In a video update on YouTube, crypto analyst Rekt Capital delved into the dynamics of Bitcoin’s value actions via the lens of the PI Cycle Top Indicator, a predictive instrument that has garnered consideration for its historic accuracy in pinpointing the peaks of Bitcoin bull runs.

Here’s How High Bitcoin Price Could Go This Cycle

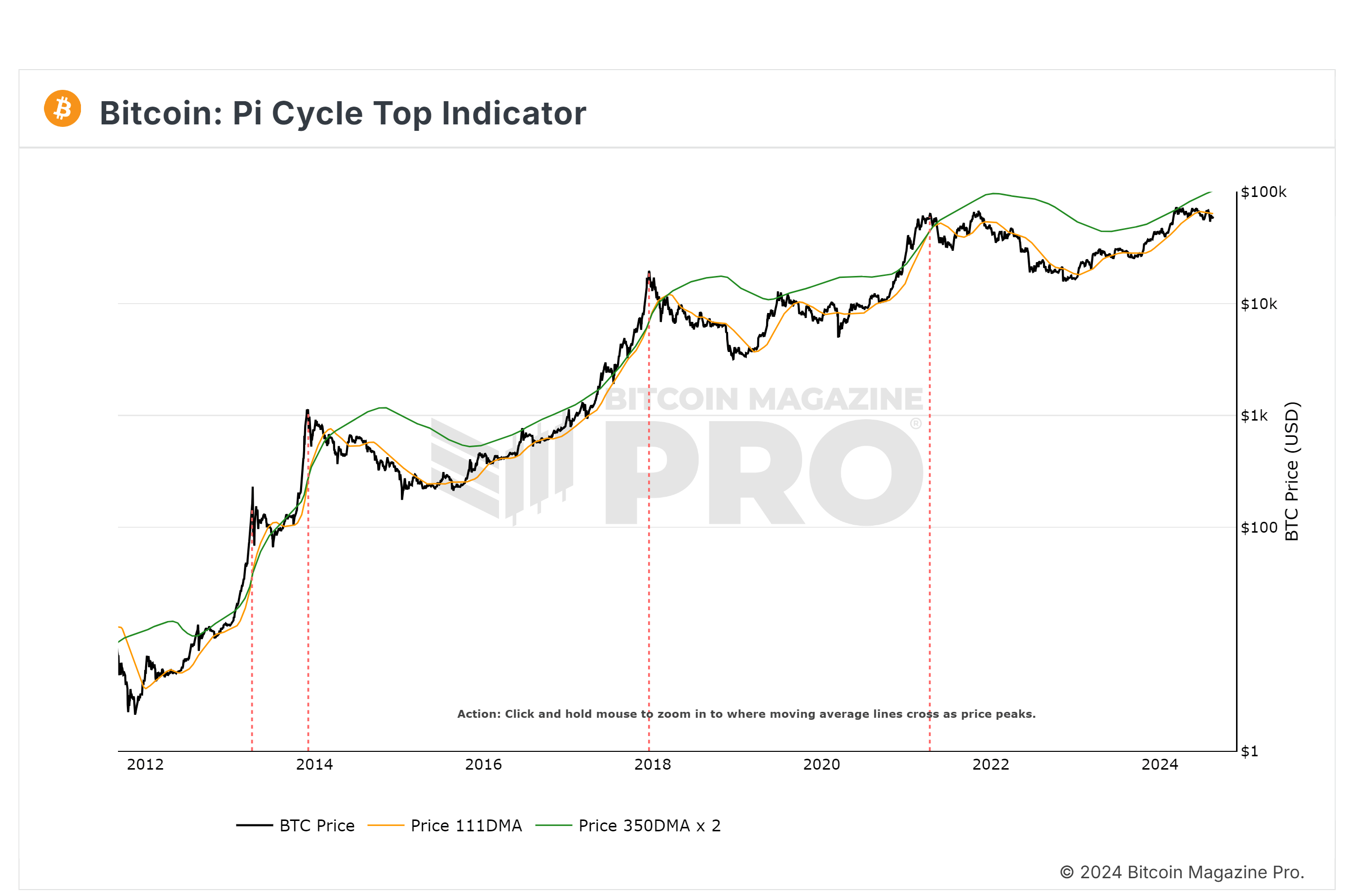

The PI Cycle Top Indicator operates by monitoring two key transferring averages: a short-term 111-day transferring common (coloured orange in Rekt Capital’s visible evaluation) and the 350 day transferring common (depicted in inexperienced) to gauge prolonged market traits. A vital side of this instrument is the “crossover” occasion the place the short-term transferring common rises above the long-term common, traditionally signaling a peak in Bitcoin’s bull market inside a number of days.

However, the present market information reveals that these two transferring averages are diverging reasonably than converging, suggesting that the situations for a bull market peak aren’t but in place. “As these two PI Cycle moving averages are currently diverging from one another, the bull market peak is nowhere close,” Rekt Capital defined in his video.

Related Reading

The 111-day transferring common serves as a important metric in Rekt Capital’s evaluation. During bear market phases or pre-halving years, this transferring common acts as a barometer for discount shopping for alternatives, oscillating round it in downtrends. Conversely, in halving years, reminiscent of 2020, it tends to behave as a assist degree, underpinning uptrends that result in new all-time highs.

“Any dip below this moving average is a bargain buying territory,” Rekt Capital famous, emphasizing the strategic significance of this degree throughout totally different market phases. Currently, Bitcoin is buying and selling under this transferring common, roughly at $59,000, which has not occurred for a big interval because the pre-halving 12 months, marking a doubtlessly undervalued state relative to historic patterns.

The evaluation means that if Bitcoin reclaims the $63,900 degree—simply above the present place of the 111-day transferring common—it might finish the present discount shopping for alternative, setting the stage for additional upward motion. “We are approximately $5,000 away from reclaiming this region. Not much needs to happen for Bitcoin to bounce back and reclaim this region to end this bargain buying opportunity,” remarked Rekt Capital.

Related Reading

Another factor of the PI Cycle Top Indicator is the 350 day transferring common. This common usually will get revisited in later phases of the market cycle, typically appearing as resistance earlier than an upside deviation happens.

“Upside deviations beyond the green moving average that’s when we see parabolic price action take place,” Rekt Capital identified, referencing previous occasions in 2013 and 2017 the place such actions have been noticed. The present inexperienced transferring common resides round $96,000, indicating a big upside potential earlier than any parabolic dangers manifest.

Rekt Capital’s evaluation means that whereas Bitcoin is way from reaching the $96,000 mark, historical patterns predict that it’s going to finally strategy and presumably exceed this degree, resulting in a short-lived interval of speedy value improve.

“[We are] nowhere close to this green moving average because it resides at around $96k, so we’re still almost $30k away from this region […] once we break beyond $96k we have to understand that the clock is starting to then start ticking really for the end of the ball run and we might have have a a window of just a few months where Bitcoin will be rallying uninterruptedly with of course pullbacks,” the analyst defined.

Looking forward, Rekt Capital emphasised the significance of monitoring the convergence of those two transferring averages for indicators of a possible bull market peak. “We need to see a flick up in the Pi Cycle moving average for that crossover to be in place to some degree,” he said, indicating {that a} sharp rise in value motion is required for a definitive crossover to materialize.

At press time, BTC traded at $58,695.

Featured picture created with DALL.E, chart from TradingView.com