Here’s what the information associated to the Ethereum futures market suggests relating to whether or not the sentiment round ETH is trying bearish or bullish.

Ethereum Taker Buy Sell Ratio Has Observed A Strong Surge Recently

In a brand new CryptoQuant Quicktake post, an analyst has talked concerning the outlook of Ethereum based mostly on futures market information. The focus indicator right here is the “Taker Buy Sell Ratio,” which retains observe of the ETH taker purchase and taker promote volumes on the derivatives platforms.

When the worth of this metric is bigger than 1, it means the taker’s purchase or lengthy quantity outweighs the taker’s promote or brief quantity and thus, a majority bullish sentiment is current out there.

On the opposite hand, the indicator being below the mark implies the dominance of a bearish mentality amongst future customers as extra sellers are keen to promote at a lower cost.

Now, here’s a chart that exhibits the development within the 14-day easy transferring common (SMA) Ethereum Taker Buy Sell Ratio over the previous couple of months:

The 14-day SMA worth of the metric seems to have been sharply going up in current days | Source: CryptoQuant

As is seen within the above graph, the 14-day SMA Ethereum Taker Buy Sell Ratio has noticed a speedy improve just lately, implying that the stability out there has been shifting.

Alongside this spike within the indicator, the asset’s worth has additionally seen a surge. The chart exhibits {that a} comparable development within the metric was additionally noticed within the lead-up to the worth rally within the first quarter of the yr.

Based on the current development, the quant feedback:

This surge signifies robust shopping for curiosity within the perpetual market, suggesting a notable bullish sentiment. If this upward development within the Taker Buy/Sell Ratio continues, it confirms a possible mid-term bullish development out there, with the worth doubtless rallying towards larger values.

It stays to be seen if the 14-day SMA Taker Buy Sell Ratio will proceed its surge within the coming days, thus confirming this attainable bullish setup for the cryptocurrency.

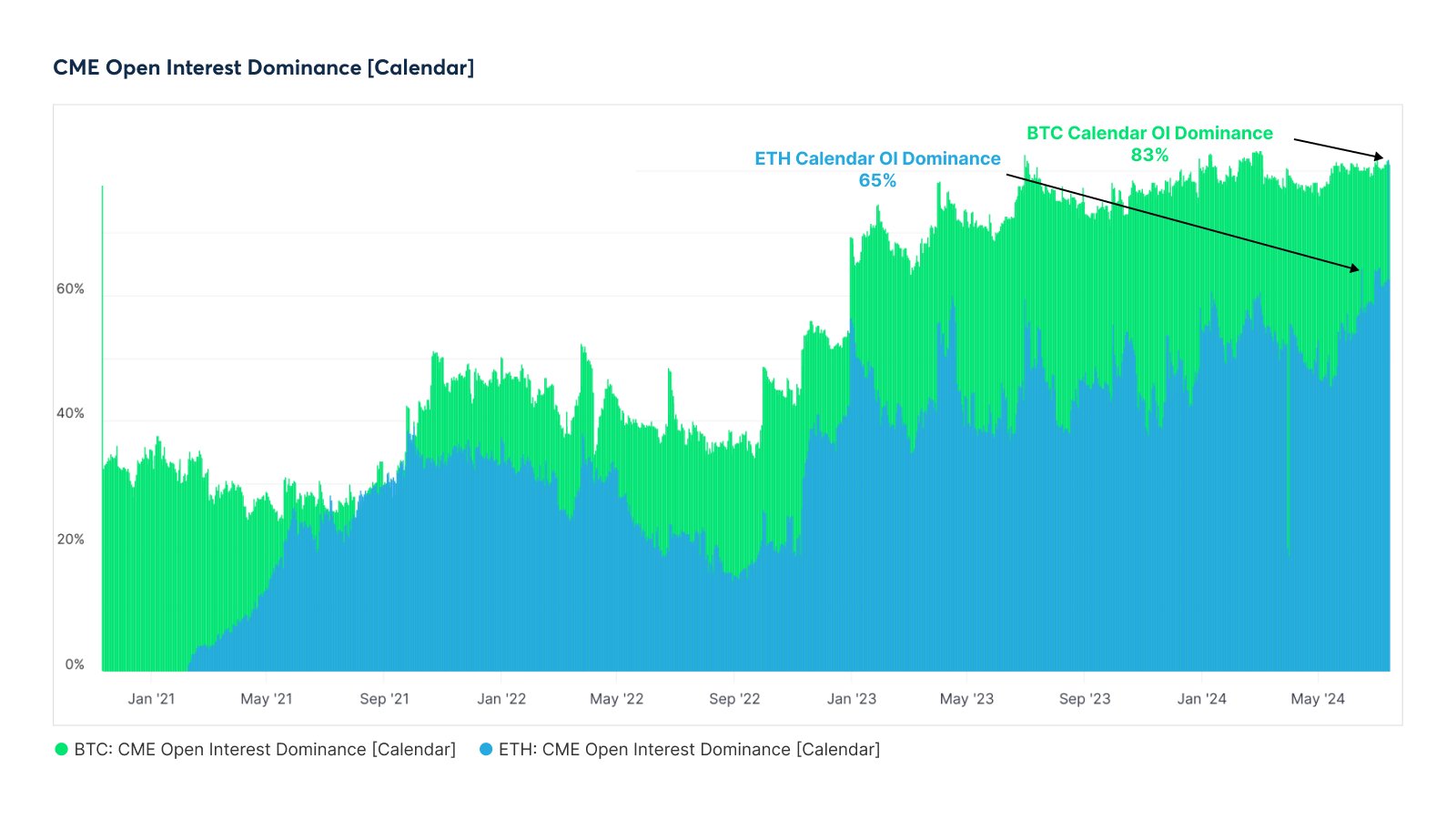

Speaking of the futures market, the CME Group has just lately seen its dominance develop within the calendar futures marketplace for Ethereum and Bitcoin, because the analytics agency Glassnode identified in an X post.

The development within the Open Interest dominance of the CME group within the BTC and ETH calendar futures market | Source: Glassnode on X

The above chart shows the information for the Open Interest dominance of the CME Group. The Open Interest refers back to the variety of contracts at present open on the calendar futures market.

It would seem that the CME Group now occupies 83% and 65% of the Bitcoin and Ethereum calendar Open Interests, respectively.

ETH Price

Ethereum’s restoration has stalled throughout the previous couple of days because the asset’s worth nonetheless trades across the $3,400 mark.

Looks like the worth of the coin has been transferring sideways since its surge | Source: ETHUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com Glassnode.com, chart from TradingView.com