Bitcoin value hit a excessive of $64,955 after Federal Reserve Chair Jerome Powell gave his strongest sign on Fed price cuts. This triggered an upside momentum within the broader crypto market, with the market cap leaping greater than 4% to $2.27 trillion.

Altcoins together with ETH, SOL, XRP, DOGE, and different main crypto additionally witnessed important restoration on large rebound in sentiment. Crypto Fear and Greed Index rebounded from concern (34) to greed (56) in only a day.

Reasons Why Bitcoin Price Is Going Up Today

Bitcoin bulls strongly focused the $62,000 degree this month. BTC value noticed a 5% uptrend within the final 24 hours, with the value nearly hitting $65,000. Here are the highest 5 the explanation why Bitcoin value is rising and should rally to a brand new all-time excessive within the coming months.

Sentiment Rebound Following FOMC and Jackson Hole Event

Positive hints of Fed price cuts from the FOMC Minutes and Fed Chair Jerome Powell speech on the Jackson Hole Symposium have been main elements behind the sudden upsurge in Bitcoin value.

Dovish comments from Fed officials akin to Neel Kashkari, Alberto Musalem, Raphael Bostic, and Mary Daly and their affirmation on beginning Fed price cuts earlier this week triggered cautious shopping for by traders. They additionally agree on potential price cuts beginning in September.

While Powell didn’t present actual indications on the timing or extent of price cuts, he affirmed that it’s time for a financial coverage pivot amid slowing inflation and weakening of the US labor market. He additionally added that the timing and tempo of price cuts will rely upon incoming knowledge, the evolving outlook, and the stability of dangers.

Bitcoin Chart Flashes Technical Strength

Bitcoin chart is exhibiting technical energy and indicators flashing purchase indicators. Bitcoin value is at the moment buying and selling above the help at $62K. It is now going through resistance at $65K.

In the day by day timeframe, Bitcoin is now buying and selling above 50-DMA (blue), 100-DMA and 200-DMA (pink). Traders additionally anticipate the ‘Golden Cross’ sample formation within the coming days as 50-DMA is prone to crossover above 200-DMA, which signifies the opportunity of a long-term bull market.

Bitcoin Options Target $100K By Year-End

BTC price is at the moment buying and selling above $64,000 now, simply 12% away from its all-time excessive of 73,750. Options merchants are extraordinarily bullish on Bitcoin and additional upside momentum in direction of $100k this yr.

Deribit knowledge reveals BTC choices trades are concentrating on Bitcoin value to hit as excessive as $100k in December. According to the biggest BTC bulk possibility order on Deribit at the moment, a dealer offered 80,000 name possibility for the top of the yr and offered a 120,000 name possibility for the top of the yr.

Meanwhile, 60,477 BTC choices with $3.88 billion of notional worth is ready to run out on August 30. The max ache level is at $61,000, indicating a restoration by the top of the month itself resulting from starting of the rate of interest minimize cycle.

However, US Fed price cuts are prone to trigger volatility within the inventory and crypto markets initially, with large reshuffling of positions much like different key occasions traditionally.

Positive Shift in US Elections Fuels Bitcoin Price

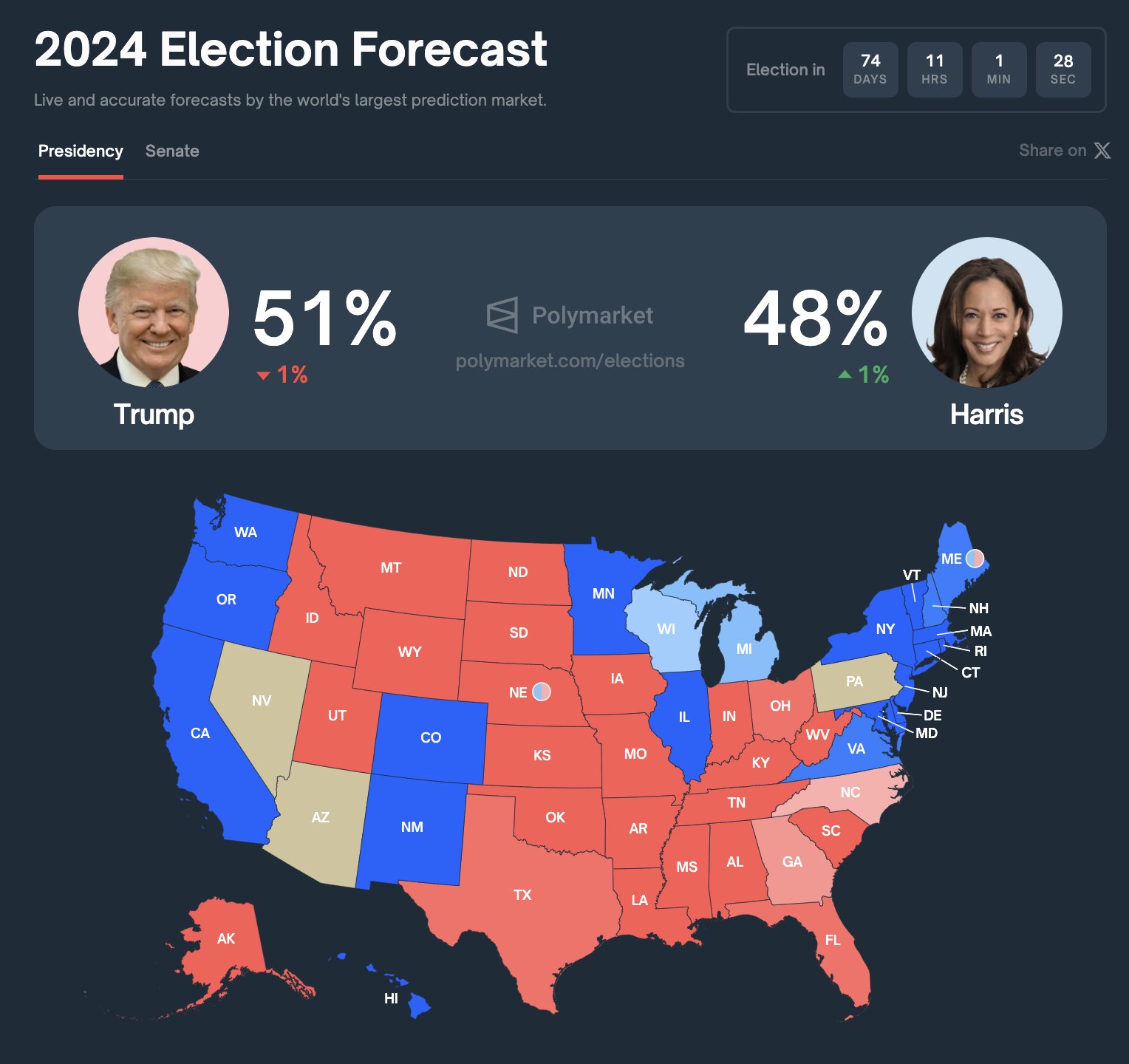

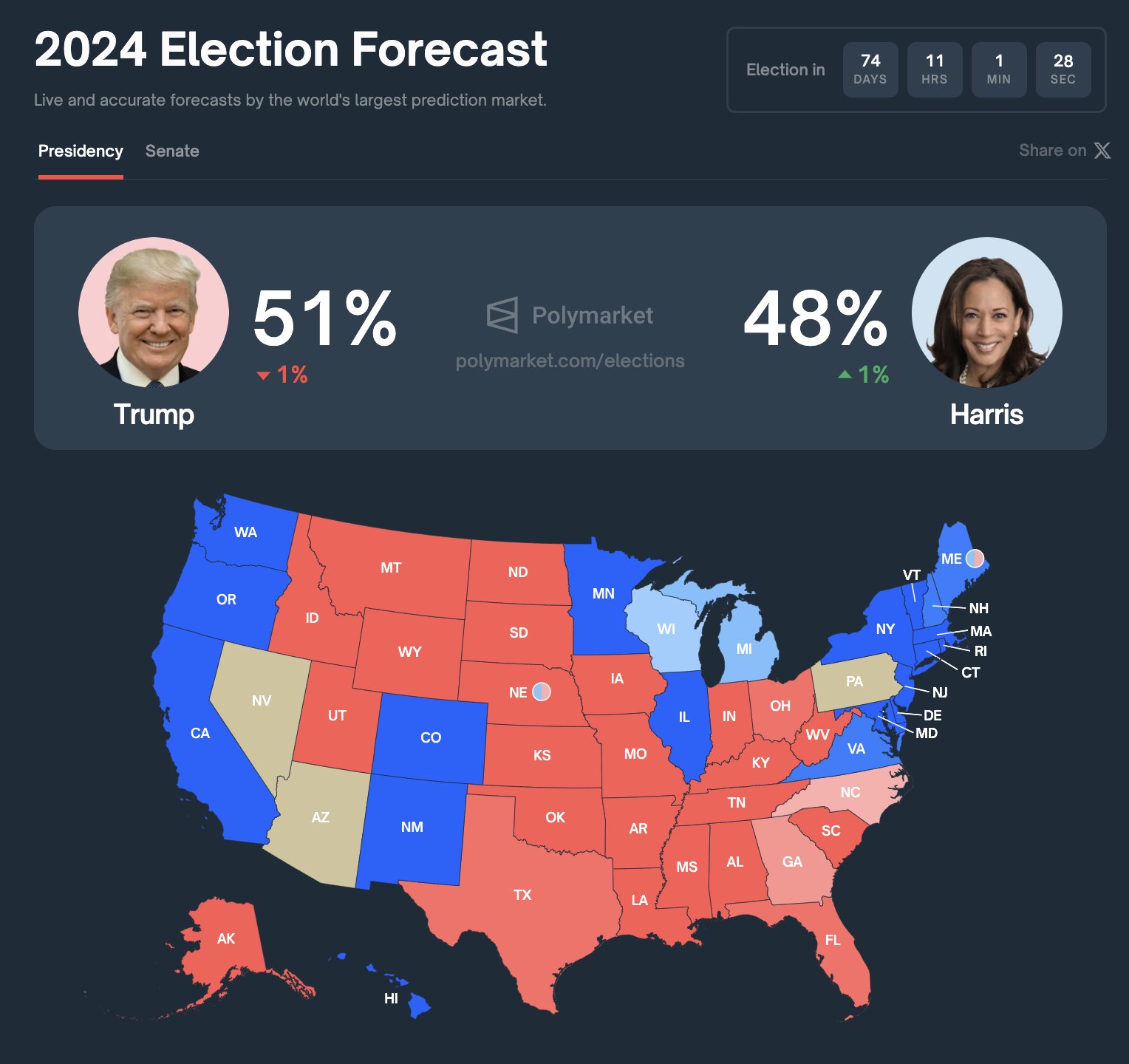

Pro-Bitcoin Robert F Kennedy Jr has formally dropped out of the presidential race. He has now endorsed Republican presidential nominee Donald Trump. This has led to a big shift in help for Trump, together with after he stated to supply a high job to Elon Musk after the elections.

Donald Trump now leads Democratic presidential nominee Kamala Harris on Polymarket prediction market. The present data signifies odds of Trump profitable the election dropped 1% to 50% and Harris’ odds elevated by 1% to 49% after RFK Jr. dropped from the race. The development is at the moment in favor of Bitcoin value.

Spot Bitcoin ETF Inflow Support Upside Momentum

Spot Bitcoin ETF noticed $252 million in internet inflows on Friday, in line with Farside UK knowledge. This brings the weekly whole to $506.4 million, with consecutive inflows for seven days. This helped Bitcoin value to carry above $60,000 this week.

The steady influx in funding displays the robust confidence amongst institutional and retail traders within the U.S. The crypto market merchants think about Bitcoin ETF flows as main indicator of market sentiment. BlackRock reported $86.8 million in BTC ETF inflows and Fidelity noticed $64 million in its BTC ETF.

Disclaimer: The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.