Zcash (ZEC) worth continued from the place it stopped final week, reaching a brand new yearly excessive on Monday earlier than its current pullback. On the talked about date, the privacy coin hit $45.45.

This worth marks not solely ZEC’s highest stage this yr but in addition its peak since March 2023.

Zcash Plans Proof-of-Stake Move, Wants Circulating Supply Reduced

Zcash (ZEC) has surged practically 45% previously 30 days, making it one of many top-performing altcoins in early August. On July 15, ZEC traded at $28.54, nevertheless it has since skilled notable development.

According to BeInCrypto, this rise isn’t solely pushed by shopping for stress or normal market curiosity. A key issue behind the rise is concept round Zcash’s doable shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS). ZEC has historically relied on the PoW algorithm, similar to Bitcoin (BTC).

However, on August 10, Zooko Wilcox, the venture’s founder, hinted at a transition to PoS. Wilcox famous that the creation of latest ZEC by means of PoW has contributed to downward worth stress through the years, which the current uptrend is starting to reverse.

Wilcox, in a statement via Medium, opined that the transfer to PoS will ease downward stress on ZEC worth because it goals to scale back new coin creation. Explaining how PoS will positively influence the cryptocurrency’s worth, the founder shared that:

“It will allow people to stake their ZEC, thus increasing demand for ZEC. It will also reduce the supply of ZEC by locking up staked ZEC.”

Supporting the founder’s concern about elevated provide, information from Messari reveals that Zcash’s new issuance has risen to 157,000 cash as of this writing. On July 1, this determine was beneath 70,000, highlighting a pointy enhance in circulating cash.

Read extra: How to Buy Your First Zcash

It’s vital to notice that the transition to Proof-of-Stake, if applied, will solely be partial. Once accomplished, a portion of ZEC’s provide will probably be staked, lowering new issuance and probably creating upward stress on the worth.

ZEC Price Prediction: Another Peak Is Close

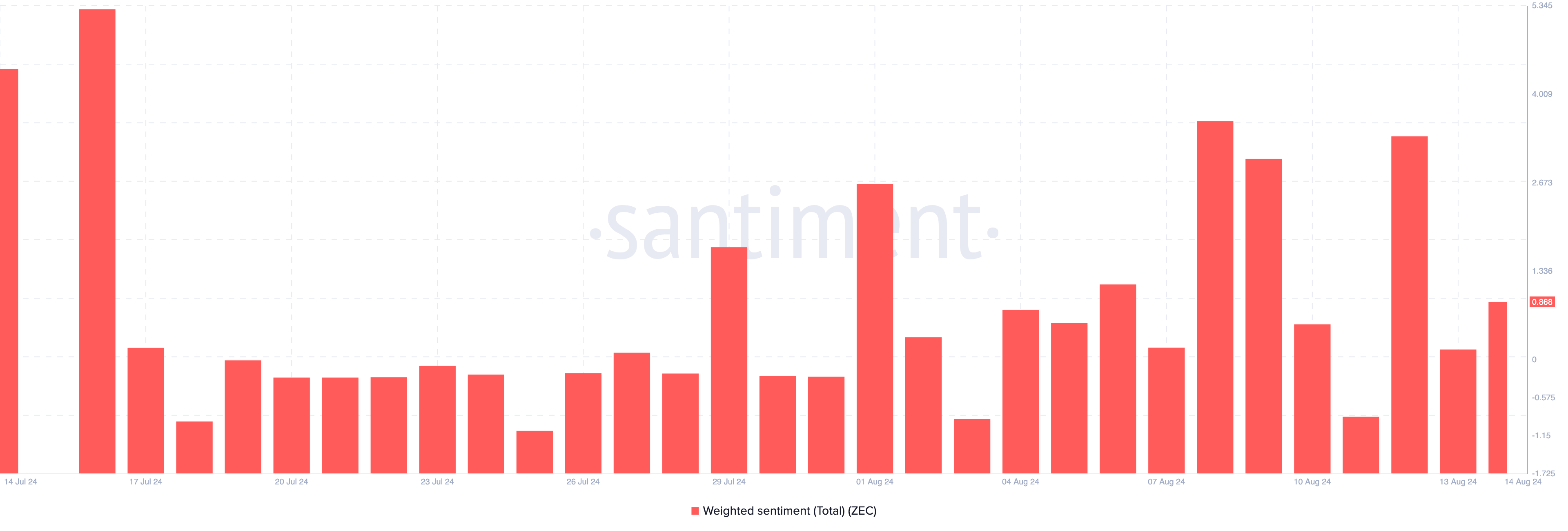

From an on-chain perspective, Santiment information present that Weighted Sentiment round ZEC has elevated. This metric makes use of social quantity to gauge the notion surrounding a venture out there.

If the Weighted Sentiment studying is optimistic, then most feedback are bullish. However, a destructive score implies that a big a part of discussions tilt toward the bearish end. For ZEC, the studying had initially dropped on August 13.

However, at press time, it has improved, suggesting that market individuals are assured in Zcash’s short-term worth efficiency. If this stays the case, demand for ZEC might enhance, as might the worth.

On the technical aspect, the day by day chart reveals that ZEC’s price has been forming Lower Highs (LH) since July. This formation signifies robust help nearly each time the worth has elevated.

In addition, the Exponential Moving Average (EMA) supplies additional perception into ZEC’s pattern. The EMA is a technical indicator used to gauge pattern route. When the shorter EMA is positioned above the longer EMA, it signifies a bullish pattern, whereas the reverse alerts a bearish pattern.

On July 14, the 20-day EMA (blue) crossed above the 50-day EMA (yellow), forming a golden cross. This sample usually confirms a bullish outlook, reinforcing ZEC’s upward momentum.

Read extra: Zcash (ZEC) Price Prediction 2024/2025/2030

The shorter EMA continues to outpace the longer one, indicating potential for additional beneficial properties. If this pattern holds, ZEC’s worth may attain $46 within the quick time period.

However, a bearish crossover may disrupt this outlook. If profit-taking intensifies, ZEC’s worth would possibly decline to round $36.74.

Disclaimer

In line with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. Always conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.