Bitcoin worth has been on the traders’ radar currently, with BTC simply topping the $65,000 mark. Notably, the strong rally over the previous few days has sparked discussions within the crypto group if the rally can be sustained or can be short-lived.

Meanwhile, a flurry of short-term considerations has additional fueled speculations over the longevity of the rally. Despite that, the market pundits stay optimistic over the continuation of this bullish sentiment.

Why Bitcoin Price Is Poised For A Rally?

The questions on whether or not the rally is to be short-lived or to proceed ahead stems from the latest short-term challenges. For context, the latest Mt. Gox reimbursement considerations have additional fueled discussions over a pull-back within the costs.

However, the latest market tendencies and optimistic feedback from business specialists have raised bets over the continuation of the rally. Here we discover among the potential causes that would additional bolster the rally.

Fed’s Interest Rate Cut To Fuel Crypto Market Rally

A latest report from CNBC highlighted the potential Fed fee lower as quickly as in September. Citing the CME FedWatch Tool prediction of 93.3% odds over a 25 foundation fee lower has fueled optimism available in the market.

Notably, this comes after the newest U.S. CPI knowledge, a favourite metric of the central financial institution to gauge inflation, reveals a cooling determine. In addition, the latest feedback from Fed Chair Jerome Powell additionally raised bets over a dovish stance within the coverage fee plans.

Jerome Powell on Monday gave some aid to the traders saying that the central financial institution wouldn’t anticipate the inflation to come back down the two% goal vary to begin trimming charges. Besides, he additionally expressed “greater confidence” that the inflation will come right down to the two% vary, given the latest set of information.

Also Read: Samson Mow Predicts Immediate Bitcoin Cash (BCH) Sale From Mt.Gox

Bitcoin ETF Hitting New Milestone

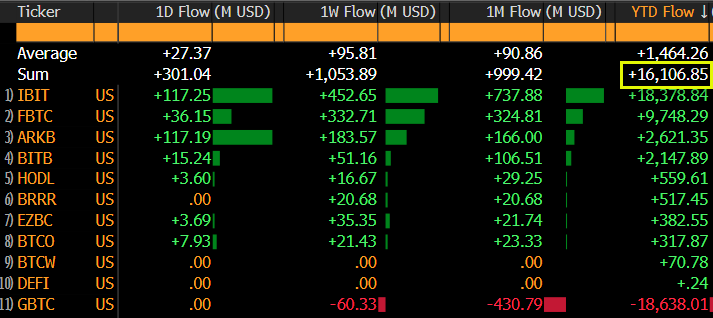

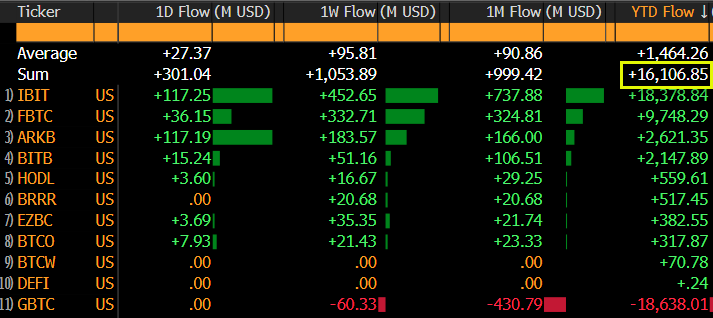

The strong influx into the U.S. Spot Bitcoin ETF has bolstered market confidence lately. It displays the rising institutional curiosity within the flagship crypto, additional cementing bets over the rally to proceed.

Senior Bloomberg analyst Eric Balchunas highlighted the strong inflow in a latest X publish. According to Balchunas, Bitcoin ETF has taken “two steps forward” after one step again in June, citing yesterday’s inflow of $300 million and weekly influx of over $1 billion.

In addition, he additionally highlighted the YTD inflow already crossing $16 billion for the primary time with latest influxes. Notably, the analysts have predicted an influx of simply $12 billion to $15 billion for the primary 12 months, which the funding instrument has already surpassed.

Mt. Gox Repayment Doesn’t Imply A Selloff

Bitcoin bulls can breathe a sigh of aid. Fears surrounding a possible selloff because of Mt. Gox repaying collectors in BTC have been downplayed by CryptoQuant CEO Ki Yong Ju. Ju assures traders that the outflow at present noticed isn’t retail dumping, however moderately Mt. Gox making ready for payouts.

Unlike the pressured sale by the German authorities, Mt. Gox collectors have the liberty to carry or promote their recovered BTC, he affirmed. Besides, analyst Alex Kruger even estimates a most 10% worth dip within the worst-case state of affairs of a direct sell-off.

Furthermore, Ju believes these long-held cash will possible react equally to present BTC available in the market, doubtlessly dampening any vital worth drops. This information provides to the optimistic sentiment surrounding the BTC worth rally.

Will The BTC Rally Continue?

The crypto market is buzzing with anticipation, as evidenced by the latest performances of digital property. In addition, the speculations over U.S. Spot Ethereum ETF buying and selling to begin on July 23 have additional fueled sentiment. Besides, this might additionally increase the altcoin market.

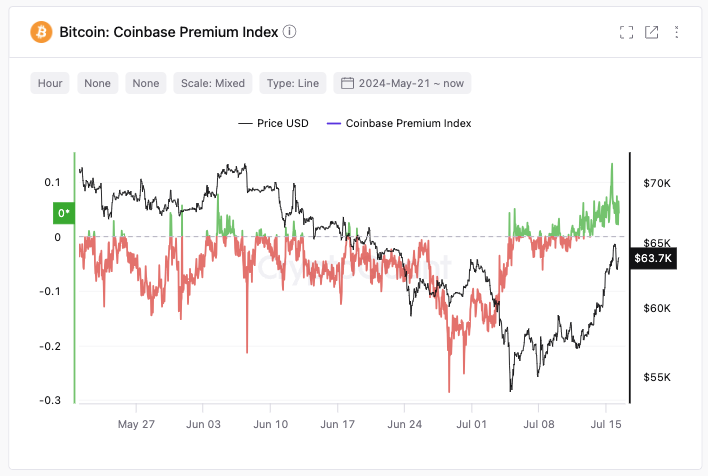

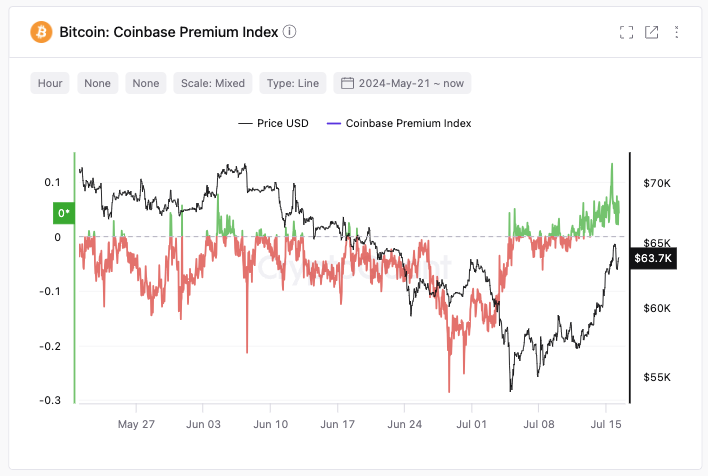

In addition, a flurry of on-chain knowledge signifies BTC worth rally is to proceed. For occasion, Ki Young Ju has lately highlighted that the Bitcoin Coinbase Premium Gap has hit a 3-month excessive, indicating a shift within the crypto market sentiment.

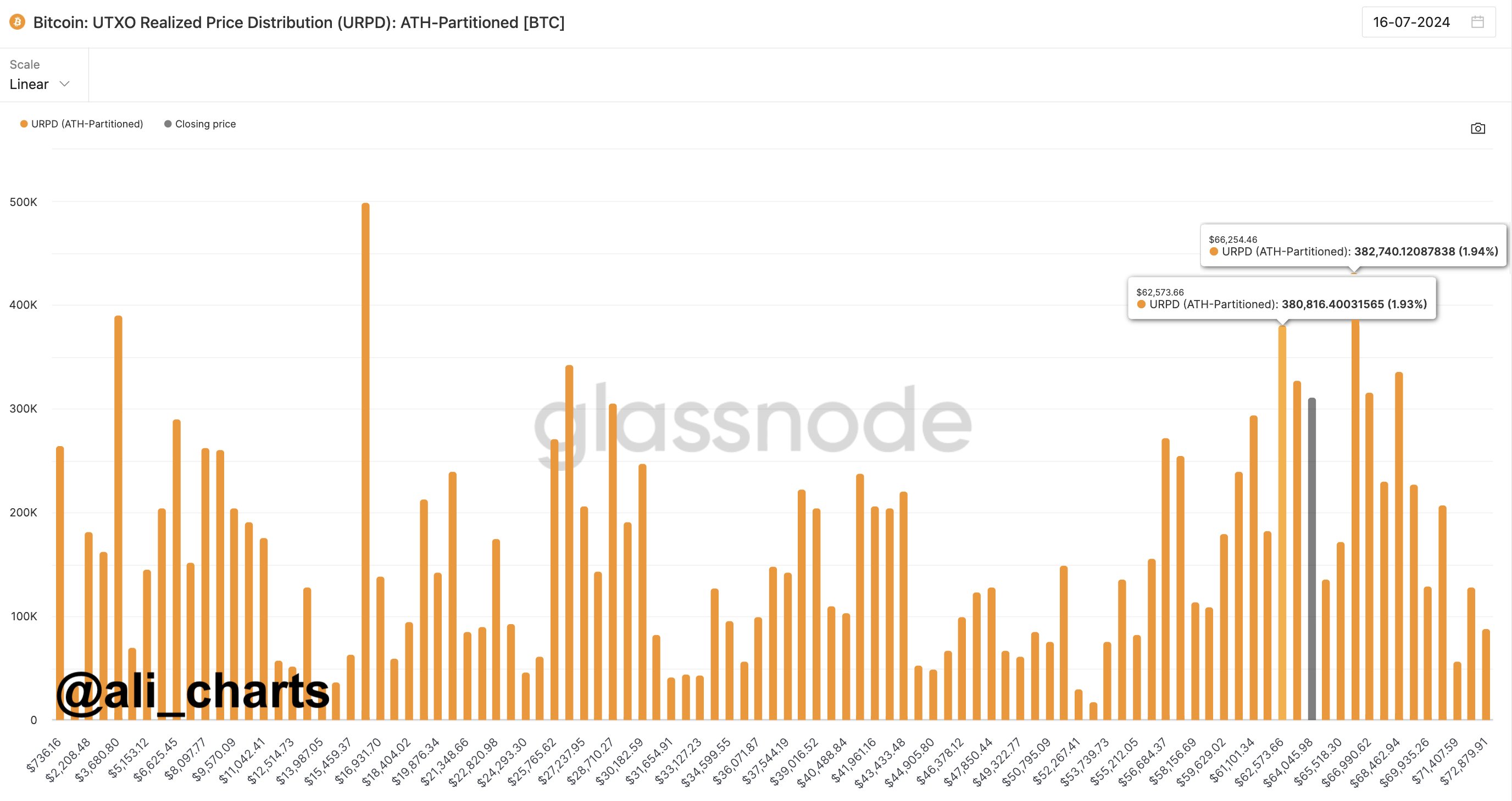

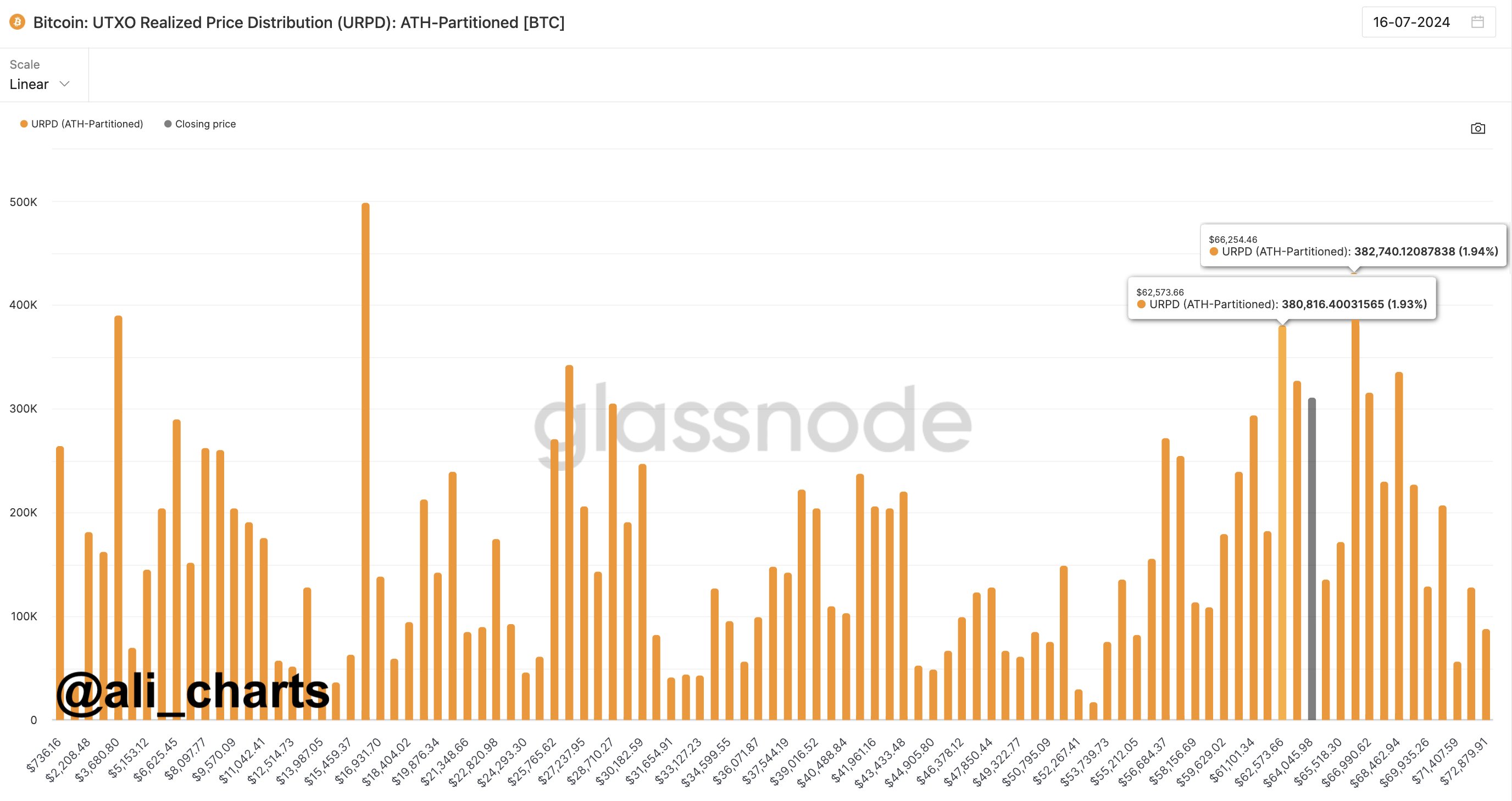

On the opposite hand, famend crypto market knowledgeable Ali Martinez stated that if BTC can keep above the $62,500 mark, the subsequent goal stage can be $66,250. Furthermore, he additionally emphasised the $66k mark to propel one other rally to a brand new ATH for BTC.

As of writing, Bitcoin price erased a few of its main beneficial properties and traded close to the $64,500 mark, after crossing the transient $65K mark lately. However, BTC Futures Open Interest (OI) was up practically 3%, in accordance with CoinGlass knowledge, indicating the market confidence within the crypto.

Also Read: SEC’s Hester Pierce Breaks Silence On Replacing Gary Gensler

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.