Asia’s main asset administration agency CSOP Asset Management CEO Ding Chen believes Bitcoin worth can hit $100K very quickly, agreeing with merchants who suppose Donald Trump-fueled BTC worth rally will likely be far bigger. Meanwhile, Trump is to provide a speech on the Bitcoin Conference this week, with rumors of a groundbreaking announcement similar to BTC strategic reserve.

CSOP Predicts Bitcoin To $100K Likely Under Donald Trump

Ding Chen, CEO of CSOP Asset Management Ltd, within the newest Tiger Money podcast of Bloomberg Intelligence, talked about launching the Asia-Pacific area’s first inverse crypto exchange-traded fund (ETF). She additionally mentioned the burgeoning crypto ETFs market, Bitcoin and crypto market, and Asia’s outsized returns.

CSOP Asset Management lately introduced Asia’s first inverse Bitcoin ETF in Hong Kong, permitting buyers to revenue from Bitcoin worth fall. She mentioned the main purpose behind launching CSOP Bitcoin Future Daily (-1x) Inverse Product was the dearth of choices for shoppers to take unfavourable positions or quick Bitcoin.

She agrees with merchants anticipating BTC worth to rally in the direction of $100K sooner amid Donald Trump’s pro-crypto technique. Donald Trump may also attend the Bitcoin 2024 Conference in Nashville, Tennessee on July 25-27. Moreover, pro-Bitcoin JD Vance’s choice as vp by Trump additionally triggered constructive sentiment within the crypto market.

Also Read: Mt Gox Transfers Over $3 Billion In Bitcoin, BTC Liquidations Mount

BTC Price Recovery Path To $100K

Spot Ethereum ETF launch turned out to be much less efficient in bringing a rally in BTC worth and the crypto market. Bitcoin ETFs noticed first outflow of $78 million after 12 consecutive inflows. Still, BlackRock noticed $72 million in inflows, indicating curiosity amongst institutional buyers.

Blackrock’s iShares Bitcoin Trust has garnered $19.0 billion in inflows year-to-date, making it the fourth most profitable ETF this 12 months. With inflows proceed to rise, Bitcoin is outperforming all different asset lessons with greater than 57% year-to-date acquire, reported 10x Research.

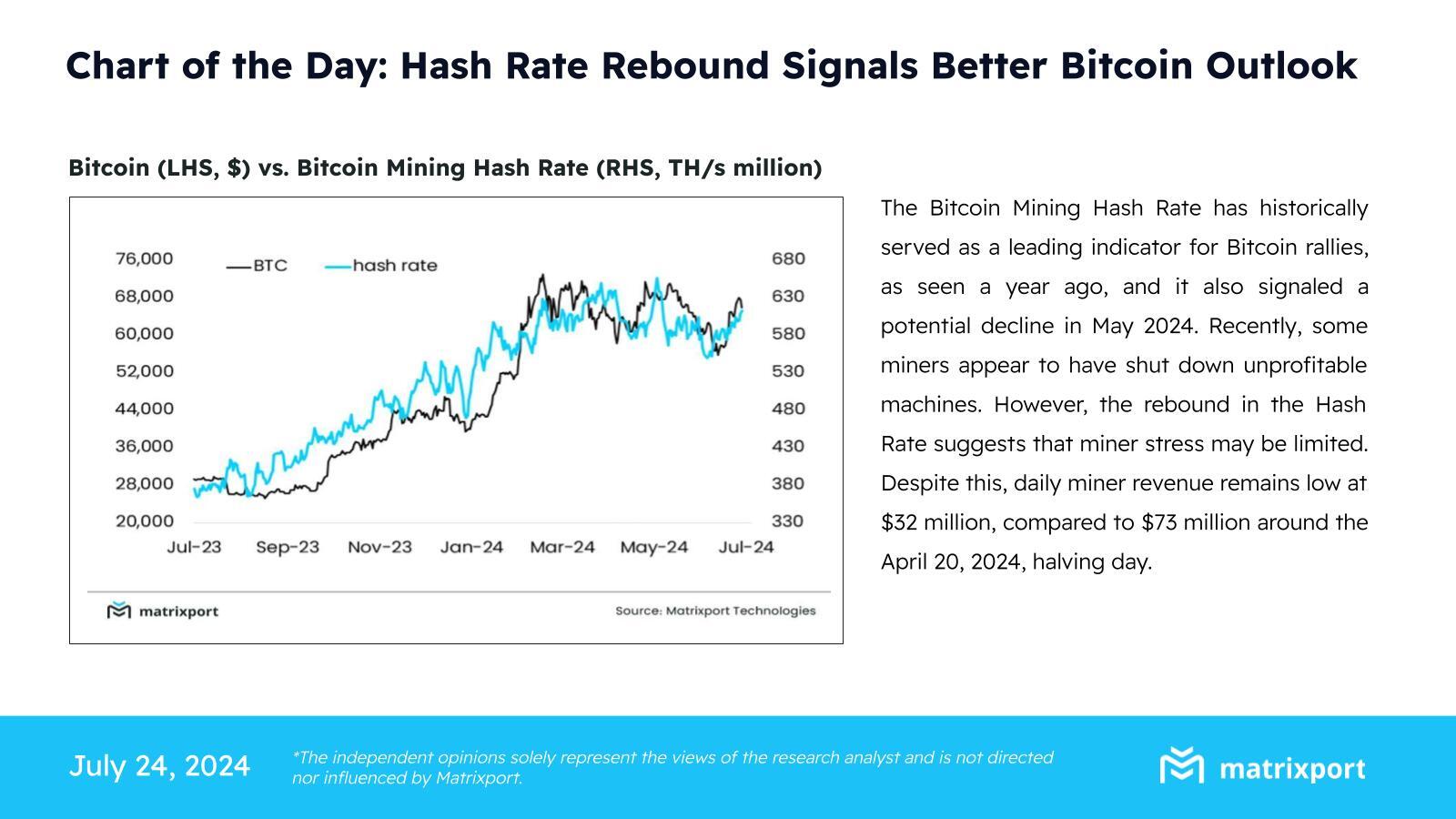

Matrixport asserts Bitcoin hash price rebound are sign of a greater outlook. It has traditionally been a number one indicator for BTC rallies, together with the decline in May. BTC miners are additionally steadily increasing to AI after Bitcoin halving as miner income has dropped considerably.

BTC price fell 0.50% up to now 24 hours, with the value at the moment buying and selling at $66,375. The 24-hour high and low are $65,484 and $67,359, respectively. The buying and selling quantity has decreased by 31% within the final 24 hours, indicating a decline in curiosity amongst merchants on account of uncertainty out there. Moreover, the futures and choices buying and selling have are additionally low within the final 24 hours.

Also Read: XRP Lawyer John Deaton Slams Sen Warren’s Bill To Overturn Chevron Ruling

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.