The winds of change are blowing within the Bitcoin market, bringing a contemporary wave of short-term merchants whereas veteran holders stay steadfast of their convictions.

A latest report by Bitfinex Alpha reveals an interesting dichotomy in investor conduct, with new gamers chasing fast earnings and seasoned hodlers (maintain on for pricey life) accumulating for the lengthy haul.

Related Reading

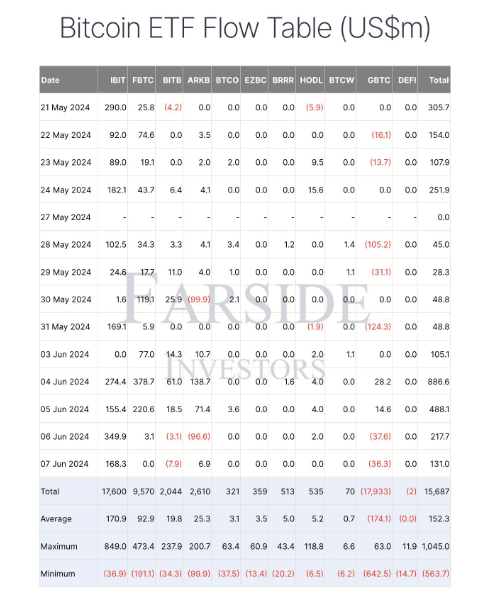

Short-Term Surge Fueled By ETF Frenzy

Spot Bitcoin ETFs, monetary devices that mirror Bitcoin’s worth, have emerged as a game-changer. These simply accessible choices are attracting a brand new breed of investor, one with a eager eye for short-term features.

This inflow is clear within the important rise of short-term holders (these holding Bitcoin for lower than 155 days). Their holdings have skyrocketed by almost 55% since January, indicating a surge in speculative exercise.

It appears to be like like we nonetheless have overhang from final cycle.

Short time period holders realized worth is steadily rising as new gamers enter the market and Buy #Bitcoin. Hedge funds, Pension Funds, Banks and many others.

But the value isn’t taking off as a result of older cash are being distributed.

We… pic.twitter.com/VxaXozgANT

— Thomas | heyapollo.com (@thomas_fahrer) June 12, 2024

However, this newfound enthusiasm comes with a caveat. Short-term traders, by their very nature, are typically extra reactive to cost fluctuations. A sudden market correction may set off a sell-off, inflicting worth volatility. The report highlights this vulnerability, emphasizing the necessity for warning amidst the present “greed” sentiment available in the market (as measured by the Fear & Greed Index).

Long-Term Holders: Diamonds In The Rough

While the short-term scene buzzes with exercise, long-term holders proceed to show unwavering religion in Bitcoin’s potential. These digital veterans, who weathered earlier market cycles, have proven a outstanding shopping for spree after initially offloading some holdings at Bitcoin’s all-time high in March.

The report additional underscores this bullish sentiment by stating the minimal quantity of Bitcoin held by long-term traders that was bought above the present worth level. This signifies a “hodling” mentality, the place traders are assured that the present worth represents entry level for future features.

Additionally, Bitcoin whales (massive traders holding important quantities) are mirroring their pre-2020 bull run conduct by aggressively accumulating Bitcoin, indicating a possible repeat of the earlier market upswing.

Navigating The Crosscurrents

The present Bitcoin market presents a novel scenario. On one hand, the inflow of short-term traders injects contemporary power and liquidity. However, their presence additionally introduces the chance of elevated volatility. On the opposite hand, long-term holders proceed to be the bedrock of the market, offering stability and confidence.

Related Reading

Bitcoin Price Forecast

The Bitfinex Alpha report coincides with a technical analysis-based prediction, forecasting a potential rise in Bitcoin’s price by 29.51%, reaching $87,897 by July 13, 2024.

However, the report additionally acknowledges the blended sentiment available in the market, with a Fear & Greed Index hovering at “Greed” territory. This signifies a necessity for warning, as investor optimism can typically precede worth corrections.

Featured picture from VOI, chart from TradingView