Crypto billionaire Arthur Hayes surprises the crypto market along with his one more daring prediction {that a} second wave will comply with quickly after the latest crypto market crash. He believes the present respite is simply non permanent and market volatility will proceed to persist in shares and crypto markets.

BitMEX Co-Founder Arthur Hayes Predicts Another Market Crash

Global fairness and crypto markets present indicators of restoration right now. Japan’s Nikkei rebounds 10% after shedding 12% in earlier periods. The world crypto market and US inventory market index futures are additionally rising larger.

However, BitMEX co-founder Arthur Hayes mentioned “That was the first wave,” warning a few cautious outlook regardless of indicators of restoration.

He asserts that the primary wave of influence on the markets has handed, and now the issue of over-leveraged traders within the conventional markets will floor. It will result in a second wave of correction in broader markets.

However, if the US Federal Reserve decides to bailout, the market might have to undergo extra ache by Friday. Moreover, Arthur Hayes provides that the present respite is simply non permanent, and market volatility will proceed amid tensions within the Middle East.

Also Read: MicroStrategy’s Michael Saylor Says HODL Bitcoin Despite Sub $50K Crash

Cathie Wood Reflects on Market Situation

ARK Invest CEO Cathie Wood shared that the VIX (Equity Volatility Index) elevated to 65, the fourth-highest stage up to now 40 years. She compares it to Black Monday in October 1987, Lehman shock in 2008, and COVID market crash in 2020. Investors counting on the carry commerce with Japan money out on the similar time.

“The US statistics like employment and the PMI have disappointed expectations and, at the same time, the Bank of Japan has raised interest rates more than expected, investors and speculators have faced margin calls forcing them to unwind the yen carry trade,” mentioned Wood.

She mentioned the 10-year Treasury bond yield ought to be round 2% right now, not the place it’s at 3.8% or final October’s 5%, as per metals to gold ratio. The US greenback index (DXY) has dropped beneath 103, which really promotes shopping for Bitcoin. However, uncertainty nonetheless exists within the markets turning traders cautious.

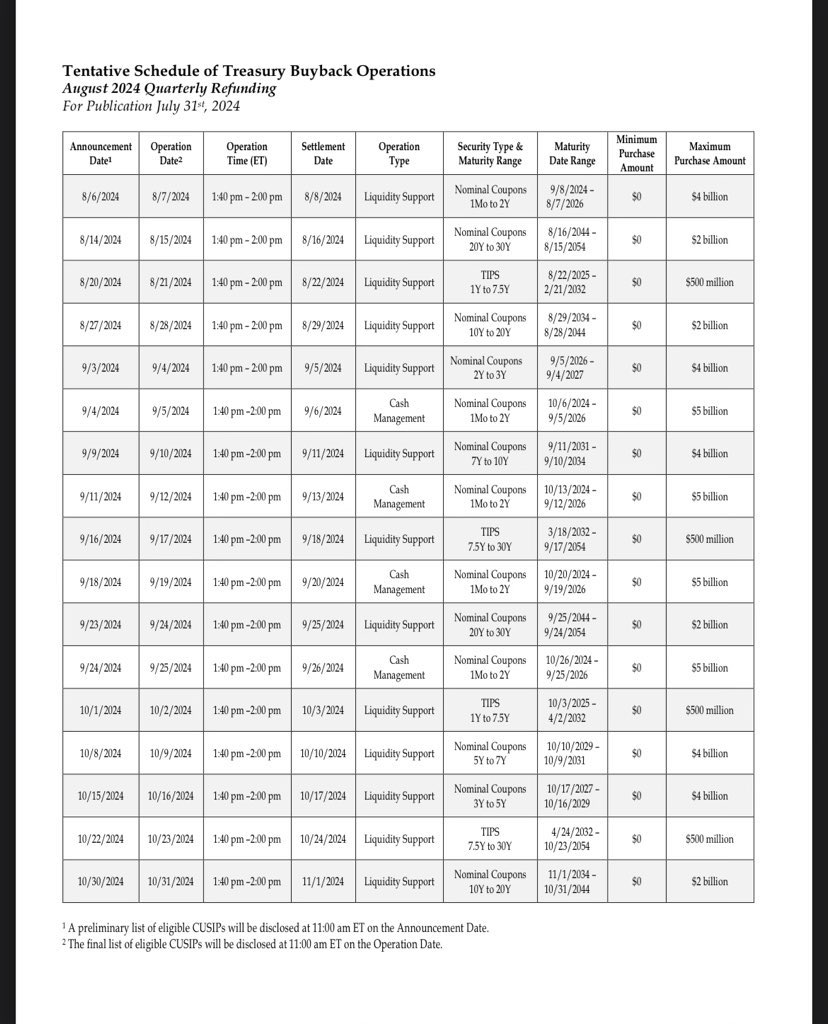

Meanwhile, the U.S. Treasury Dept. is to begin Treasury buyback once more with $30 billion a month. It may additionally assist the crypto market to rebound additional.

BTC value have rebounded above $55,800, however a BTC price analysis suggests the Bitcoin crash to proceed. If the $50,000 psychological stage is breached once more, possibilities of revisiting the $45,156 key weekly assist stage are excessive.

Also Read: JPMorgan Cites Buy-the-Dip Opportunity, Crypto Market Recovery Ahead?

Disclaimer: The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.