Crypto analyst Rekt Capital has offered some type of optimism for Bitcoin buyers, suggesting that the large promote stress on the flagship crypto is sort of over. This comes amid a major surge in Bitcoin’s dominance.

Bitcoin Seller Exhaustion Is At Its Peak

In an X (previously Twitter) post, Rekt Capital talked about that “the sell-side volume has reached and even dramatically eclipsed Seller Exhaustion levels seen at previous price reversals to the upside.” The analyst added that Bitcoin hasn’t seen this stage of sell-side quantity for the reason that Halving event in April earlier this 12 months.

Related Reading

This undoubtedly presents a bullish growth for the flagship crypto since Bitcoin is certain to witness a large reversal with the promote stress nearly over. This is already taking place, as Bitcoin has rebounded within the final 24 hours, following its drop below $50,000 for the primary time since January.

Rekt Capital additionally suggested that Bitcoin may rebound to as excessive as $62,550 within the brief time period because it appears to be like to fill the CME gap, which is presently between $59,400 and $62,550. He famous that the chances favor Bitcoin filling this hole for the reason that crypto token has stuffed the entire CME Gaps it has created over the previous a number of months.

Crypto analyst Skew additionally commented on the large sell-side quantity that Bitcoin not too long ago skilled. He defined that this occurred as a result of Bitcoin failed to carry above $70,000 following its July worth rebound. The analyst added that there’s “no actual chaos yet,” suggesting there was no should be nervous in regards to the latest worth correction.

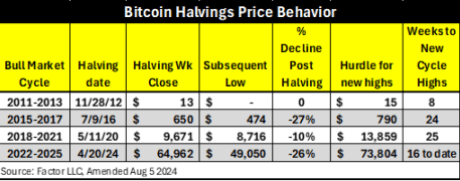

With vendor exhaustion at its peak, there’s additionally the chance that Bitcoin has discovered a backside and that this might be the ultimate correction earlier than the bull run kicks into full gear. Veteran dealer and analyst Peter Brandt famous that Bitcoin’s decline for the reason that halving means it has now achieved a worth drop just like the one throughout the 2015 to 2017 Halving bull market cycle.

BTC’s Dominance Hits 3-Year High

Amid the market turmoil, data from Coinglass reveals that Bitcoin’s dominance not too long ago hit its highest stage since April 2021. This rise has been largely as a result of Spot Bitcoin ETFs, which have prompted new cash to move into the Bitcoin ecosystem. Meanwhile, altcoins have needed to battle for capital from present retail buyers who proceed to divest their money between a number of crypto property.

Related Reading

Crypto analysts like Roman have advised that Bitcoin’s dominance will possible proceed to rise for now, as he predicted that the flagship crypto will proceed to suck up all of the liquidity till later this 12 months. He expects Ethereum and other altcoins to proceed buying and selling sideways throughout this era.

At the time of writing, Bitcoin is buying and selling at round $56,000, up over 10% within the final 24 hours, in keeping with data from CoinMarketCap.

Featured picture from Cointribune, chart from Tradingview.com