During the business day of the annual Bitcoin convention in Nashville, Tennessee, Robert Kennedy Jr., an impartial candidate for the US presidency, unveiled an formidable monetary coverage plan that might rework the United States into the world’s largest holder of Bitcoin. The coverage facilities on the strategic acquisition of Bitcoin, valued at $619 billion, to match the present US gold reserves. This transfer, in line with Kennedy Jr., is aimed toward redefining financial coverage and enhancing fiscal self-discipline inside the federal authorities.

Kennedy Jr. Vs. Donald Trump

During a roundtable discussion with Scott Melker and Caitlyn Long, CEO of Custodia Bank, Kennedy Jr. emphasised the philosophical alignment between his insurance policies and the Bitcoin group’s beliefs of private freedom, property rights, and governmental integrity. “This is more than about increasing the size of your pile,” Kennedy Jr. stated, underlining Bitcoin’s potential to reinforce self-sovereignty and counteract what he describes as a “destructive war economy” pushed by fiat forex.

“Bitcoin is not only an offramp to this inflationary highway which is the highway to hell, but it also is a way of restoring integrity to our government. It’s a way of restoring personal freedoms, it’s a way the middle class can isolate itself from inflation which is just a form of government theft,” the impartial candidate said.

Related Reading

Kennedy Jr. drew a distinction between his constant advocacy for Bitcoin and the recent supportive gestures from former President Donald Trump, who will communicate on the convention on Saturday. Kennedy identified Trump’s prior skepticism and his current controversial resolution to doubtlessly appoint JPMorgan CEO Jamie Dimon as Treasury Secretary, which Kennedy criticized as opposite to the ethos of draining the political “swamp.”

He added, “President Trump also was connected with Steve Mnuchin who tried to end person-to-person Bitcoin transactions,” emphasizing the necessity for a cautious strategy in direction of Trump’s newfound enthusiasm for Bitcoin.

Moreover, Kennedy Jr. detailed his plan to incrementally combine Bitcoin into the US treasury. Starting with the issuance of treasury payments anchored to a basket of laborious currencies—together with platinum and gold—Kennedy proposed a phased strategy that will start with 1% of recent treasury issuances backed by these laborious belongings, scaling as much as 100% over time.

US Would Need To Buy $619 Billion In Bitcoin

“I would be willing to add Bitcoin to the balance sheet. I’m going to do that. I’m gonna actually do a basket of hard currencies of maybe platinum and gold and other hard currencies and begin issuing at least the class of treasury bills that are anchored to hard currency. Let’s say the first year by 1% and then maybe the next year by 2% to watch how that goes because that will inject discipline into the product and ultimately get up to 100%,” Kennedy Jr. defined.

Related Reading

Notably, his technique would contain direct purchases of Bitcoin to attain holdings equal to the US gold reserves. “I would like to have the federal government begin to buy Bitcoin and over the term my term of office ultimately have an equivalent amount of Bitcoin that we have gold. Because Bitcoin is an honest currency, it’s a currency that’s based upon proof of work,” he declared.

According to data by Arkham, the US authorities at present holds 213,239 BTC value $14.3 billion confiscated by means of regulation enforcement. That means, even when Kennedy would switch all of those right into a strategic reserve, the US would want to purchase far more BTC at present costs.

The US at present holds the most important official gold reserves on this planet, with 8,134 tons of gold valued at roughly $619 billion. To match this worth with Bitcoin at present costs would require buying about 9.4 million BTC. This acquisition would signify almost 45% of the whole 21 million BTC that may ever be mined.

For perspective, MicroStrategy, the most important company holder of Bitcoin, owns 226,331 BTC, and BlackRock, the most important spot Bitcoin ETF supervisor, controls 334,000 BTC.

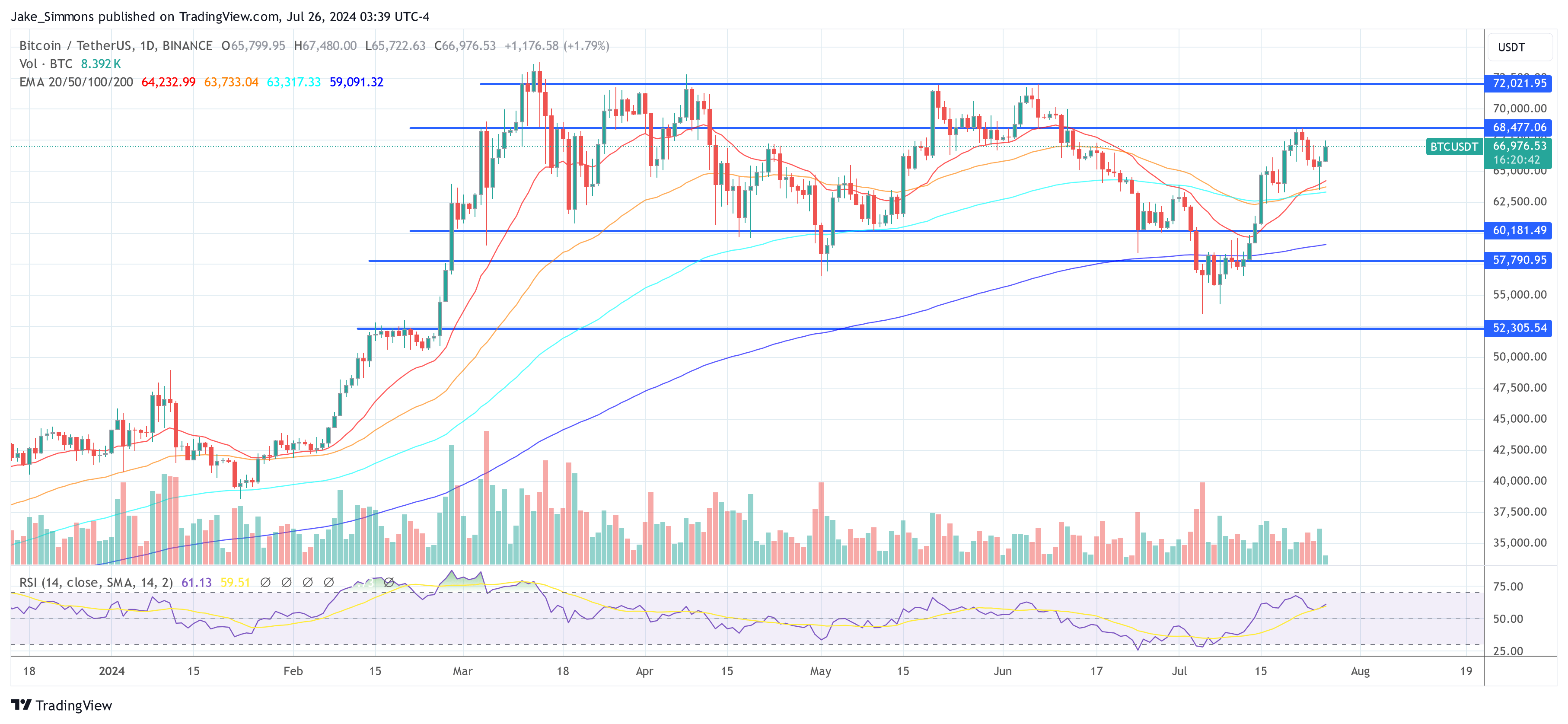

At press time, BTC traded at $66,976.

Featured picture from YouTube, chart from TradingView.com