Popular analyst Michaël van de Poppe shares an inventory of altcoins that might bounce off extra strongly after the final dip. This comes as crypto markets reel from the latest correction that noticed Bitcoin (BTC) take a look at the depths of $49,000.

Portfolio rebalancing is a well-liked funding technique amongst intentional merchants, particularly during times of market volatility. To successfully handle threat, merchants ought to diversify their investments throughout promising crypto narratives, set up a transparent exit technique, and preserve a disciplined dollar-cost averaging method.

Analyst Top Altcoin Picks as Market Attempts Recovery

Van de Poppe observes how altcoins are doing after the correction. He notes that Ethereum (ETH) DeFi has been bouncing off extra strongly than Solana DeFi tokens, which reveals the potential of the respective ecosystem. He additionally observes the commendable efficiency amongst meme cash, AI, and DePIN classes.

“If we are looking at the data, then you want to be positioned at AI and DePIN, meme coins, or you want to be positioned into ETH DeFi. You want to be into the biggest bounces because those are likely going to continue with the momentum as traders are looking at the hype coins or the strongest bounces and start allocating toward those,” van de Poppe noted.

Bittensor (TAO)

An analyst has predicted a 5 to 10X potential for TAO, an AI-driven crypto coin, following its 70% rally from latest lows. This surge has caught the eye of many merchants. Michaël van de Poppe isn’t alone in his optimism; different specialists additionally foresee additional positive aspects for the Bittensor token, contemplating it a robust funding.

“If you’re aiming for a significant boost in your portfolio, TAO might be a compelling choice. Currently, the market cap stands at an impressive $2 billion, reflecting the strong performance and potential of TAO,” noted Lucky, a seasoned Bitcoin investor.

Meanwhile, TAO is a front-runner for the synthetic intelligence (AI) sector, which has shifted market sentiment from bearish to bullish. This shift is attributed to the rising world demand for AI applied sciences. The Relative Strength Index (RSI) additionally signifies that bulls preserve management, because the RSI stays above the midpoint of fifty.

Read extra: What Is Altcoin Season? A Comprehensive Guide

Aave (AAVE)

Michaël van de Poppe has additionally pointed to AAVE as a promising asset, noting important accumulation towards Bitcoin and the formation of upper highs towards the USDT stablecoin, each indicators of rising bullish momentum. He observes that AAVE has been in horizontal consolidation, with no important value drops, which he sees as a robust indicator.

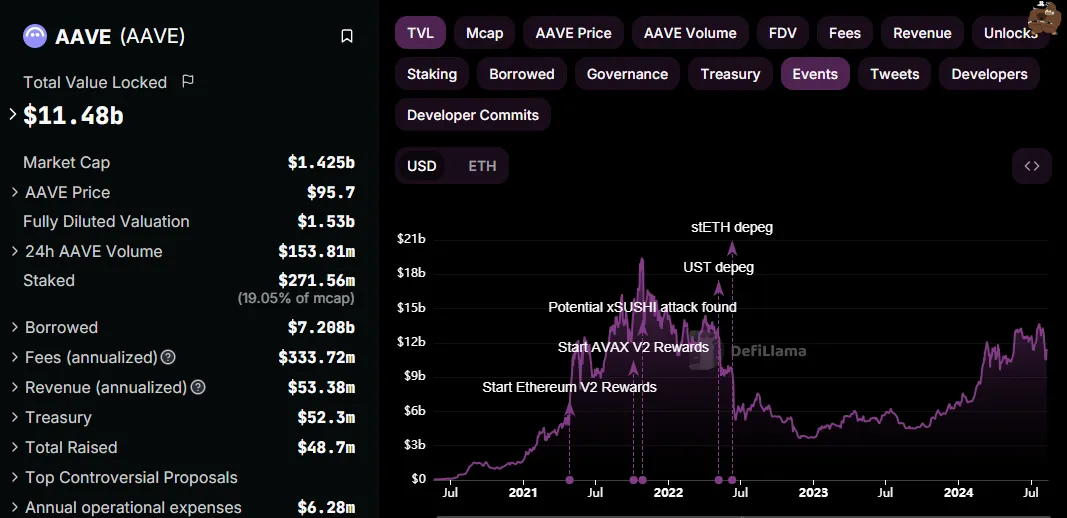

Beyond the bullish technical outlook, on-chain metrics for AAVE are additionally favorable. The Aave blockchain boasts a complete worth locked (TVL) of round $11.5 billion, towards a market capitalization of over $1.4 billion. This valuation suggests appreciable upside potential, in accordance to van de Poppe.

Notably, the Aave DAO just lately launched the first $100 million yield loan alongside key companions. The transfer, which exemplifies how tokenization and blockchain expertise can revolutionize the issuance and administration of bonds and securities, might bode effectively for the AAVE token.

Aevo (AEVO)

Michaël van de Poppe additionally highlights AEVO as a promising purchase, pointing to its predictions and choices market. From a technical perspective, he notes a bullish divergence within the Relative Strength Index (RSI), the place the RSI reveals larger lows towards the value’s decrease highs, indicating rising bullish momentum.

Van de Poppe additional identifies a falling wedge sample on AEVO’s one-day chart, which suggests a possible breakout to the upside. This sample is extensively considered a bullish reversal sign, confirmed when the value breaks above the higher development line. The revenue goal for this sample is usually calculated by including the utmost distance between the higher and decrease development traces to the breakout level.

Read extra: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

The analyst didn’t spotlight any tasks on his radar for the DePIN class. Nevertheless, experts are already looking at Lumerin (LMR), Destra Network (DSYNC), AIOZ Network (AIOZ), StorX Network (SRX), and Storj (STORJ).

Investors are actively making ready for an altcoin season regardless of skepticism that the capital rotations will happen. Notwithstanding, getting forward of issues is a safer choice than succumbing to the worry of lacking out. Nevertheless, merchants and traders should additionally conduct their personal analysis.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to present correct, well timed data. However, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.