Bitcoin derivatives market indicators an upcoming “short squeeze” that may result in a pointy rally in Bitcoin worth, with an finish of selloff within the largest crypto asset. Moreover, analysts have turned general bullish on account of technical power within the BTC chart and the newest macroeconomic information.

Bitcoin Price To Witness “Short Squeeze”

Crypto market is staging sharp recoveries because the funding charges on Bitcoin and plenty of altcoins are nonetheless damaging, indicating a giant brief squeeze forward.

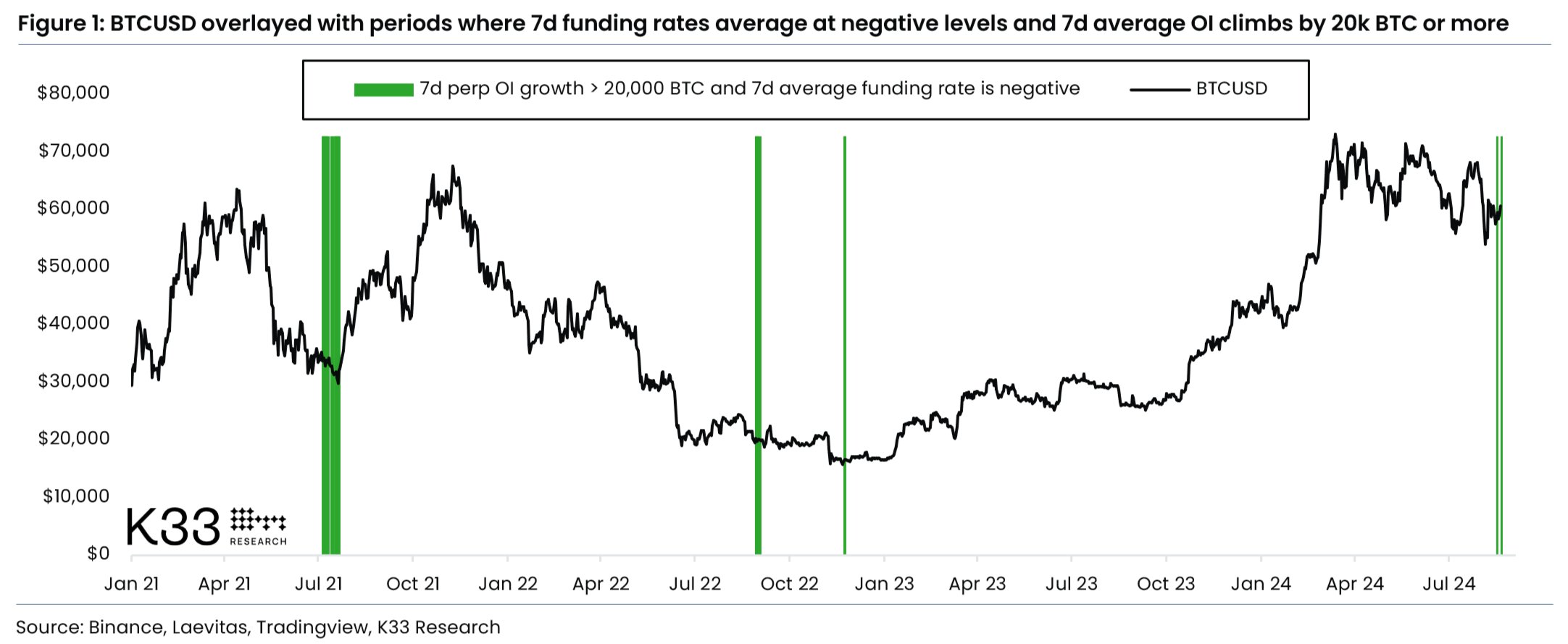

According to K33 Research data, the seven-day common annualized BTC perpetual funding charge was the bottom on Tuesday since March 2023 — when US financial institution failures spooked traders — indicating a prevalence of draw back dangers.

The report predicts a possible sell-side exhaustion, with a setup indicative of an imminent brief squeeze coming quickly. The chart illustrates a BTC open curiosity spike throughout damaging perpetual funding charges.

“Perpetual swap funding rates have averaged at negative levels over the past week, while open interest has sharply increased,” K33 analysts Vetle Lunde and David Zimmerman wrote in a word. “This suggests aggressive shorting, structurally creating a setup ripe for a short squeeze.”

The sharp worth jumps will pressure merchants to shut their brief positions. The rise in brief liquidation will gas upside momentum in BTC worth. This may change the general crypto market path, growing the optimistic sentiment amongst traders.

Meanwhile, the worldwide inventory gauge rebounded to hit a document excessive whereas gold additionally set a brand new document hit. The US greenback index (DXY) and 10-year Treasury yield have hit yearly lows, triggering an uptrend in Bitcoin worth.

Analysts Turned Bullish on BTC

Spot Bitcoin ETFs recording inflows for consecutive days and restoration within the Fear and Greed Index have fueled Bitcoin rally. However, the present US political panorama amid elections continues to influence BTC and different crypto. On Tuesday, Bitcoin ETFs noticed $88 million in inflows, with BlackRock Bitcoin ETF recording $55.4 million.

Crypto analyst Rekt Capital expects BTC to enter post-halving reaccumulation phase if it closes above $60,600 this week. Bitcoin worth is presently under $60,000 psychological stage.

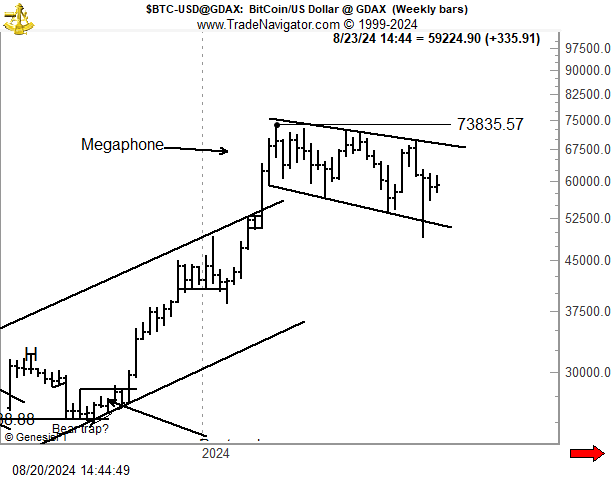

Veteran dealer Peter Brandt stated Bitcoin and Ether charts proceed to drive curiosity. BTC weekly and every day graphs proceed to kind a megaphone or broadening triangle sample. This signifies market volatility and uncertainty, however usually indicators an impending main worth motion.

Bitcoin worth may transfer in direction of its all-time excessive of 73,835, however he asserts there is no such thing as a declaration of subsequent development but. The latest $700 million BTC transfer by Mt. Gox and election dynamics proceed to influence the market development.

BTC worth is rebounding to $60,000 after falling under $59,000. The worth is presently buying and selling at $59,648. Moreover, the buying and selling quantity has declined by 8% within the final 24 hours, indicating a decline in curiosity amongst merchants. A latest BTC price analysis by CoinGape predicts when BTC may attain $70,000 once more.

Disclaimer: The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.