Bitcoin crash dangers on account of Mt Gox compensation have now dropped to virtually 75%, on-chain analytics platform Arkham Intelligence acknowledged on Saturday. Institutional and retail traders offloaded Bitcoin holdings on fears of an enormous market crash as Mt Gox Trustee began BTC compensation in July this 12 months.

Mt Gox Wallet Down To 25% Bitcoin Holdings

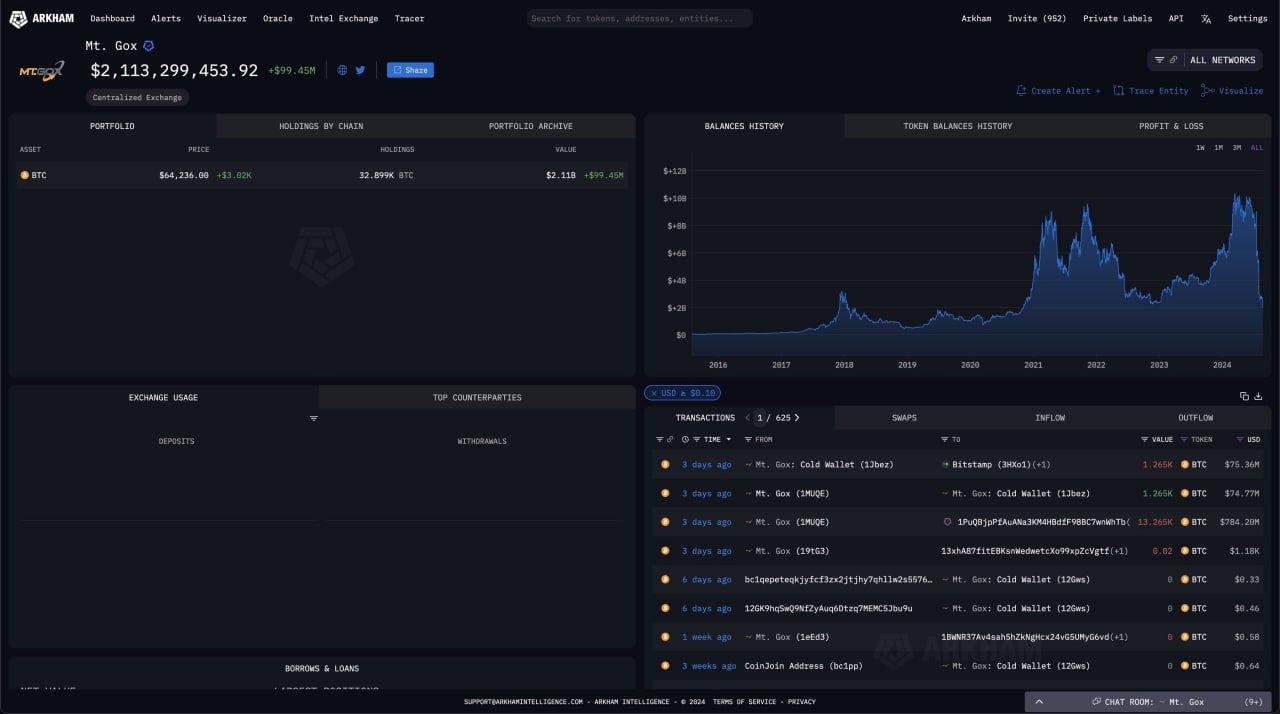

Arkham Intelligence confirmed on August 24 that beleaguered crypto alternate Mt Gox wallets now have lower than 25% BTC. This means the dangers of any extra Bitcoin liquidation or crash as a result of compensation have dropped considerably, contributing extraordinarily towards bullish sentiment.

Mt Gox wallets have held 141.69K BTC since 21, with a peak worth of $10.12 billion as of March 2024, as per Arkham data. The pockets now holds 32.9k BTC price $2.11 billion. Moreover, collectors have to date not bought their BTC holdings and are prone to not promote them as a result of ongoing bull run.

With Bitcoin selloff by the US authorities the one remaining main crash threat, consultants imagine the trail to $100k is much more clear. The crypto market bulls confirmed resilience amid selloffs by the German authorities, the US govt, and compensation by the alternate.

More Factors Suggesting BTC Price Rally

Mt Gox has distributed almost 109K BTC price $6.6 billion to collectors since July, which is taken into account spectacular as BTC value recovered above $60,000 after falling beneath the extent many instances in the previous couple of months.

Institutional and retail traders are extra bullish now after sturdy alerts of Fed price cuts from the FOMC Minutes and Fed Chair Jerome Powell speech. US Fed officers are additionally extra upbeat on price cuts, indicating that the Federal Open Market Committee is prone to vote for a financial coverage pivot within the September assembly.

Traders additionally count on the ‘Golden Cross’ sample formation within the coming days as 50-DMA is prone to crossover above 200-DMA, which signifies the opportunity of a long-term bull market.

Moreover, US spot Bitcoin ETF noticed $252 million in web inflows on Friday, bringing the weekly whole to $506.4 million. The 11 Bitcoin ETFs noticed consecutive inflows for seven days, which helps hypothesis of a massive BTC rally this 12 months.

Disclaimer: The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.