered a major downturn because of the escalating geopolitical tensions within the Middle East, with several large-cap assets shedding their recently-accrued features over the previous week. Specifically, the worth of Ethereum crashed from above $2,600 to as little as $2,300 in some unspecified time in the future throughout the week.

This represents a contemporary setback for the “king of altcoins,” which has not had a very constructive efficiency previously few months. Interestingly, a well-liked crypto pundit on X has come ahead with an on-chain commentary into the conduct of Ethereum buyers during the last quarter.

How Ethereum Whales Shaving Off Their Holdings Will Impact Price

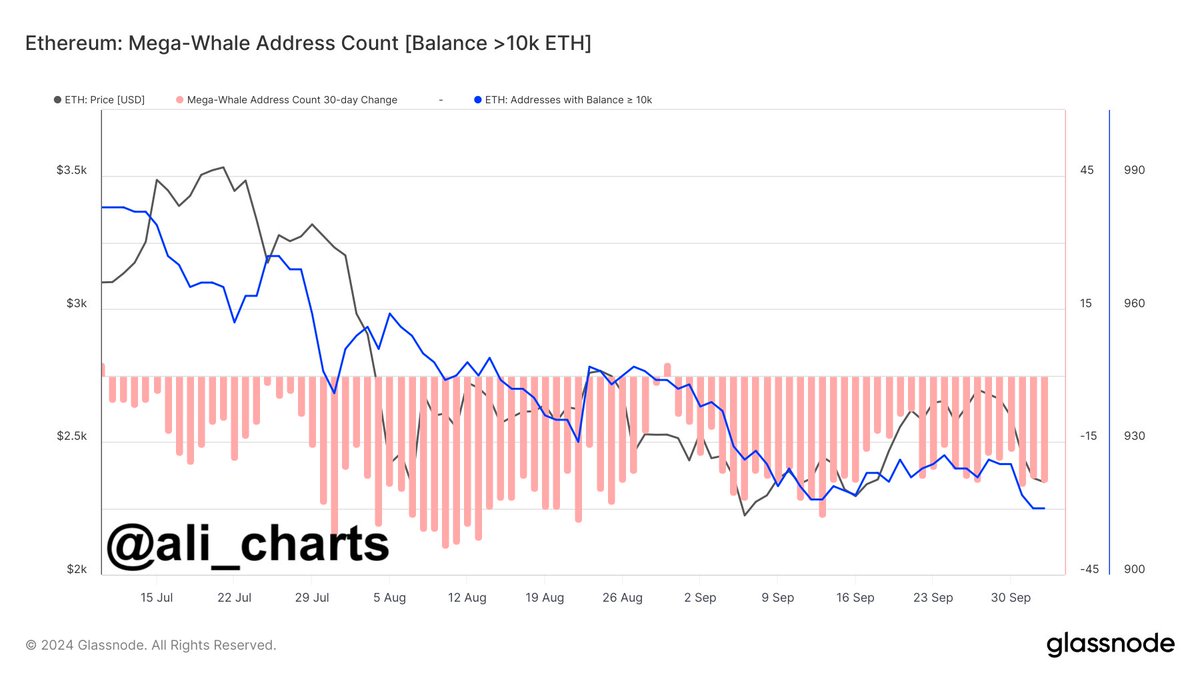

In a current submit on the social media platform X, crypto analyst Ali Martinez revealed {that a} explicit group of Ethereum whales has been shaving their holdings over the previous few months. This on-chain revelation is predicated on the Mega-Whale Address Count, which tracks the variety of addresses holding greater than 10,000 models of a specific cryptocurrency.

Whales check with entities (people and organizations) that personal important quantities of a particular cryptocurrency (Ether, on this case). Investors often pay additional consideration to whale actions, as these massive entities are inclined to wield notable affect on market liquidity and costs as a result of their substantial holdings.

Source: Ali_charts/X

According to Martinez, the variety of whale addresses holding over 10,000 ETH has fallen by greater than 7% since July 2024. This decline within the inhabitants of enormous Ethereum holders factors to some redistribution or profit-taking and suggests a notable shift in market sentiment, particularly amongst large-scale buyers and institutional gamers.

Interestingly, this discount in whale addresses coincided with a interval the place the Ethereum worth struggled. Despite the approval and launch of spot ETH exchange-traded funds (ETFs), the altcoin’s worth fell from above $3,500 in July to as little as $2,200 by August.

As already seen within the token’s worth motion over the previous few months, the lower in massive Ethereum holders might diminish shopping for stress on a grand scale, resulting in sluggish worth motion. Moreover, sustained profit-taking actions by these whales might potentiate downward stress on the ETH worth.

ETH Price At A Glance

As of this writing, the worth of Ethereum sits simply above the two,400 mark, reflecting an insignificant 0.1% lower previously 24 hours. The cryptocurrency’s performance on the weekly timeframe will not be so insignificant, because the ETH worth is down by almost 10% previously seven days.

The worth of ETH rebounds from $2,300 on the each day timeframe | Source: ETHUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView