The BNB Smart Chain (BSC) skilled a blended efficiency within the second quarter (Q2) of the 12 months because the broader cryptocurrency market cooled off after a powerful worth surge in March. While BNB, the native token of the BSC, remained principally flat, down 5% quarter-over-quarter (QoQ), the community’s key metrics confirmed each optimistic and adverse tendencies.

Binance Smart Chain Revenue Plunges

According to a current report by market intelligence platform Messari, the chain’s income, which measures the entire charges collected by the community, fell 28% QoQ to $48.1 million throughout Q2, though it was solely down 8% year-over-year from $52.4 million in Q2 2023.

According to the report, this decline was largely pushed by the lower in BNB’s worth, as income within the community’s native token phrases declined 51% sequentially from 165,100 BNB to 81,300 BNB.

Related Reading

The report additionally highlighted a decline in community exercise, with common daily transactions lowering 10% QoQ to three.7 million and common each day energetic addresses dropping 18% QoQ to 1.1 million. This development was not remoted to the BSC, as on-chain exercise decreased throughout most sensible contract platforms in Q2 following a powerful Q1.

Despite the general decline, the report famous notable shifts in person preferences throughout the BSC ecosystem as decentralized trade (DEX) Uniswap skilled a major improve in each day transactions, up 630% QoQ, whereas the beforehand dominant PancakeSwap noticed a 46% QoQ lower.

Staking Surges 30%, TVL Drops

Messari additionally highlighted that the entire BNB staked elevated 30% QoQ to 30.4 million BNB, with the entire greenback worth of staked funds rising 24% to $17.7 billion. This ranks the Binance Smart Chain because the third-highest Proof-of-Stake (PoS) community by staked worth, although it nonetheless lags behind the Solana blockchain by a major $38.4 billion.

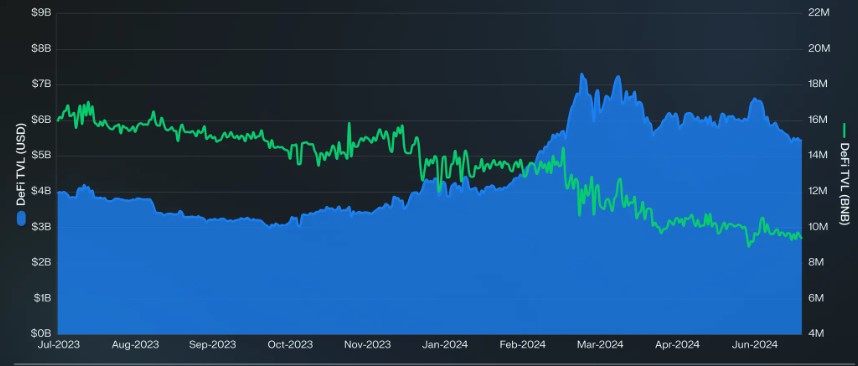

The BSC’s decentralized finance (DeFi) ecosystem, nevertheless, noticed a lower in whole worth locked (TVL), down 24% QoQ to $5.5 billion, primarily pushed by a 41% QoQ drop in borrowing on the DeFi protocol, Venus Finance.

The firm notes that this means that the general lower in value locked was partially because of the drop in worth of the BNB token, which closed the quarter at a low of $567 after reaching an all-time excessive of $722 in March.

Despite these fluctuations, Messari reported that the Binance Smart Chain maintained the third-highest decentralized trade (DEX) buying and selling quantity through the second quarter of the 12 months, with $66 billion in whole quantity, trailing solely Ethereum (ETH) and Solana.

BNB Price Analysis

At the time of writing, the BNB token was buying and selling at $586, up over 2% within the final 24 hours. However, buying and selling quantity within the final 24 hours was down 3% to $830 million, in line with CoinGeko data.

Since Friday, the token has been consolidating between $570 and the present buying and selling worth, following the lead of the most important cryptocurrencies available on the market, after a failed try on Monday to interrupt by means of its nearest resistance wall at $590, which is the final impediment stopping a transfer upwards to the $600 milestone.

Related Reading

Conversely, the important thing degree to look at for BNB bulls is the 200-day exponential transferring common (EMA) famous on the each day BNB/USDT chart under, with the yellow line slightly below the present worth, which may act as a key assist for the token, probably stopping additional declines.

Featured picture from DALL-E, chart from TradingView.com